US 500 forecast: quotes approach resistance, but the downtrend continues

The US 500 index remains in a downtrend, which is unlikely to be long-term. The US 500 forecast for today is negative.

US 500 forecast: key trading points

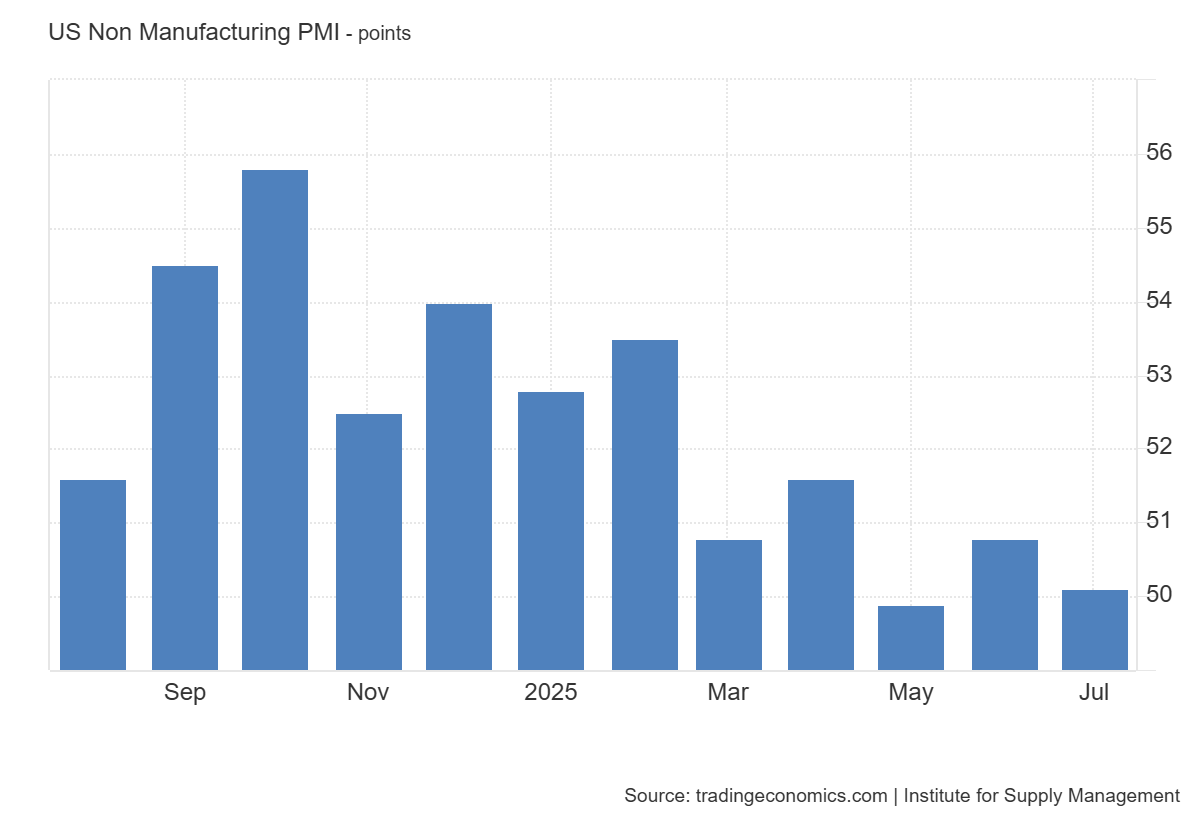

- Recent data: the US ISM non-manufacturing PMI came in at 50.1 in July

- Market impact: for the US stock market, such data has a mixed effect

US 500 fundamental analysis

The ISM non-manufacturing PMI is a key indicator of the service sector, which accounts for more than 70% of US GDP. The July 2025 reading of 50.1 shows that the economy in the service segment continues to grow, but very weakly, and is almost on the verge of stagnation. The figure came in below the forecast of 51.5 and barely changed from the previous 50.8, indicating a lack of strong growth drivers and possibly declining business confidence in the industry.

For the US stock market, such data has a mixed impact. On one hand, weak service sector figures cool expectations for corporate earnings growth in consumer-facing industries and raise concerns about the sustainability of domestic demand. This could put negative pressure on the broad US 500 index, especially in cyclical sectors that depend on economic activity.

