US 30 forecast: the index has shifted to a downtrend

The US 30 stock index has turned unstable again and broken below the support level, signalling a shift to a downtrend. The US 30 forecast for today is negative.

US 30 forecast: key trading points

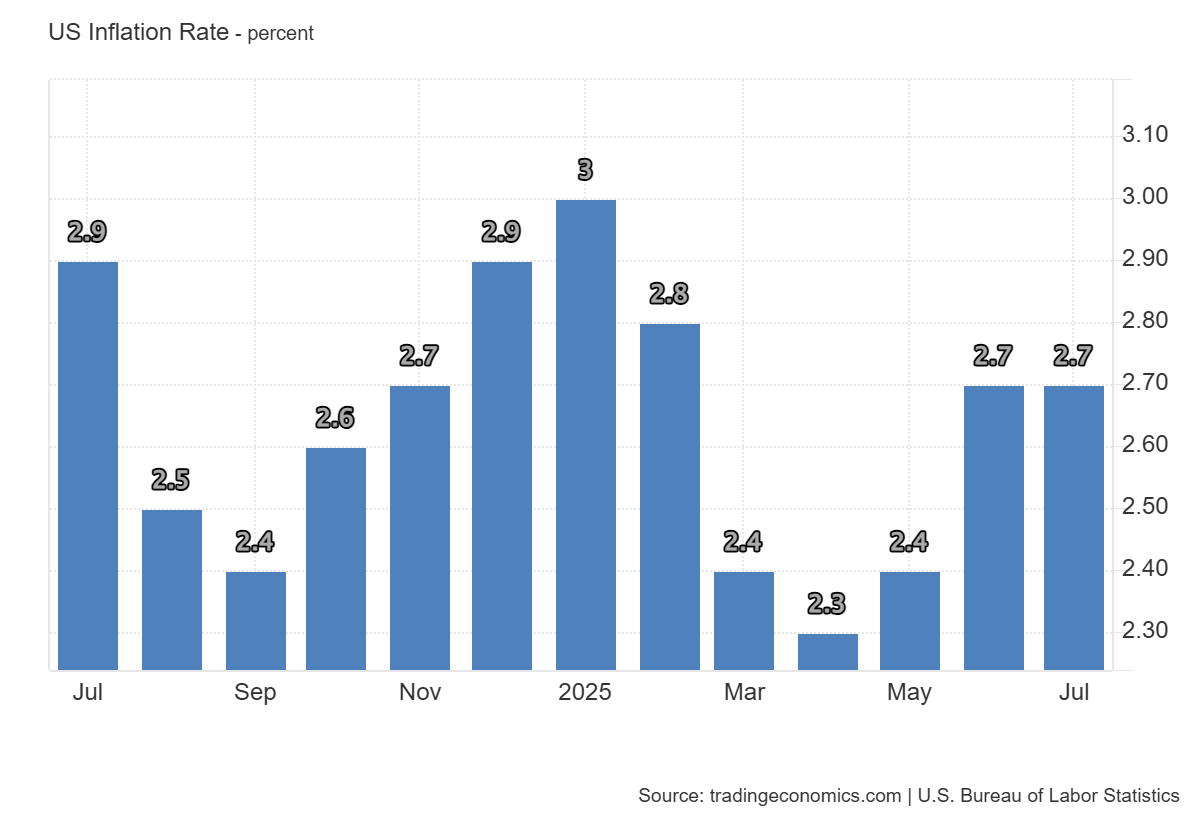

- Recent data: the US CPI came in at 2.7% year-on-year in July

- Market impact: current data is largely positive for equity market participants

US 30 fundamental analysis

The CPI came in at 2.7% y/y, 0.1 percentage point below expectations of 2.8% and in line with the previous month, which the market sees as a moderately dovish signal: broad-based price pressure is not increasing. However, core CPI accelerated to 3.1% y/y, above the forecast of 3.0% and the previous reading of 2.9% – a hawkish signal. Such figures typically do not give the market a clear direction. The scenario of an immediate rate cut looks less likely, as the Fed will probably wait for a decline in core inflation (especially in services) before lowering the key rate.

For the US 30 index, where industrials, materials, consumer companies, and financial institutions make up a significant share, the balance of factors leans towards caution. A strong US dollar and expensive capital traditionally hurt export revenues and investment appetite in capital-intensive industries, putting pressure on industrials and material producers.

