US 30 analysis: the downtrend is expected to continue next week

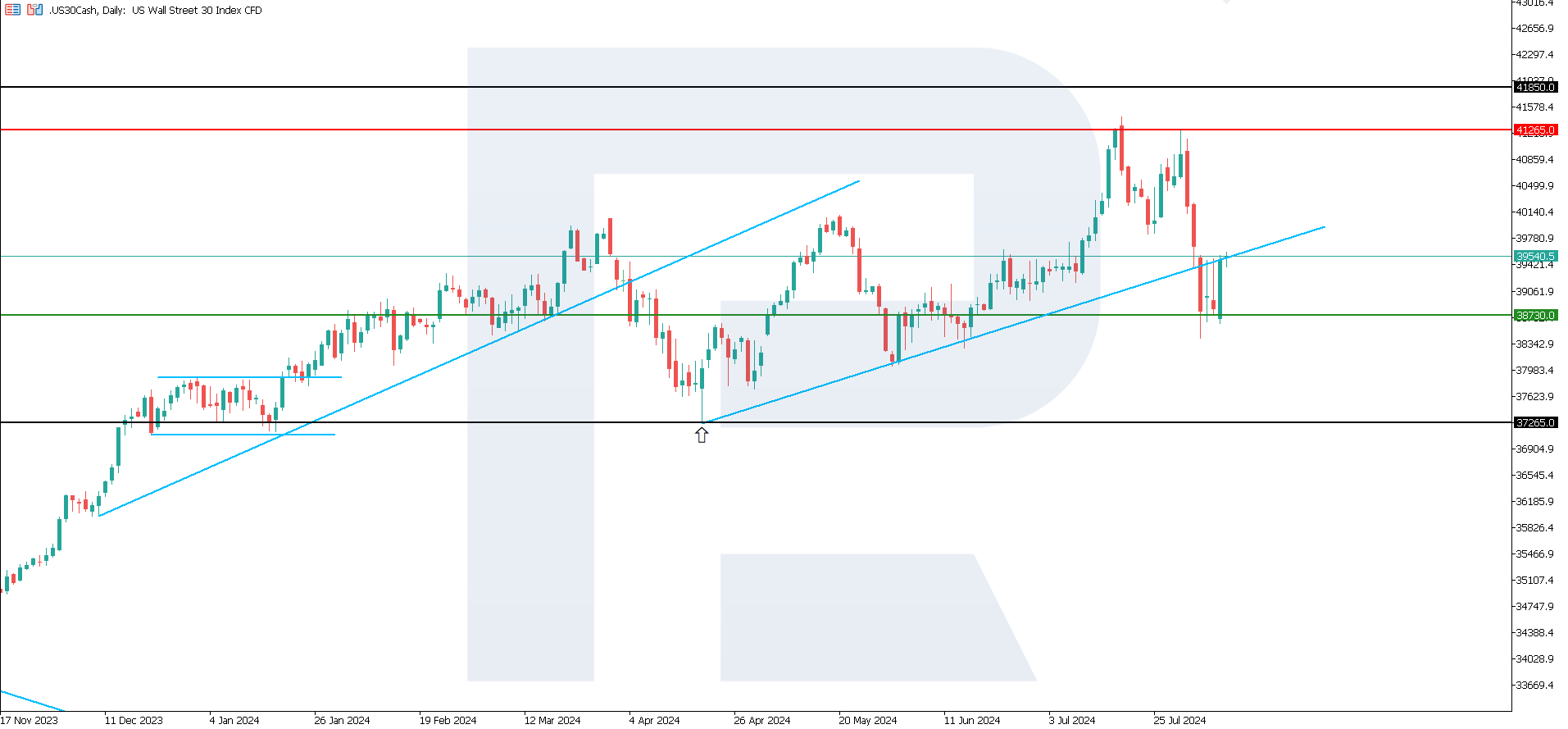

During a significant stock market decline, the US 30 stock index broke below the ascending channel’s support line and the main support level. The US 30 forecast for next week suggests a further decline.