US ISM services PMI: https://tradingeconomics.com/united-states/non-manufacturing-pmiUS 500 technical analysis

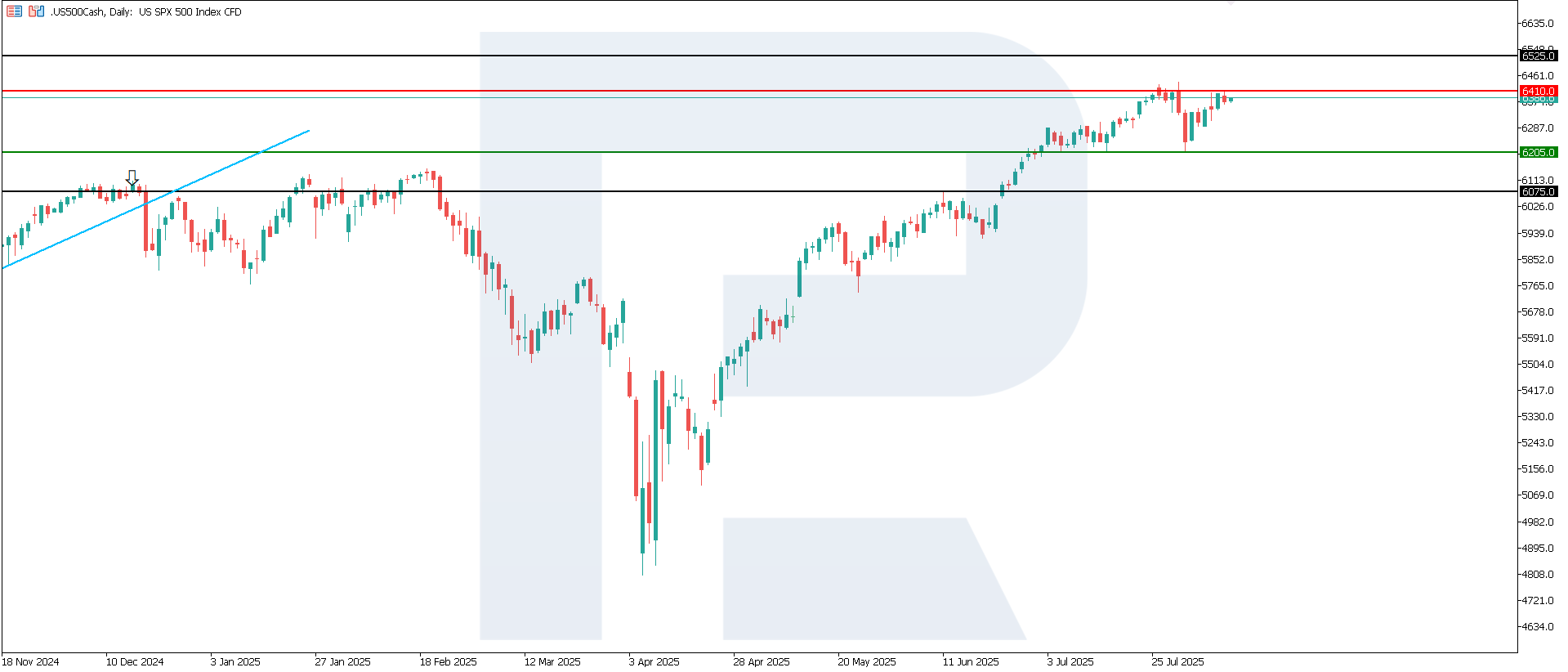

After hitting an all-time high, the US 500 index entered a correction phase. The current dynamics indicate the formation of a downtrend, although it will likely be short-lived. The support level lies at 6,205.0, while resistance stands at 6,410.0. The price will most likely continue to decline, with a potential downside target at the 6,075.0 level.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 scenario: a breakout below the 6,205.0 support level could push the index down to 6,075.0

- Optimistic US 500 scenario: a breakout above the 6,410.0 resistance level could boost the index to 6,525.0

Summary

The PMI reading of 50.1 is a slowdown signal, which in the short term may lead to a mixed market reaction: moderate declines in the broad US 500 index alongside capital rotation into more resilient sectors. If the index drops below 50 in the coming months, this will be a clear bearish signal indicating the beginning of a contraction in the service sector, potentially leading to deeper corrections in the stock market. From a technical perspective, the US 500 index may continue to fall towards 6,075.0.