US 500 analysis: US deflation helped the index to hit a new all-time high

The US 500 stock index reached a new all-time high following the release of US consumer inflation data. Actual price growth rates allow the Federal Reserve to lower the key rate twice by the end of the year.

US 500 trading key points

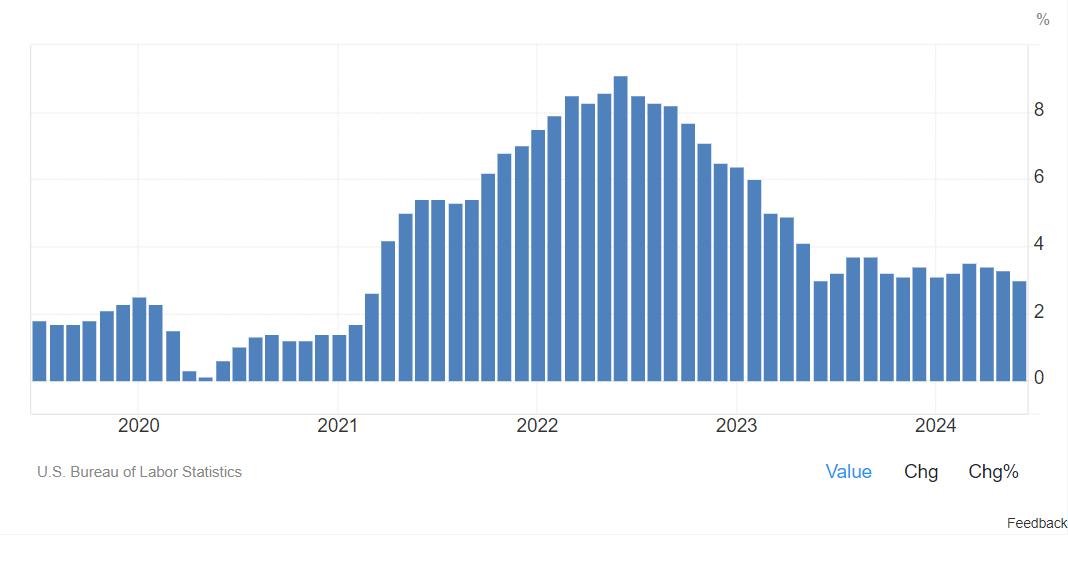

- Recent data: consumer CPI inflation in June fell to 3.00% year-over-year compared to the forecasted 3.10%

- Economic indicators: this is currently the strongest signal yet that the US Federal Reserve may soon reduce interest rates

- Market impact: a key rate reduction leads to decreased investor investments in the national debt and increased demand for shares

- Resistance: 5,640.0, Support: 5,450.0

- US 500 price target: 5,750.0

Fundamental analysis

US inflation reduced significantly in June due to a much-anticipated slowdown in housing price growth, adding to Federal Reserve officials’ confidence and enabling an imminent interest rate cut.

Source: https://tradingeconomics.com

The core consumer price index, which excludes food and energy costs, rose by 0.1% from May, marking the smallest increase in three years, according to the Bureau of Labor Statistics data released on Thursday. The overall indicator decreased for the first time since the beginning of the pandemic due to lower gasoline prices.

A heightened political confrontation during the US election campaign may have a mixed impact. The assassination attempt on former President Donald Trump in Pennsylvania could boost demand for conservative assets.

