US 30 analysis: the downtrend continues

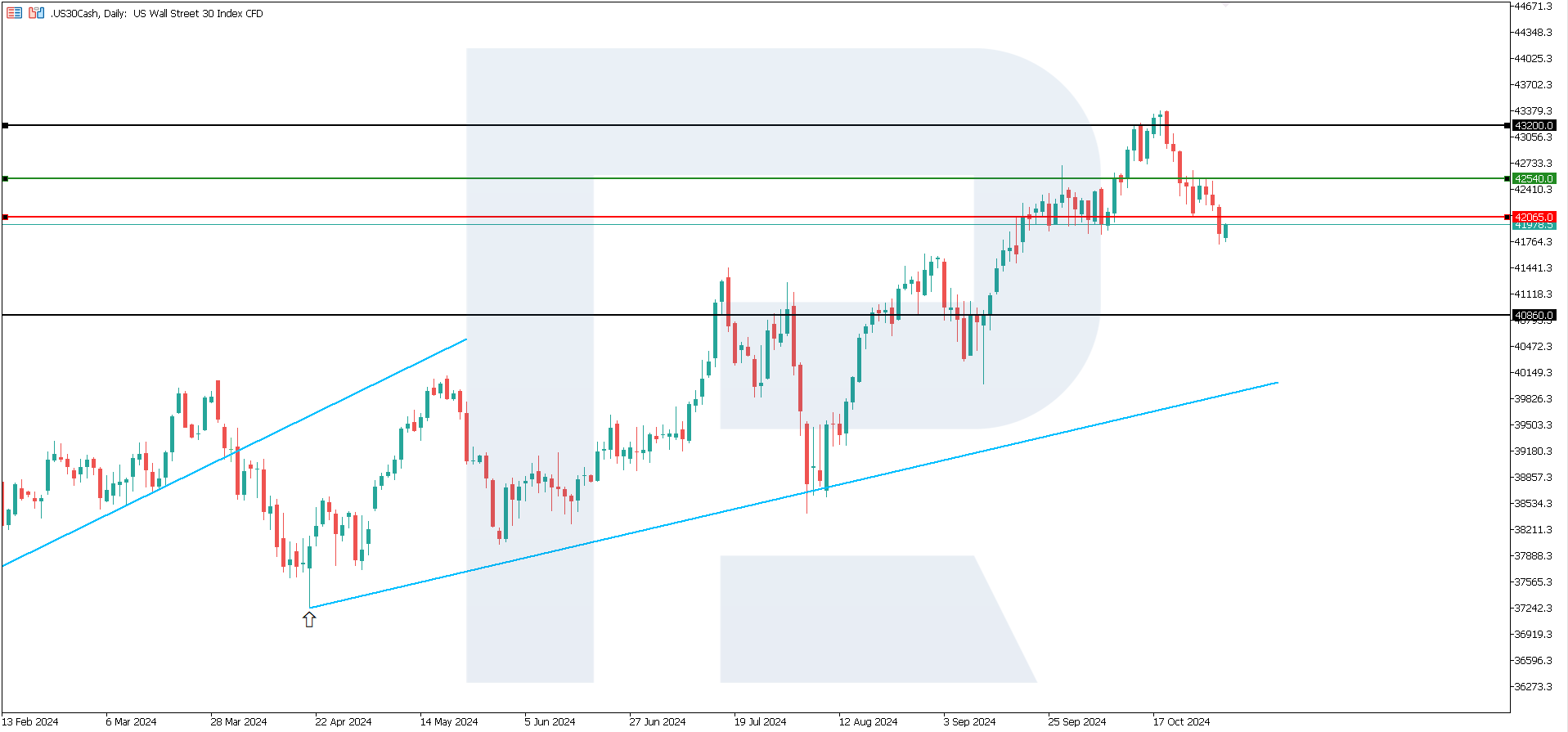

The US 30 stock index is in a downtrend, surpassing the 42,065.0 support level. The US 30 forecast for next week is moderately negative.

