US 30 forecast: the uptrend continues, but resistance has not yet been broken

After reaching a new all-time high, the trend in the US 30 index remains unstable. The US 30 forecast for today is positive.

US 30 forecast: key trading points

- Recent data: the US PMI for August came in at 55.5

- Market impact: for US equities, this result signals a cautious investor sentiment

US 30 fundamental analysis

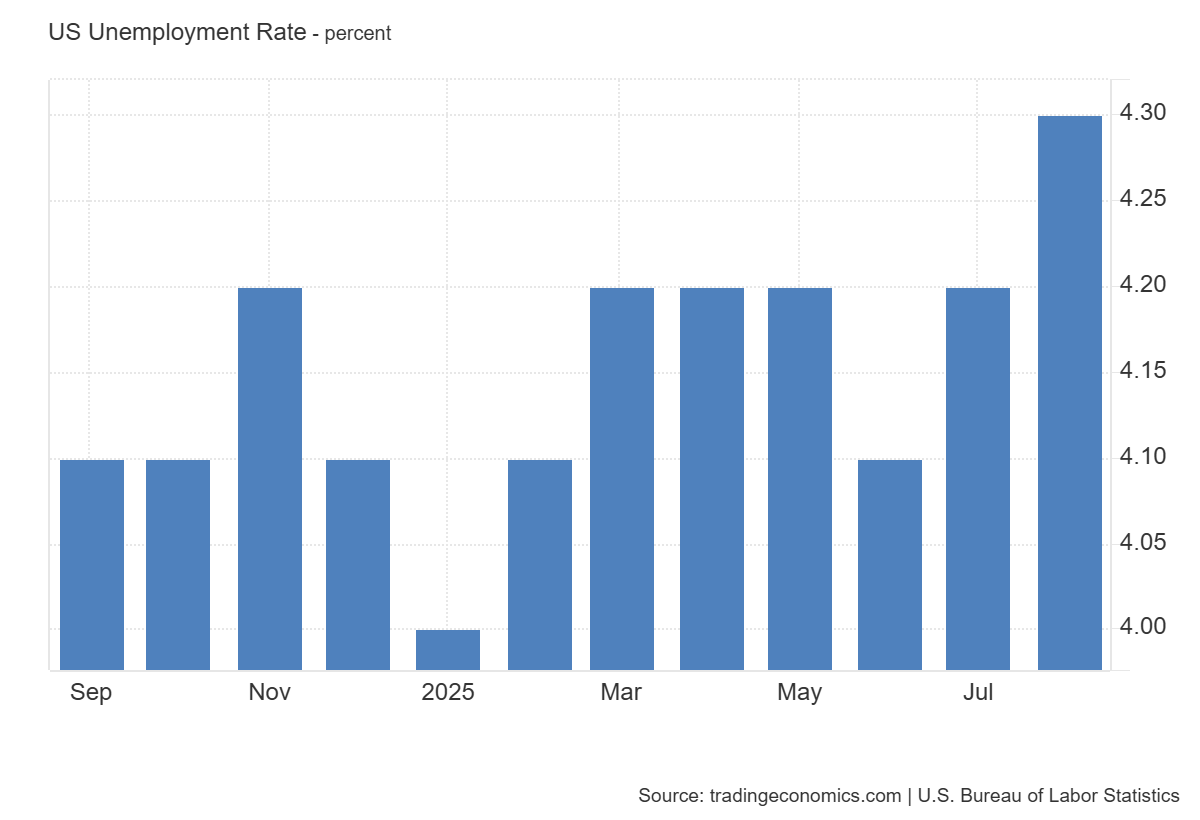

The US unemployment rate stood at 4.3% in line with market forecasts but above 4.2% in July. From a macroeconomic perspective, this indicates a gradual cooling of the labour market: a moderate rise in unemployment eases wage pressure and reduces service-sector inflation. In terms of financial conditions, this is generally favourable, as expectations of a softer monetary policy path increase, Treasury yields tend to decline, and funding costs for companies decrease. At the same time, the fact that unemployment is rising points to a slower pace of economic growth.

For the US 30, the signal is mixed. If markets interpret the figure as evidence of a soft landing, we may see a short-term improvement in risk appetite driven by lower yields and stronger expectations of Fed easing. However, if focus shifts to risks for growth momentum, the index could show a more restrained performance given its heavy weighting in cyclical sectors.

