US 500 analysis: US inflation data reversed the index trend

The US 500 stock index rose by 4.30% from its local lows last week, driven by lower US inflation growth. The US 500 forecast for next week is moderately optimistic.

US 500 forecast: key trading points

- Recent data: CPI rose by 0.2% in August

- Economic indicators: a surge in inflation was the main reason for a US Federal Reserve interest rate hike

- Market impact: slowing price growth increases the likelihood of an interest rate cut at the upcoming FOMC meeting

- Resistance: 5,655.0, Support: 5,400.0

- US 500 price forecast: 5,780.0

Fundamental analysis

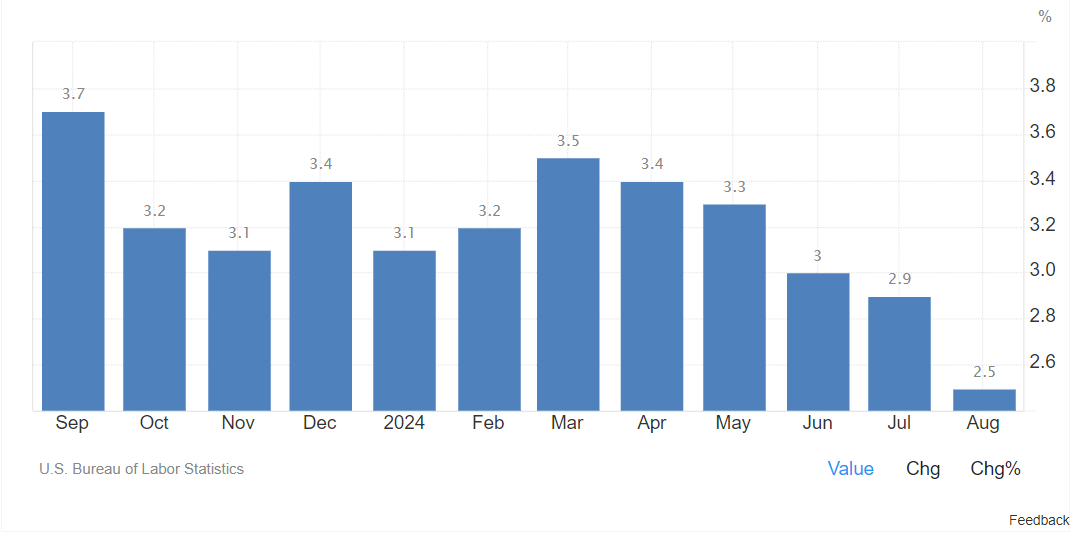

The US Department of Labor has released statistics on the consumer price index (CPI) for August 2024. According to the new data, consumer inflation rose by 0.2% month-over-month and by 2.5% year-over-year from 2.9% a month earlier.

Source: https://tradingeconomics.com/united-states/inflation-cpi

Economists expected the CPI index to increase by 0.2% in the reporting month. The core index excluding food and energy rose by 0.3% in August compared to July and by 3.2% from August 2023. The reading was 3.2% a month earlier.

The Federal Reserve will highly likely make a decisive turn this week, cutting interest rates for the first time in more than four years as it seeks a soft landing for the US economy. With inflation apparently under control and the US employment market showing weakness, the Federal Reserve will lower the key lending rate by at least a quarter of a percentage point at its upcoming meeting. For this reason, the US 500 index forecast remains moderately positive.

