US 30 forecast: the index aims to reach a new all-time high

The US 30 stock index shows an upward trajectory, though it has not yet reached a new all-time high. The forecast for US 30 today is positive.

US 30 forecast: key trading points

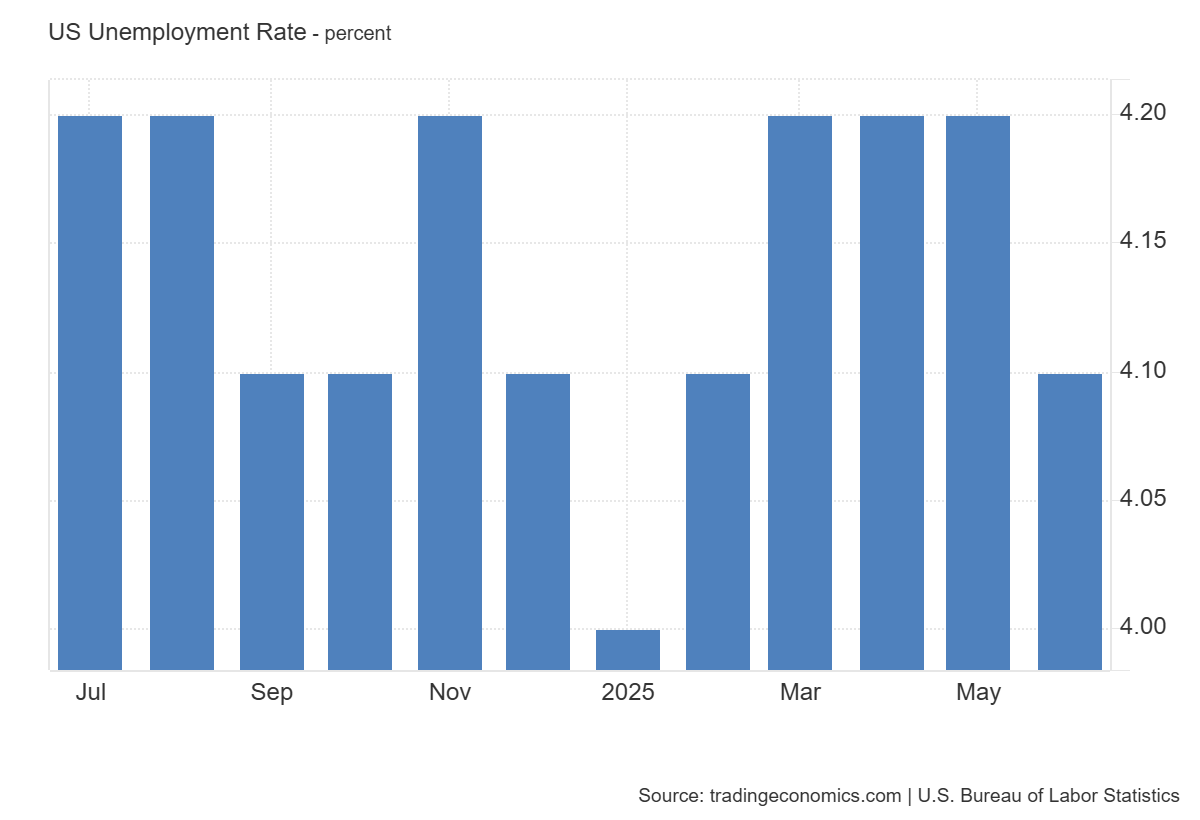

- Recent data: US unemployment rate for June stood at 4.1%

- Market impact: a strong labour market is viewed positively by investors, though concerns about further monetary easing may limit their optimism

US 30 fundamental analysis

The unemployment rate is one of the key macro indicators of economic health. The figure came in below expectations (4.1% vs. 4.2%) and lower than the previous reading (4.3%), indicating a stronger labour market. Companies continue active hiring, while consumers feel more confident due to stable income.

A low unemployment rate signals economic resilience, supporting consumer demand and corporate earnings. For US 30, this is generally a positive factor as leaders in the consumer, financial, and industrial sectors benefit from this growth.