US Unemployment Rate: https://tradingeconomics.com/united-states/unemployment-rateUS 30 technical analysis

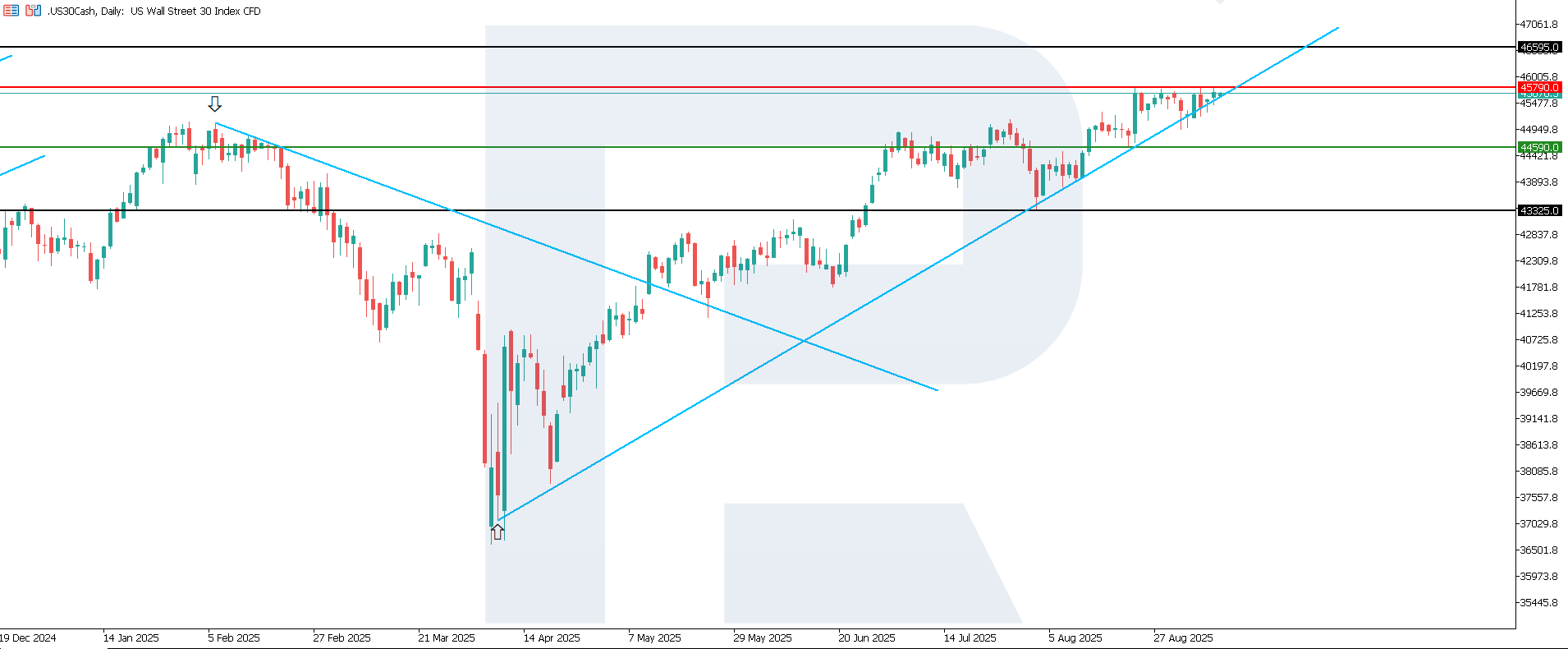

The US 30 index once again shows signs of upward movement. The resistance level is seen at 45,790.0, while the support level is located around 44,590.0. However, persistently high volatility underlines the fragility of the current trend. Growth potential remains limited in the near term, and weak momentum increases the risk of a reversal towards the downside.

The US 30 price forecast considers the following scenarios:

- Pessimistic US 30 scenario: a breakout below the 44,590.0 support level could push the index down to 43,325.0

- Optimistic US 30 scenario: a breakout above the 45,790.0 resistance level could boost the index up to 46,595.0

Summary

From a Federal Reserve policy perspective, the unemployment figure meeting expectations while edging higher strengthens the case for a softer stance if labour market and inflation data continues to weaken. For equities, this means the short-term trajectory will depend on the balance of two forces: support from lower rates and the discount applied for slowing growth risks. The base case is a moderately neutral-to-positive reaction in the US 30 as yields decline, but with heightened sensitivity to upcoming labour and inflation releases. The next upside target stands at 46,595.0.