US 500 forecast: after the correction, the index resumed growth

The US 500 has completed its correction within the uptrend and is set to climb higher. The US 500 forecast for today is positive.

US 500 forecast: key trading points

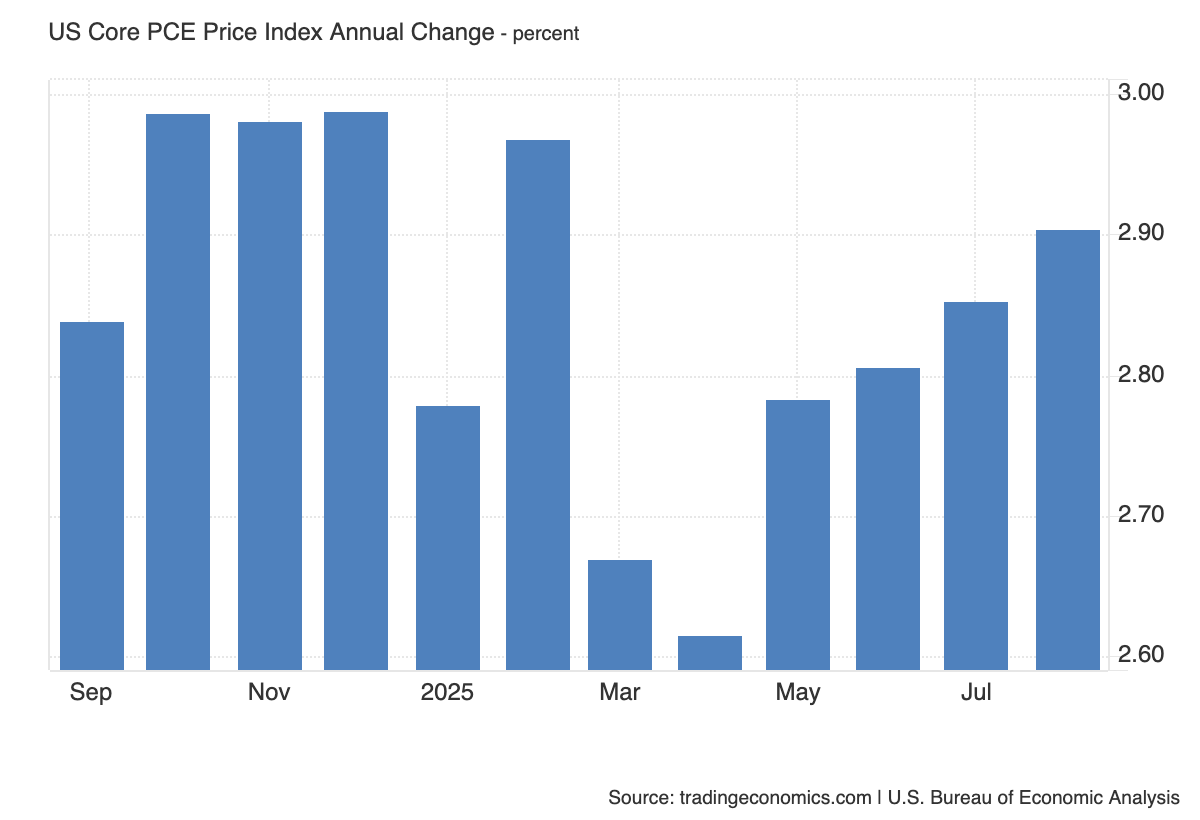

- Recent data: the US core PCE for August came in at 2.9% year-on-year

- Market impact: the current data has a moderately neutral impact on the US equity market

US 500 fundamental analysis

The US core PCE reached 2.9% year-on-year, matching both the consensus forecast and the previous figure. This points to steady but not accelerating core inflation: price pressures remain above the Fed’s 2% target, but there are no signs of a new inflationary impulse. For monetary policy, this result is neutral: it supports expectations of cautious easing while keeping further decisions data-dependent. In the short term, this reduces the likelihood of abrupt changes to the interest rate trajectory.

The impact on the US 500 balances between supportive and restraining factors. Support comes from stabilising inflation expectations and lower uncertainty premiums regarding Fed policy. The headwinds include inflation above target, which keeps long-term yields relatively high and limits demand for risk assets.