United States Unemployment Rate: https://tradingeconomics.com/united-states/unemployment-rateUS 30 technical analysis

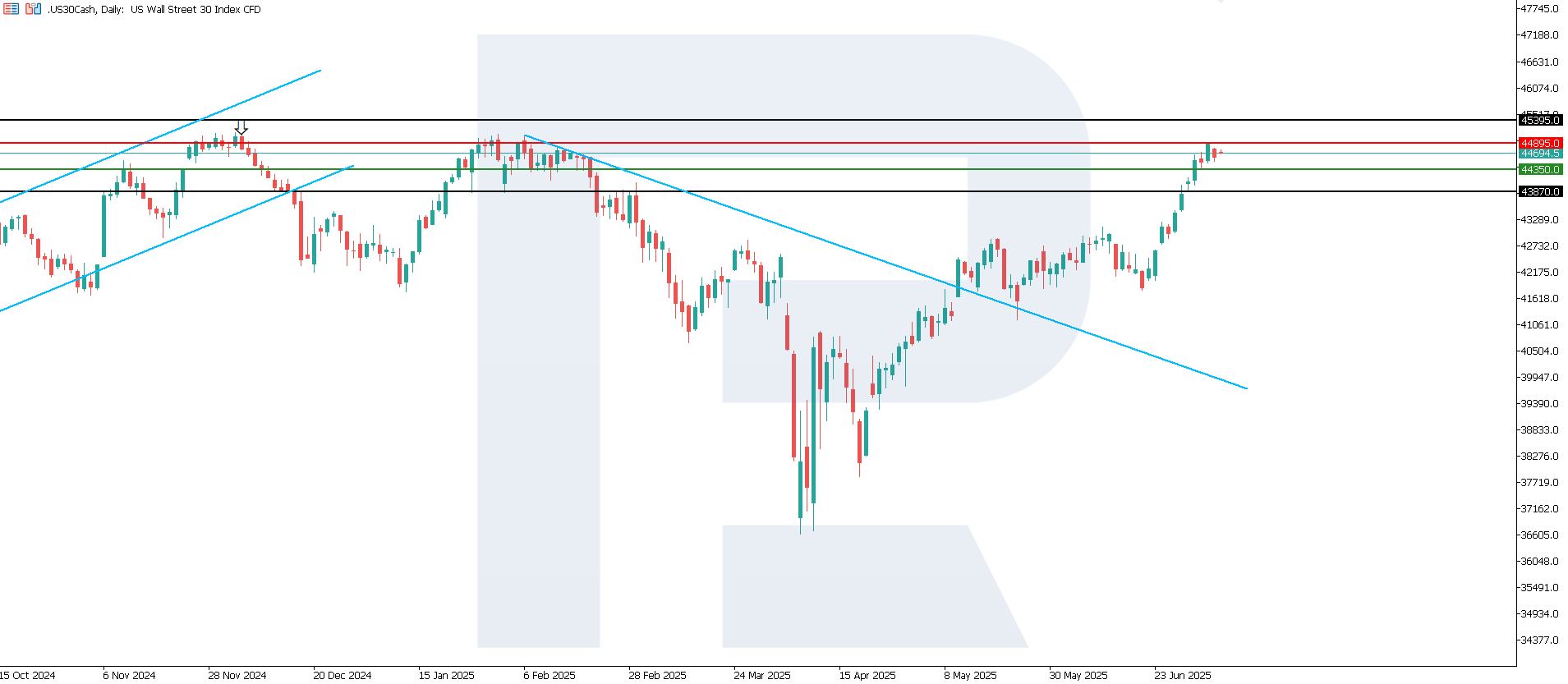

The US 30 index continues to trade in a strong upward trend. Unlike other US indices, it has not yet set a new all-time high. Resistance formed at 44,895.0, with support at 44,350.0. It is worth noting the strong momentum with which the previous resistance level was broken.

Scenarios for the US 30 index price forecast:

- Pessimistic scenario for US 30: if the support level at 44,350.0 is breached, prices may fall to 43,870.0

- Optimistic scenario for US 30: if the resistance level at 44,895.0 is broken, prices may rise to 45,395.0

Summary

A strong labour market reduces credit risks and improves borrower solvency. Banks benefit from a stable loan portfolio. However, the Fed’s future monetary policy decisions will depend on inflation: if the labour market runs too hot, it could delay rate cuts and put pressure on the banking sector. Low unemployment demonstrates economic strength, boosting consumer demand and corporate earnings, which is positive for US 30 thanks to support from leaders in the consumer, financial, and industrial sectors.