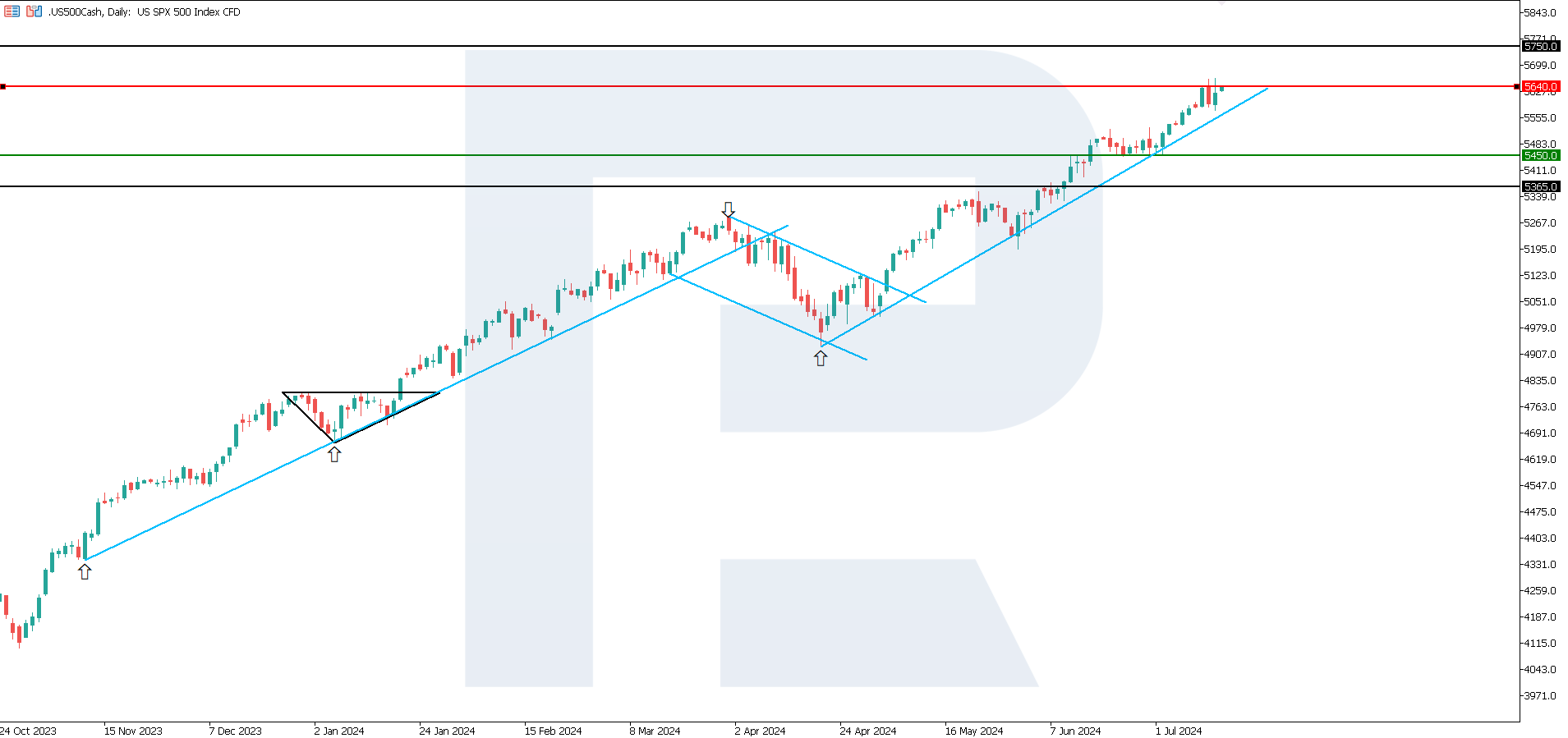

US 500 technical analysis

The US 500 stock index is in an uptrend. There is still potential for further growth, with the price likely reaching new all-time highs several times. From the technical analysis perspective, there are no hindrances to the US 500 index.

- Key US 500 levels to watch next week include:

- Resistance level: 5,640.0 – if the price breaks above this level, it could reach 5,750.0

- Support level: 5,450.0 – if the price breaks below this level, the index could fall to 5,365.0

Summary

The US 500 stock index continues to reach all-time highs within an uptrend, with the next target at 5,750.0. Thursday’s US consumer inflation data gave growth momentum to the index, enabling the Federal Reserve to lower the key rate twice by the end of 2024.