US Tech analysis: growth may continue after a correction

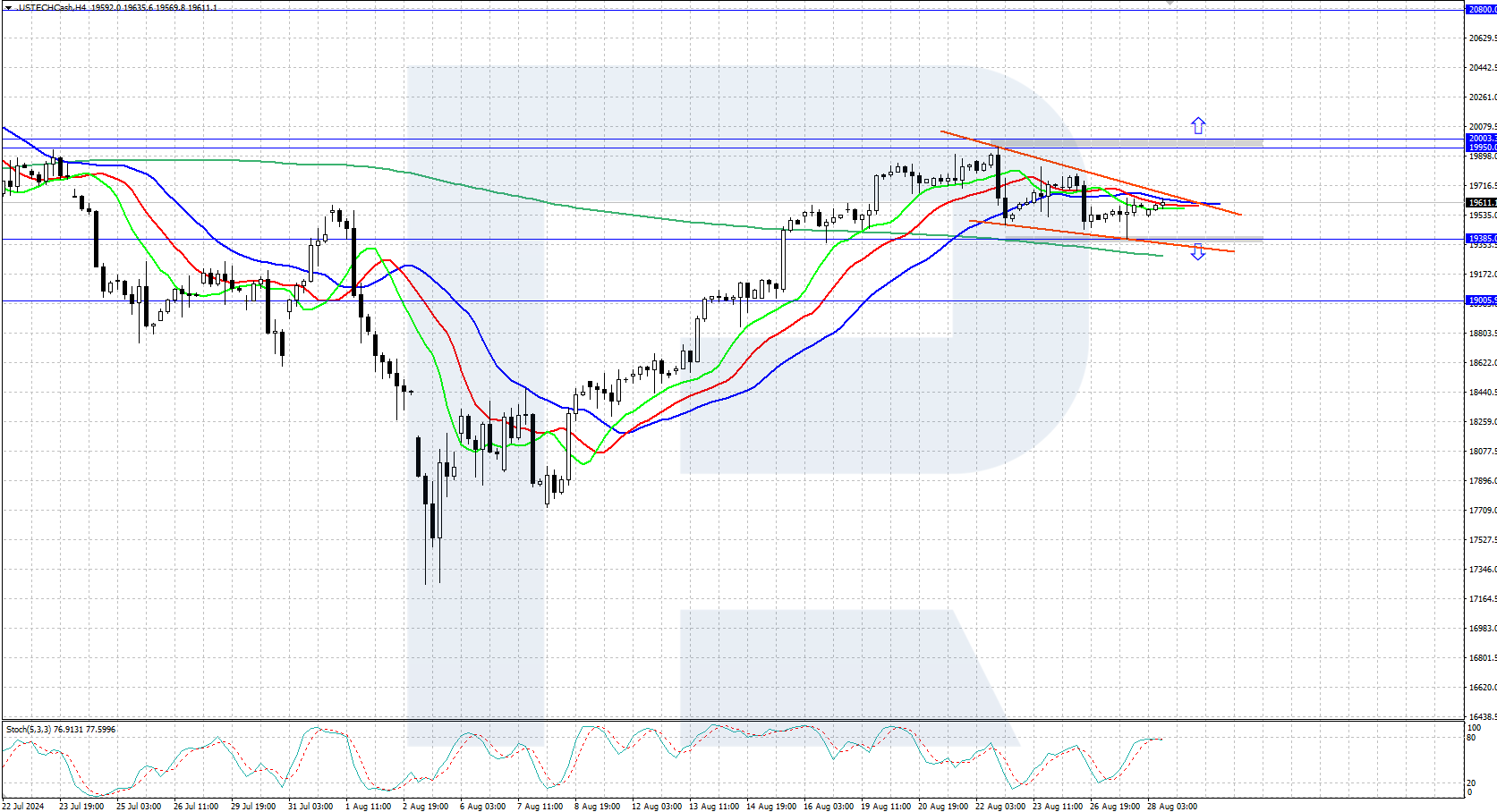

The US Tech stock index is correcting after an impressive rise, reaching the 20,000.0 mark. Overall, the US stock market feels confident now, so the US Tech index forecast remains positive, with further growth expected following the correction.