US Core PCE Price Index: https://tradingeconomics.com/united-states/core-pce-price-index-annual-changeUS 500 technical analysis

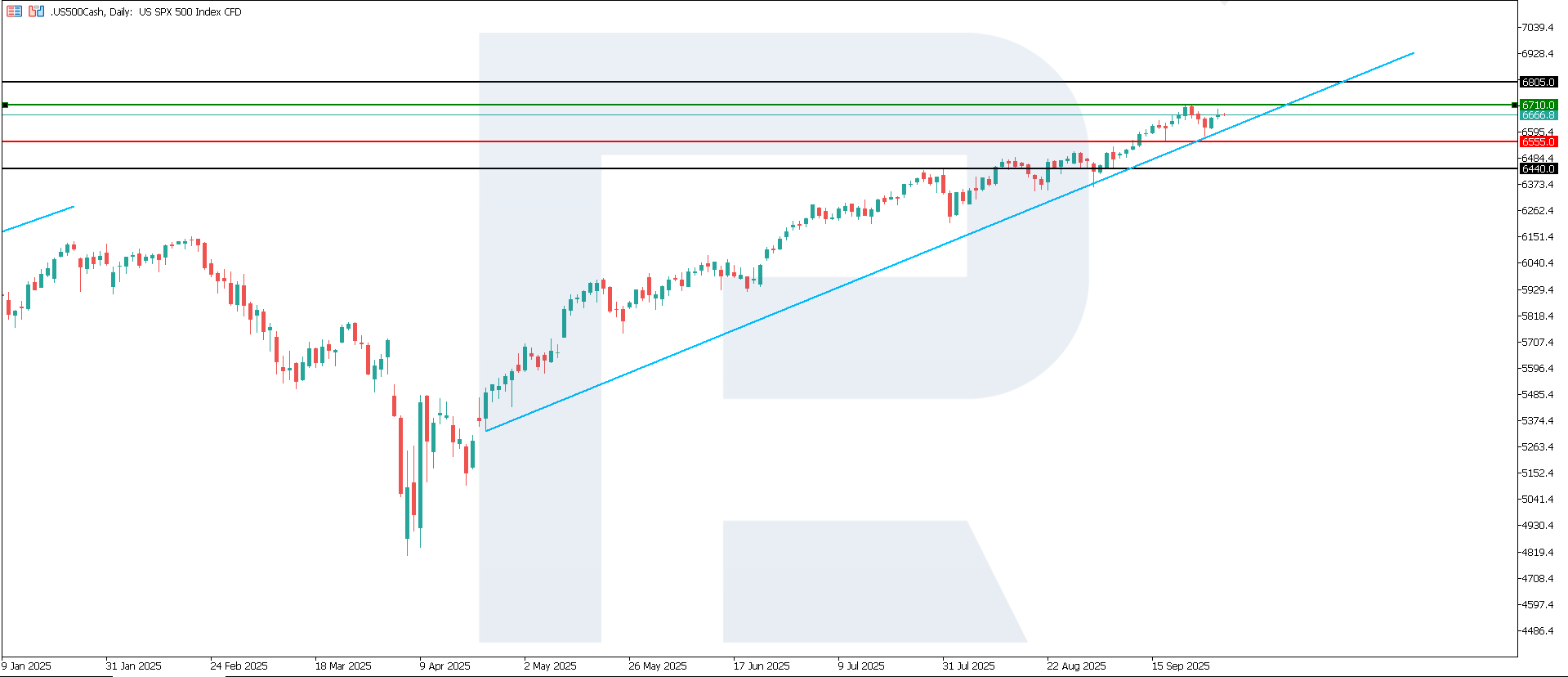

After reaching a new all-time high, the US 500 entered a downward correction. However, the index has now resumed its growth. The support level has been established at 6,555.0, while the nearest resistance level is located at 6,710.0. The most likely scenario remains further upside, with a target near 6,805.0.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 scenario: a breakout below the 6,555.0 support level could push the index down to 6,440.0

- Optimistic US 500 scenario: a breakout above the 6,710.0 resistance level could propel the index to 6,805.0

Summary

For the US 500, the base case points to neutral dynamics with increased sector selectivity. The supportive factor remains stable expectations regarding interest rates, while the main risk lies in core inflation stabilising around 3%, which could cap the expansion of valuation multiples. From a technical perspective, the US 500 is expected to continue its rise towards 6,805.0.