US 500 forecast: the index hit new all-time high

The US 500 index continued to reach new all-time highs within the ongoing uptrend. The US 500 forecast for today is positive.

US 500 forecast: key trading points

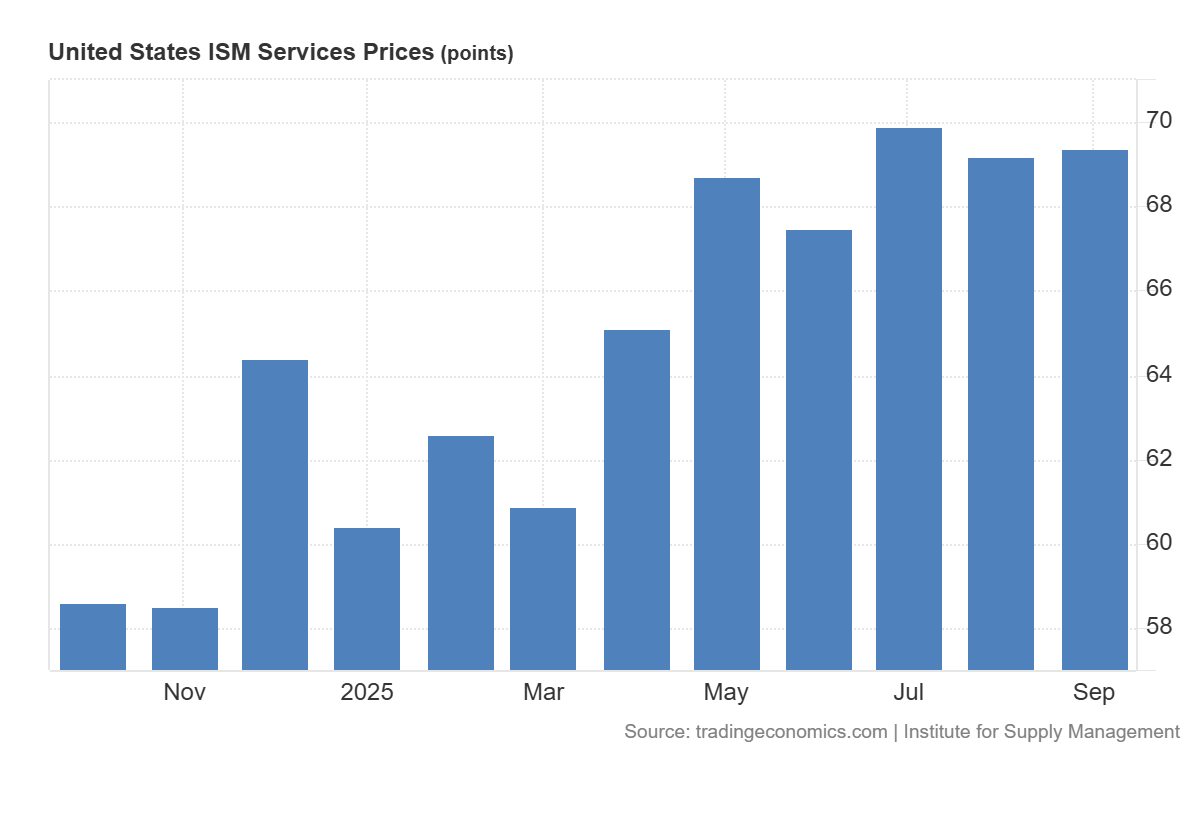

- Recent data: the US ISM services prices for September came in at 69.4

- Market impact: the data has a moderately negative effect on the US stock market

US 500 fundamental analysis

The ISM non-manufacturing prices index for October 2025 reached 69.4, slightly above the forecast of 68.0 and only marginally higher than the previous reading of 69.2. Rising prices in the non-manufacturing sector indicate persistent inflationary pressure in the services industry, the key segment of the US economy. For market participants, this is a signal that inflationary processes remain stable despite the gradual cooling of the manufacturing sector. Such dynamics may strengthen expectations that the Federal Reserve will maintain interest rates at elevated levels for longer than previously anticipated. As a result, investors may act cautiously, particularly towards companies sensitive to changes in borrowing costs.

For the US 500, the released data could have a moderately negative impact. Elevated prices in the services sector reduce the likelihood of an imminent monetary policy easing, which could limit short-term growth of the index. However, since the figure only slightly exceeded expectations, the market reaction is likely to remain balanced.

