US 500 forecast: the index renews its all-time high

The US 500 index rebounded from its previous decline and set a new all-time high following U.S. inflation data. The forecast for US 500 today is positive.

US 500 forecast: key trading points

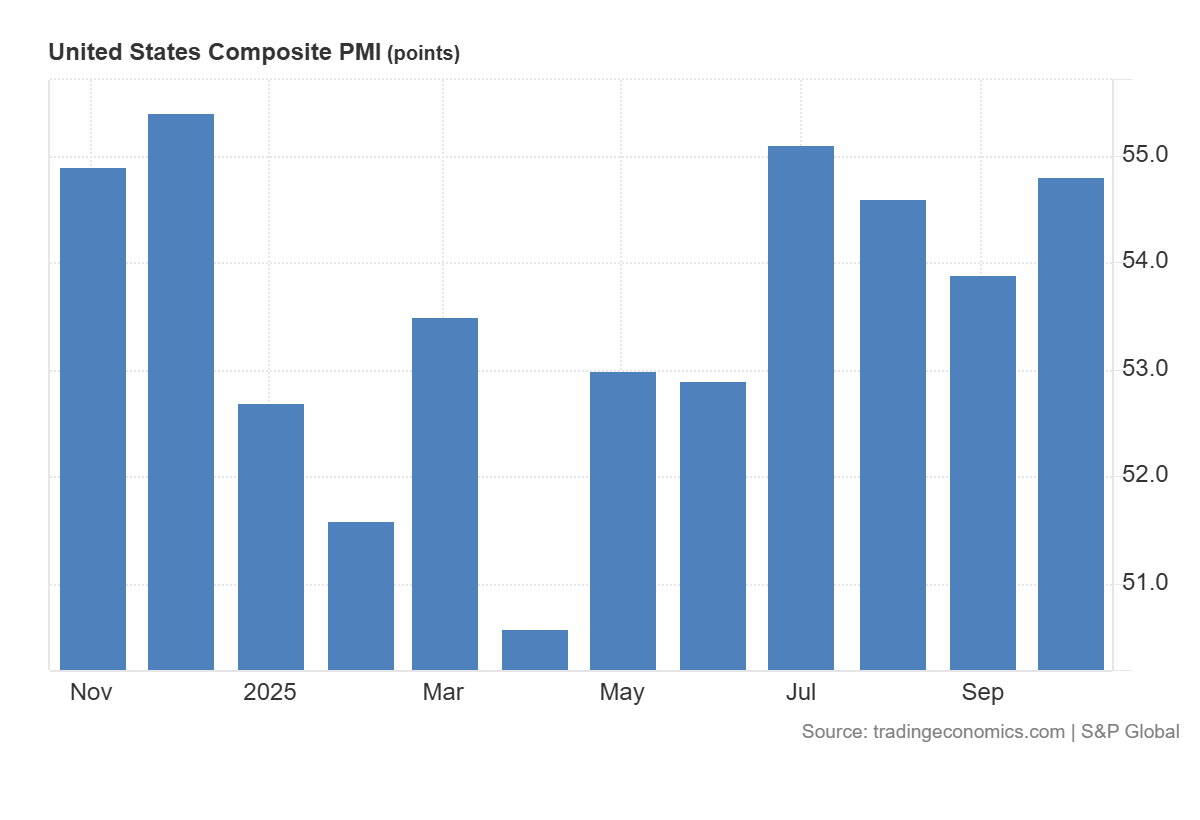

- Recent data: U.S. S&P Global Composite PMI (preliminary, October) came in at 54.8

- Market impact: the data are generally positive for the U.S. equity market

US 500 fundamental analysis

The U.S. S&P Global Composite PMI rose to 54.8, exceeding both the forecast (53.5) and the previous reading (53.9). This indicates an acceleration in overall economic activity across both manufacturing and services sectors.

For the stock market, such data represent a pro-cyclical signal: stronger growth supports expectations for corporate revenues and operating leverage, reduces the probability of a recession scenario, and typically contributes to narrowing credit spreads. At the same time, the acceleration in PMI carries a potential inflationary risk through stronger employment and wage dynamics.

For the US 500 index, the conclusion is moderately positive, though with possible sector rotation within the index. In a scenario of “strong PMI without a significant rise in bond yields,” the main beneficiaries are likely to be cyclical sectors — industrials, materials, consumer discretionary, and financials — benefiting from improved demand outlook and margin expansion.