US 30 forecast: key trading points

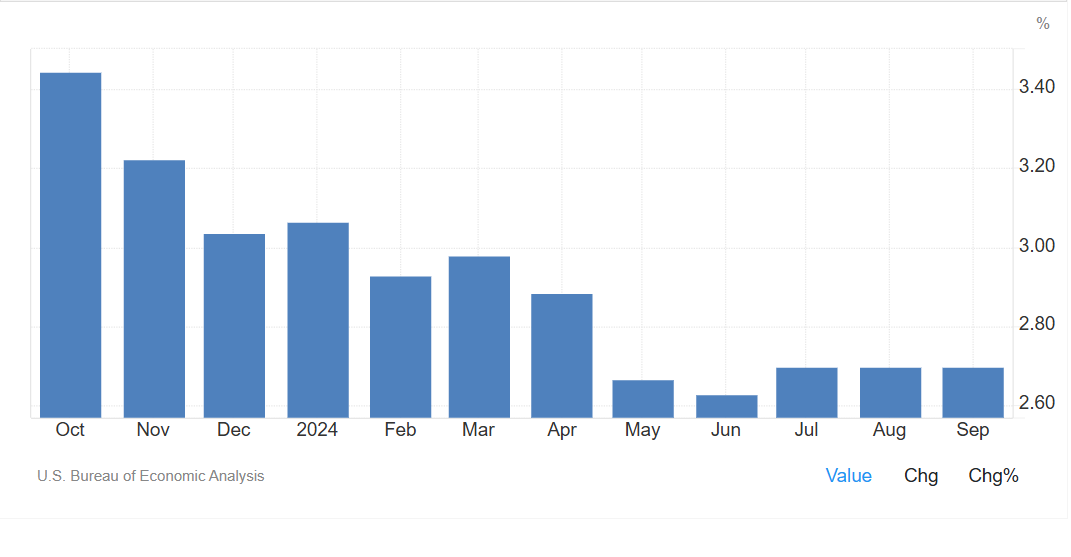

- Recent data: the PCE index was 2.7% year-on-year

- Economic indicators: the PCE index measures inflation, excluding volatile food and energy prices

- Market impact: the PCE index is one of the key gauges for the US Federal Reserve in making future monetary policy decisions

- Resistance: 42,540.0, Support: 42,065.0

- US 30 price forecast: 40,860.0

Fundamental analysis

The PCE index is a primary inflation gauge that the Federal Reserve prefers to consider, as it better reflects the changes in consumer spending. Moderate changes in the overall and core PCE indices indicate that inflation remains stable, subdued, and within expectations.

Source: https://tradingeconomics.com/united-states/core-pce-price-index-annual-change

Steady PCE growth in line with forecasts may positively impact the US 30 index. At the same time, the index’s stability does not compel the Federal Reserve to urgently tighten monetary policy, which reduces risks to corporate earnings. Overall, moderate inflation supports the stock market as it does not diminish the purchasing power of consumers and allows the Fed to maintain a softer policy.

The combination of stable inflation and a resilient labour market creates a favourable environment for the stock market. Investors may respond positively to this data, as it reduces the risk of abrupt changes in Federal Reserve interest rates and bolsters confidence in the economy. This data may drive overall US 30 growth, especially in demand-sensitive consumer goods and manufacturing sectors. However, sustained strengthening requires confirmation of a buoyant labour market trend from the US government. Until then, the US 30 index forecast is moderately negative.

US 30 technical analysis

The US 30 stock index is in a downtrend, showing no signs of a reversal. The price has decisively broken below the 42,065.0 support level. According to the US 30 technical analysis, the decline will continue if the quotes remain below this level. A trend reversal is only possible if the price breaks above the current resistance level.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: if the price remains below the 42,065.0 support level, the index could fall to 40,860.0

- Optimistic US 30 forecast: a breakout above the 42,540.0 resistance level could propel the price to 43,200.0

Summary

The PCE index increased 2.7% year-on-year, compared to analysts’ expectations of 2.6%. The indicator is the Federal Reserve’s primary measure of consumer demand, used alongside labour market data to determine future monetary policy. The US 30 index will likely decline until the Federal Reserve provides comments and official US labour market statistics are released.