US ISM services prices: https://tradingeconomics.com/united-states/ism-non-manufacturing-pricesUS 500 technical analysis

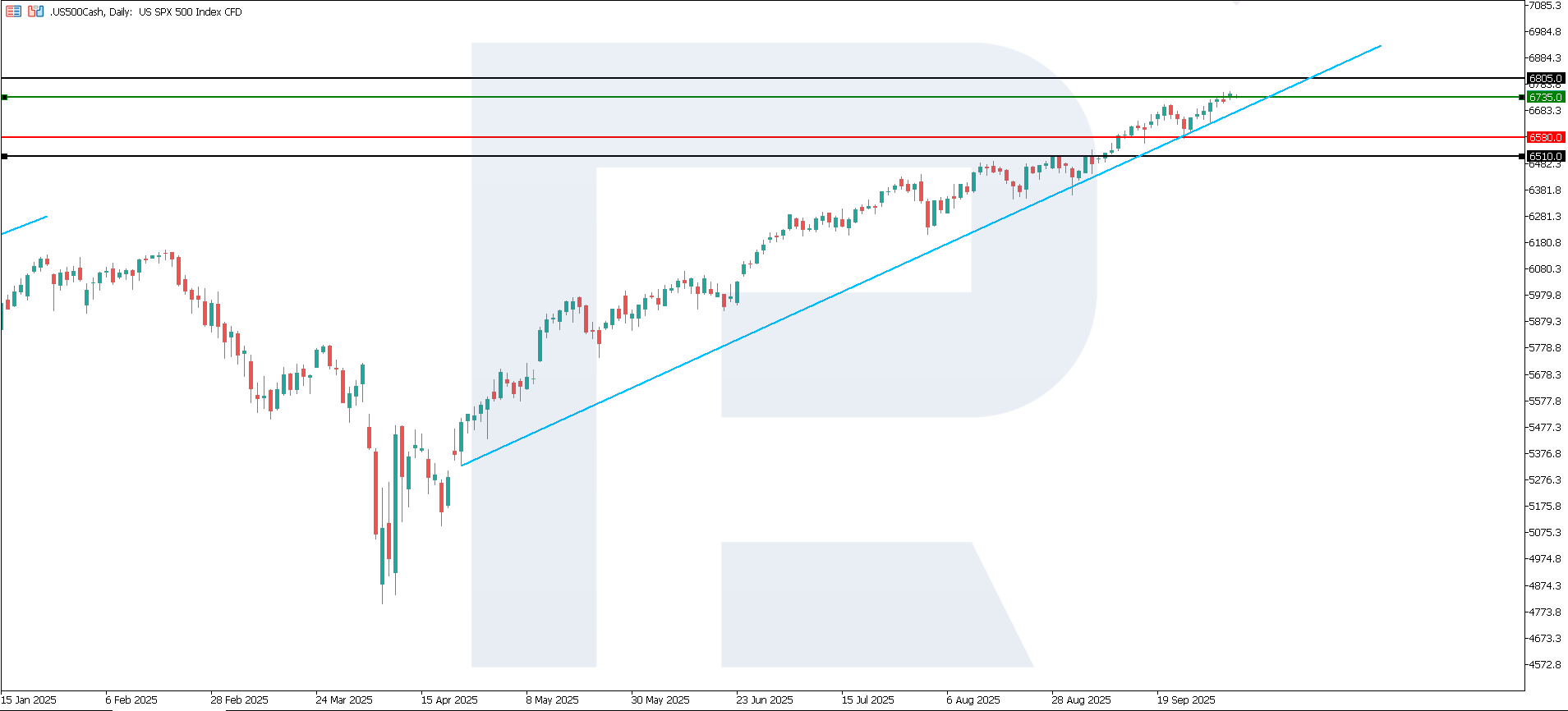

After reaching a new all-time high, the US 500 index continues its rally, with the support level at 6,580.0 and the resistance level yet to form. The most likely scenario remains further upside, with a target near 6,805.0.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 scenario: a breakout below the 6,580.0 support level could push the index down to 6,440.0

- Optimistic US 500 scenario: if prices consolidate above the previously breached resistance level at 6,710.0, the index could climb to 6,805.0

Summary

The higher-than-expected reading indicates that inflationary pressure in the services sector remains persistent despite the slowdown in other parts of the economy. This suggests continued growth in service prices, wages, and related costs, which may compel the Fed to keep interest rates elevated for an extended period. From a technical perspective, the US 500 index is expected to continue its upward trajectory towards 6,805.0.