US Tech forecast: key trading points

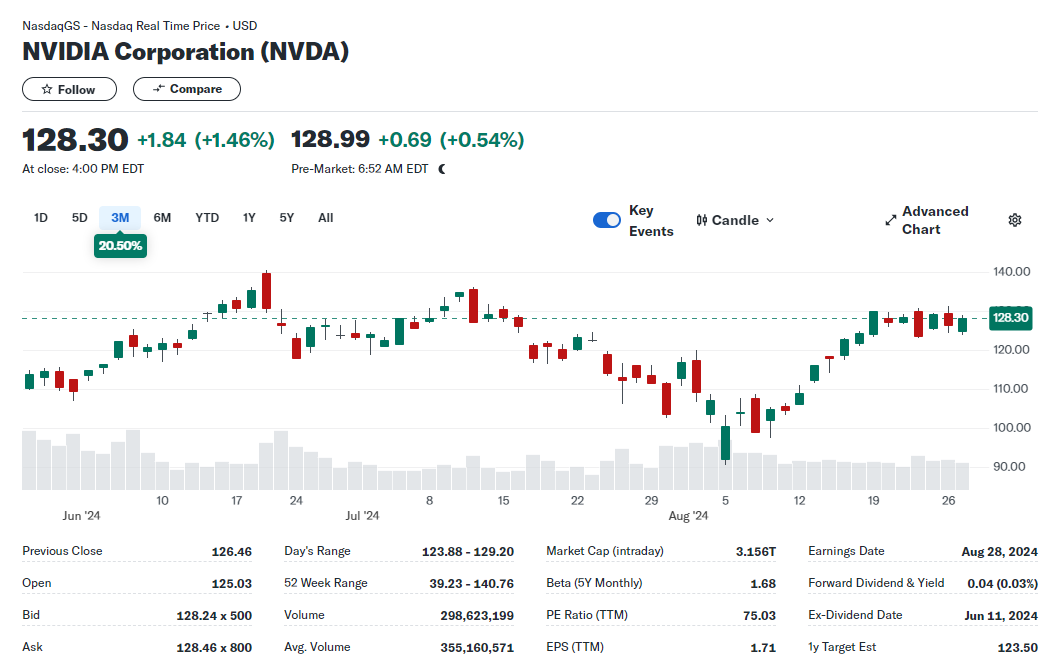

- Recent data: NVIDIA Corporation releases its Q2 earnings report today

- Market impact: NVIDIA Corporation is one of the top three companies by weight in the US Tech index

- Resistance: 19,950.0, Support: 19,385.0

- US Tech price forecast: 19,950.0

Fundamental analysis

NVIDIA (NASDAQ: NVDA) stock is in the spotlight this week as the company is due to release its Q2 earnings report today. NVIDIA Corporation stock is trading near the annual high of 140.00. The tech giant’s upcoming report could significantly impact the US Tech index’s price.

Source: https://finance.yahoo.com/quote/NVDA/

The US stock market is buoyed by optimism following Federal Reserve Chair Jerome Powell’s confirmation of monetary policy easing during his recent Jackson Hole Symposium speech. Market participants believe this will positively influence business activity and stock prices.

US corporations appear unconcerned about the possibility of a l recession, with expectations falling to their lowest level since 2021. The Q2 US GDP data, set to be released tomorrow, will reveal the dynamics of US economic growth. The US Tech forecast for next week suggests further growth.

US Tech technical analysis

The US Tech stock index experienced a slight correction after a sharp rise, reaching the 20,000.0 resistance area. It is currently in an uptrend, and if the price holds above this level, the US Tech price forecast suggests a rise to the annual high of 20,800.0.

Key levels for the US Tech analysis:

- Resistance level: 19,950.0 – if the price breaks above this level, it could rise to 20,000.0 and higher

- Support level: 19,385.0 – if the price breaks below the support level, it could decline to 19,000.0

Summary

The US Tech stock index is trading within a daily uptrend, supported by the Federal Reserve’s intention to take decisive action to lower the key rate. Today’s NVIDIA Corporation Q2 earnings report may impact index price movements.