US 30 forecast: the index hits new all-time highs for the third consecutive session

The uptrend in the US 30 index has strengthened, suggesting the potential for another record high. The US 30 forecast for today is positive.

US 30 forecast: key trading points

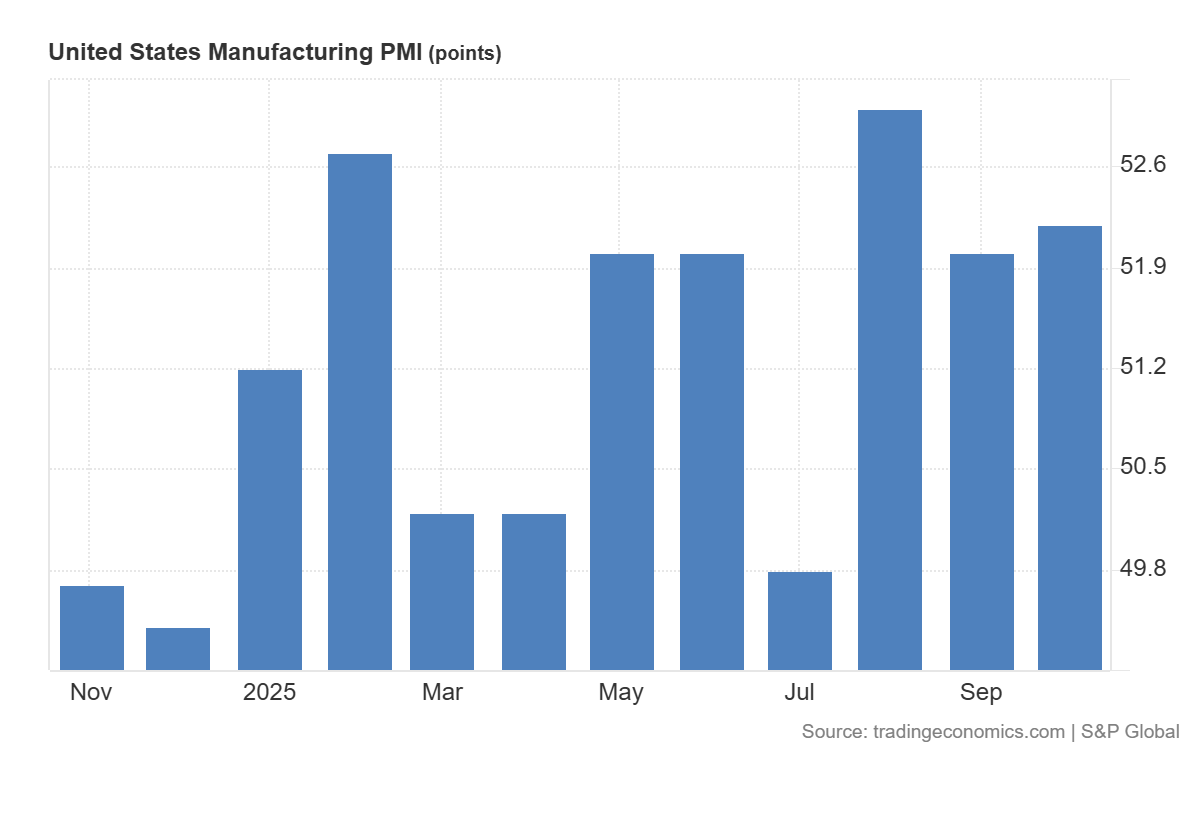

- Recent data: the US manufacturing PMI preliminarily came in at 52.2 in October

- Market impact: the data is moderately positive for the US stock market

US 30 fundamental analysis

The US manufacturing PMI was reported at 52.2, above the forecast of 51.9 and the previous reading of 52.0, indicating continued expansion in industrial activity. This serves as a pro-cyclical signal for the stock market, strengthening expectations for revenue growth and operating leverage in manufacturing and related sectors, lowering the perceived probability of a recession, and narrowing credit spreads. At the same time, stronger PMI readings can raise inflation expectations through employment and capacity utilisation, potentially pushing US Treasury yields higher.

For the US 30 index, the balance of factors appears moderately positive. With its heavy weighting in industrial, materials, and financial stocks, the index benefits from improving macroeconomic activity and a potential yield curve steepening, which supports bank margins. If yields remain stable or rise only modestly, valuation multiples for value stocks and exporters could increase.

US manufacturing PMI: https://tradingeconomics.com/united-states/manufacturing-pmiUS 30 technical analysis

The US 30 index has reached a new all-time high, forming an uptrend. The 47,165.0 resistance level has been broken, while support is located near 46,475.0. It is difficult to say how long this trend will last.

The US 30 price forecast considers the following scenarios:

- Pessimistic US 30 scenario: a breakout below the 46,475.0 support level could push the index down to 4,565.0

- Optimistic US 30 scenario: if the price consolidates above the previously breached resistance level at 47,165.0, the index could advance to 48,755.0

Summary

The rise in US manufacturing PMI to 52.2, above the forecast and prior levels, is a pro-cyclical signal that improves expectations for revenue growth and operating leverage in real-economy sectors. This provides short-term support for the US 30 index, which has a high concentration of industrial, materials, and financial stocks. Economic data is still unavailable due to the ongoing government shutdown. The next upside target could be 48,755.0.