The US 500 stock index reached a new all-time high within the uptrend, driven by major players’ expectations of a US Federal Reserve interest rate cut amid weak employment market data.

US 500 trading key points

- Recent data: US unemployment rate increased to 4.1% in June

- Economic indicators: a weak employment market may cause the US Federal Reserve to lower the interest rate before September 2024

- Market impact: an interest rate reduction leads to a decrease in the yield of the national debt market, resulting in capital outflow to the stock market and other riskier asset

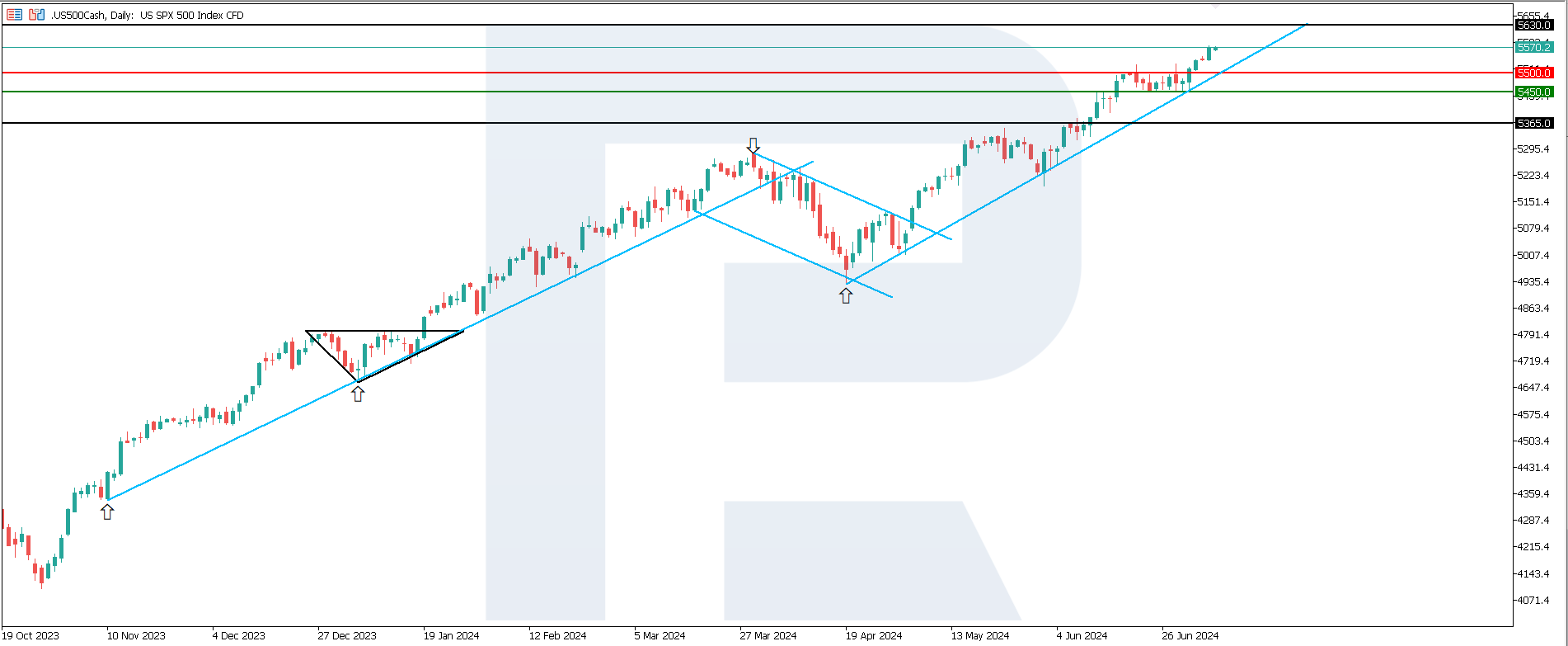

- Resistance: 5,500.0, Support: 5,450.0

- US 500 price target: 5,630.0

Fundamental analysis

The US unemployment rate rose to 4.1% in June, the highest reading since November 2021. US continuing jobless claims have increased for the ninth consecutive week, marking the most extended period since 2018. This indicates that an increasing number of people are having difficulty finding new jobs.

The unemployment rate will likely increase further, combined with slowing price growth rates, which may convince the Federal Reserve to lower the key interest rate before September. In this case, some investors will reduce their government bond purchases and increase their investments in stock assets.

US 500 technical analysis

The US 500 stock index is in an uptrend on the daily timeframe. It has relatively strong growth potential amid favourable fundamental indicators. The 5,500.0 resistance level was breached, and a new one is yet to form. This level may be used as a reference point for a potential correction. Key levels to watch include:

- Resistance level: the price has breached the 5,500.0 level, with the next target at 5,630.0

- Support level: 5,450.0 – if this level breaks, the decline target could be 5,365.0

Summary

US unemployment growth gives reasons to expect the Federal Reserve to take more decisive action to lower the interest rate. The US 500 index will highly likely attempt to reach a new all-time high. The actual support level is at 5,450.0, while the 5,500.0 resistance level has already been breached. The next growth target could be 5,630.0.