US 30 analysis: US inflation data prevented the price from falling, but the negative trend persists

The US 30 stock index ended Thursday's trading session with gains after the release of US consumer inflation data. However, the stock market will remain under pressure until the Federal Reserve cuts the interest rate. For this reason, the US 30 forecast for next week is negative.

US 30 forecast: key trading points

- Recent data: CPI rose by 2.5% year-over-year in August

- Economic indicators: easing inflation is the main reason for the US Federal Reserve's tight monetary policy

- Market impact: lower interest rates due to falling inflation will have a favourable impact on the stock market in the long term

- Resistance: 41,590.0, Support: 40,280.0

- US 30 price forecast: 39,805.0

Fundamental analysis

The US Department of Labor released the CPI data for August 2024, according to which consumer inflation was 0.2% in the eighth month of the year (compared to the previous month) and 2.5% year-over-year, down from 2.9% a month earlier.

Source: https://tradingeconomics.com/united-states/inflation-cpi

Economists expected the CPI index to rise by 0.2% in the reporting month. The core index (excluding food and energy) increased by 0.3% in August compared to July and by 3.2% from August 2023. The reading was 3.2% a month earlier.

Amid rising unemployment and declining price growth rates, the US Federal Reserve has no other option but to lower the key rate at the upcoming meeting. The regulator’s plans for the end of the year and the pace of monetary policy easing remain unknown. The central bank’s balance sheet has decreased by 20% from its 2021 peak, marking the sharpest decline since 1913. The short-term US 30 index forecast is negative.

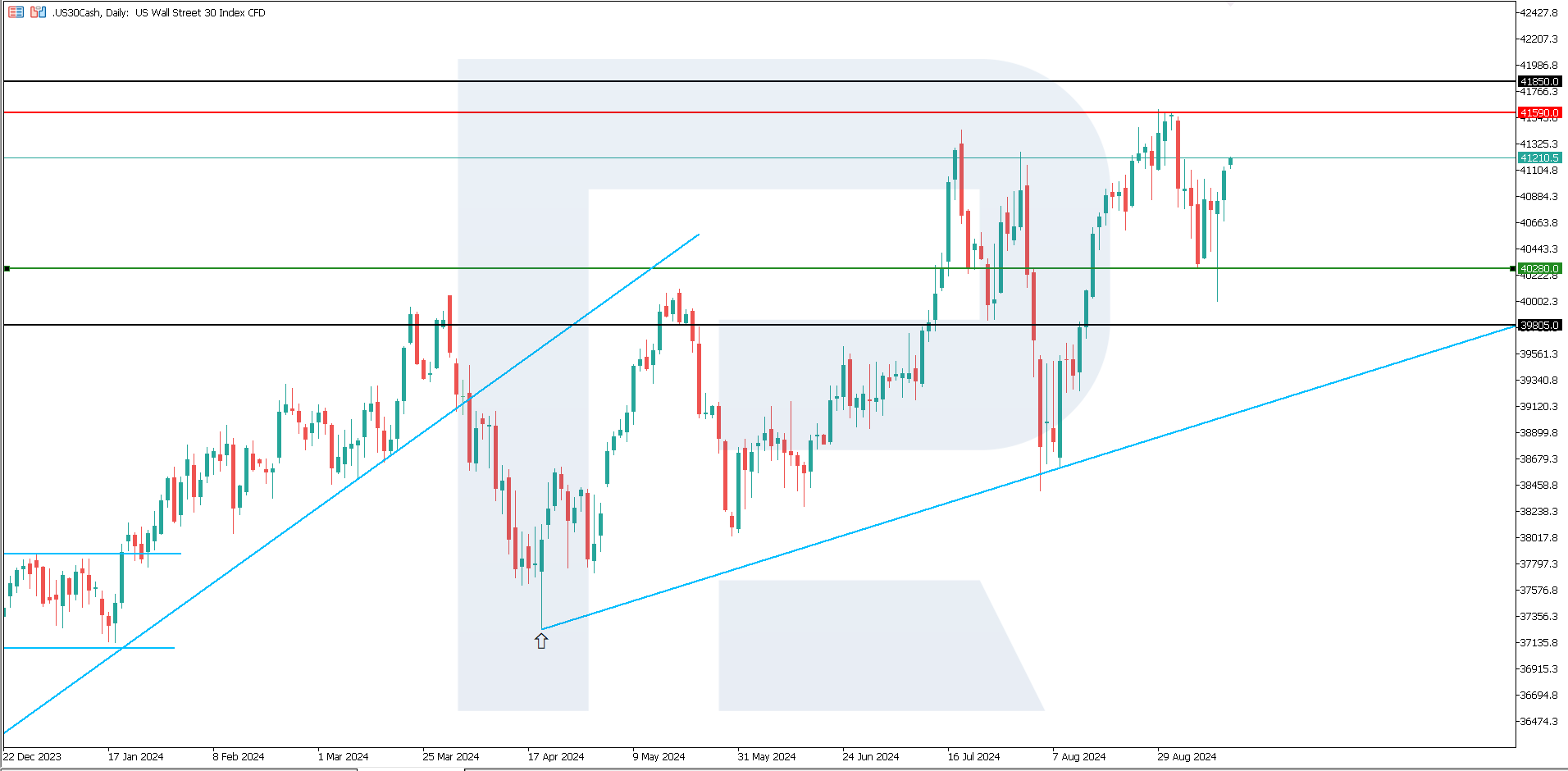

US 30 technical analysis

In terms of technical analysis, the US 30 index is in a downtrend, with the decline highly likely to continue early next week. Following the FOMC meeting, volatility may increase. The short-term US 30 price forecast is negative.

Key levels for the US 30 forecast include:

- Resistance level: 41,590.0 – a breakout above this level could drive the price to 41,850.0

- Support level: 40,280.0 – with a breakout below the support level, the decline target could be at 39,805.0

Summary

The US 30 stock index is in a downtrend, with the next decline target at 39,805.0. As reported by the US Department of Labor, CPI rose by 2.5% year-over-year. This fact gives a reason to expect a key rate cut by the US Federal Reserve as early as this month, which may positively affect the stock market in the long term.