US 30 trading key points

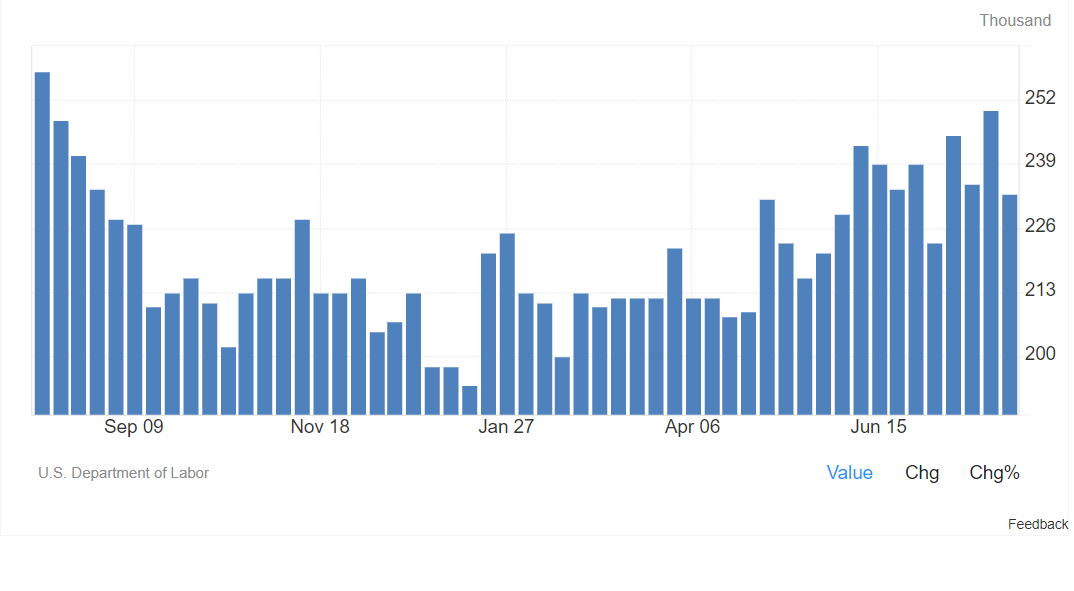

- Recent data: initial jobless claims reached 233 thousand

- Economic indicators: the employment market is the main gauge for the US Federal Reserve in monetary policy

- Market impact: any strengthening in the US employment market may give the Fed a reason to keep the key rate unchanged or slow the pace of rate cuts, which would be a negative signal for the stock market

- Resistance: 41,265.0, Support: 38,730.0

- US 30 price forecast: 37,265.0

Fundamental analysis

The US Department of Labor reported on Thursday that initial jobless claims decreased by 16,000 to 233,000 last week. Economists had expected the number of claims to be 240,000. However, total claims increased by 6,000 to 1.88 million, marking the highest level since November 2021.

Source: https://tradingeconomics.com/united-states/jobless-claims

The President of the Federal Reserve Bank of Richmond, Tom Barkin, stated that the central bank has time to assess whether the US economy is normalising or easing in a way that will require more decisive actions from officials. Barkin expressed optimism that inflation data would be favourable in the coming months and that recent disinflationary trends would continue.

This increases the likelihood of a significant US Federal Reserve interest rate cut by the end of 2024. Meanwhile, investors are highly likely to rebalance their portfolios and increase investments in the US national debt. As a result, the US 30 index forecast is negative.

US 30 technical analysis

The US 30 technical analysis shows that the price has breached the main support level and the ascending channel’s support line. Although the trend has reversed to a downtrend, the distance between the support and resistance levels remains significant. The price will likely breach the first level next week, with the decline continuing with renewed vigour.

Key levels for the US 30 price forecast:

- Resistance level: 41,265.0 – with an upward breakout, the price could rise to 41,850.0

- Support level: 38,730.0 – if the price breaks below the support level, the index could plunge to 37,265.0

Summary

The US 30 index will likely continue to decline next week, with a potential target at 37,265.0. Last week, total jobless claims increased by 6,000 to 1.88 million, the highest level since November 2021, indicating a continued weakening of the US employment market.