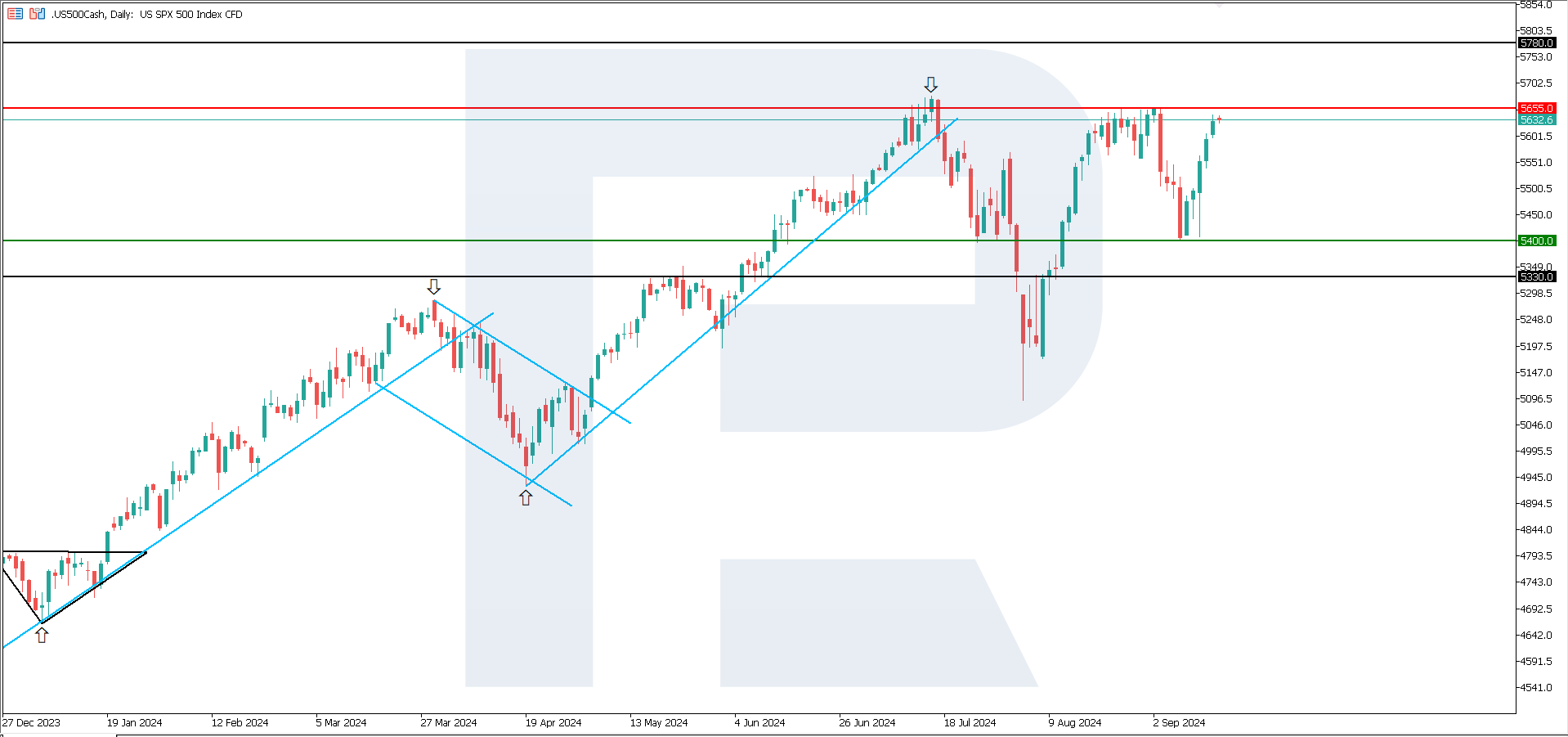

US 500 technical analysis

The US 500 stock index is experiencing strong corrective momentum from the support level at 5,400.0. There are all the prerequisites that the index will head towards a new all-time high after a slight correction. In terms of the US 500 technical analysis, after breaking above the 5,655.0 resistance level, the price could target 5,780.0.

Key levels for the US 500 price forecast:

- Resistance level: 5,655.0 – with a breakout above this level, the price could target 5,780.0

- Support level: 5,400.0 – if the price breaks below the support level, the decline target could be 5,330.0

Summary

The US Federal Reserve is poised to lower interest rates decisively this week for the first time in four years. According to the latest data, consumer inflation rose by 0.2% month-over-month and by 2.5% year-over-year from 2.9% a month earlier. As the US 500 technical analysis shows, after the price breaks above the 5,655.0 resistance level, the next growth target could be 5,780.0. For this reason, the US 500 index forecast remains moderately positive.