United States Composite PMI: https://tradingeconomics.com/united-states/composite-pmiUS 500 technical analysis

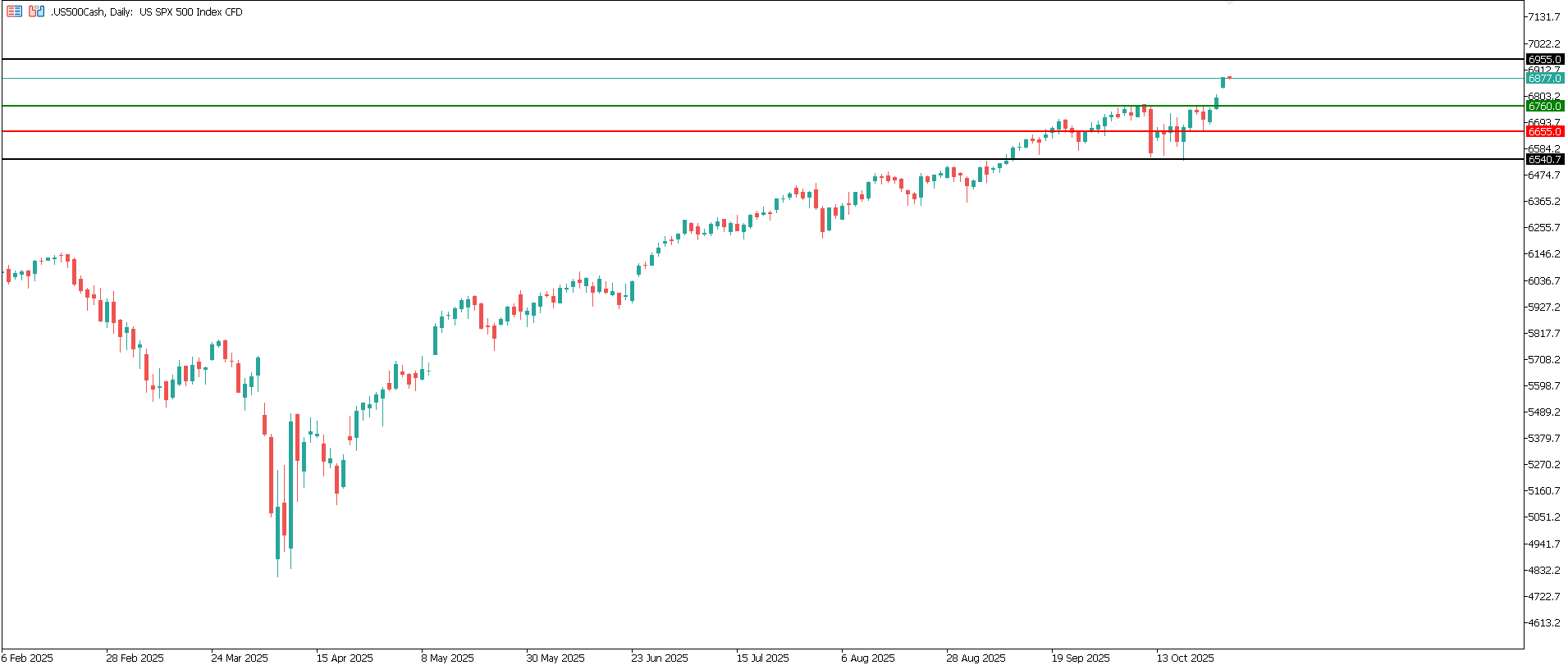

The US 500 index has renewed its all-time high for three consecutive sessions — marking the 34th record high this year. Support has formed at 6,655.0, while resistance at 6,760.0 has been broken, with a new resistance level yet to form. Prices continue to rise confidently, though a short-term correction without a trend reversal remains possible. The next potential upside target is near 6,955.0.

Scenarios for the US 500 price forecast:

- Pessimistic forecast for US 500: if the support level at 6,655.0 is broken, prices may fall to 6,540.0

- Optimistic forecast for US 500: if consolidation above the recently broken resistance at 6,760.0 holds, prices may rise toward 6,955.0

Summary

Overall, the stronger-than-expected PMI release lowers the recession risk premium and supports US 500 valuations through improved profit expectations. However, the index’s near-term trajectory will depend on whether stronger activity translates into higher inflation expectations and yields, which directly affect the cost of capital.

If reports confirming the end of the U.S. government shutdown coincide with favorable data on prices and wages, the index could gain further momentum on improving market sentiment. From a technical standpoint, the US 500 may rise toward 6,955.0.