US Inflation Rate: https://tradingeconomics.com/united-states/inflation-cpiUS 30 technical analysis

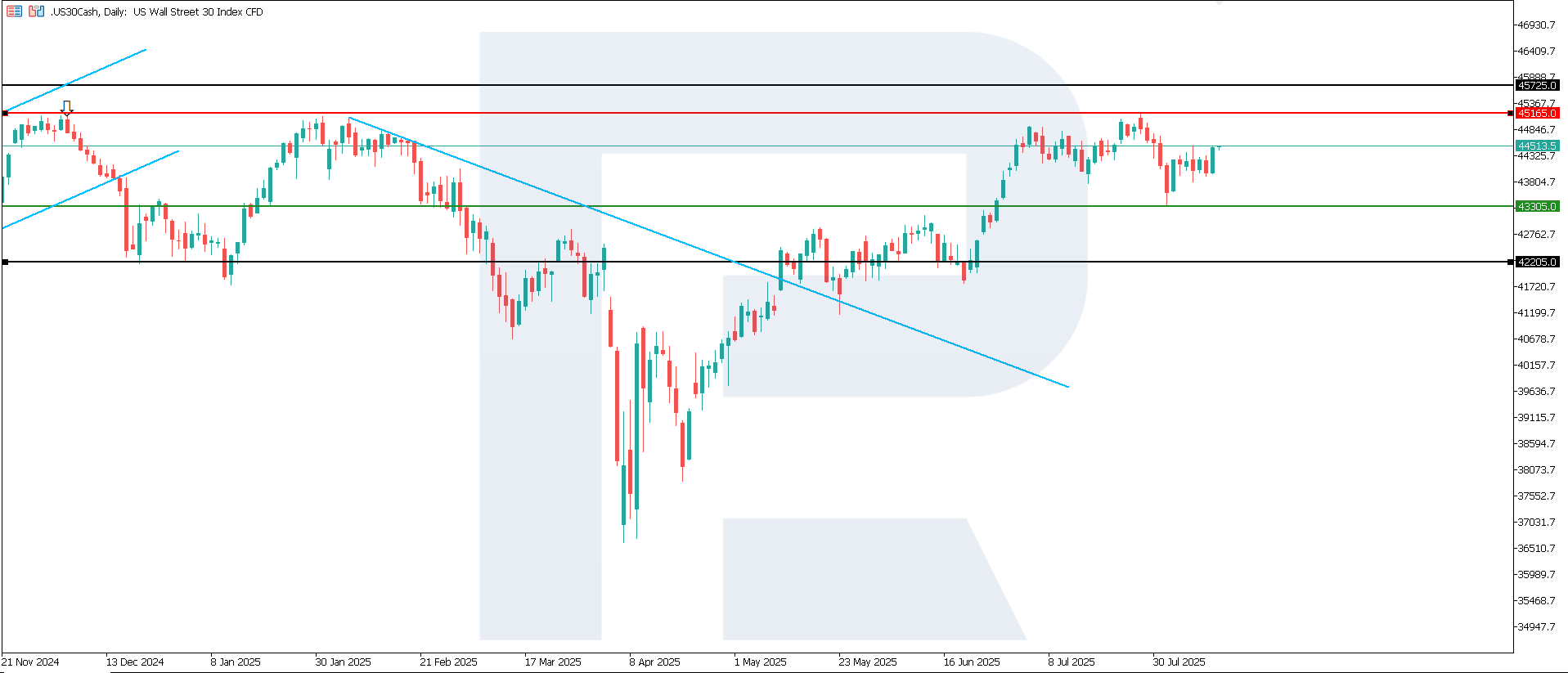

The US 30 index is in a downtrend. The resistance level has formed at 45,065.0, with the support level at 43,305.0. Volatility remains elevated for the US 30, and no clear short-term trend has yet been established.

The US 30 price forecast considers the following scenarios:

- Pessimistic US 30 scenario: a breakout below the 43,305.0 support level could send the index down to 42,205.0

- Optimistic US 30 scenario: a breakout above the 45,065.0 resistance level could boost the index up to 45,725.0

Summary

For the US 30 index, the inflation data described does not provide a clear directional trend but increases the likelihood of sideways movement. The next downside target could be 42,205.0. The further trend will be shaped by labour market data and government bond yield dynamics. Another round of the US-China trade war cannot be ruled out.

Open Account