US Tech analysis: the index headed towards a new all-time high

The US Tech index has surpassed the 21,300.0 level within the current uptrend. More details in our US Tech price forecast and analysis for next week, 9-13 December 2024.

US Tech forecast: key trading points

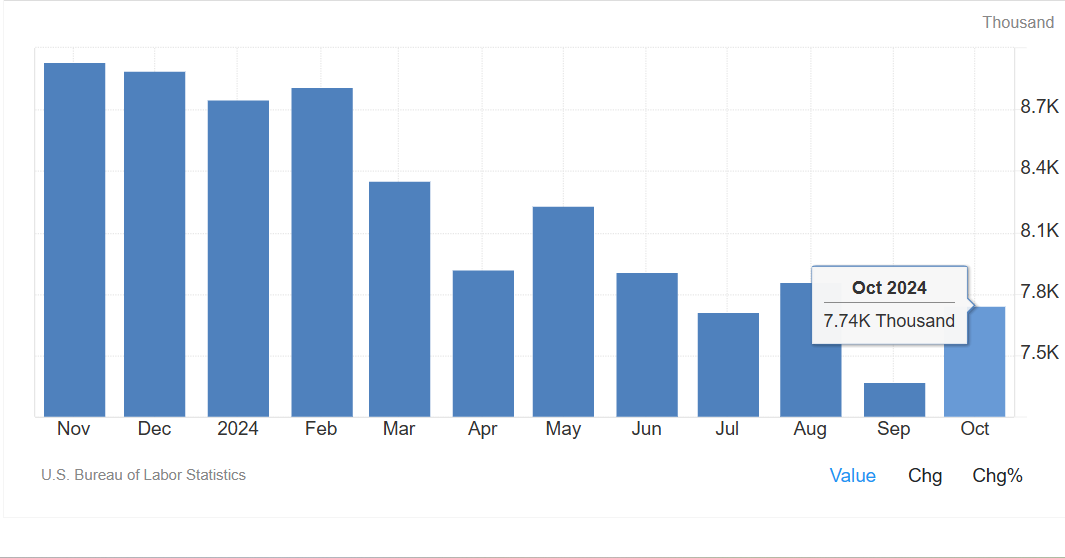

- Recent data: JOLTS job openings totalled 7.74 million in October

- Economic indicators: this figure shows labour demand in the economy and reflects movements in the labour market

- Market impact: the labour sector shapes US Federal Reserve monetary policy, which is critical for the stock market

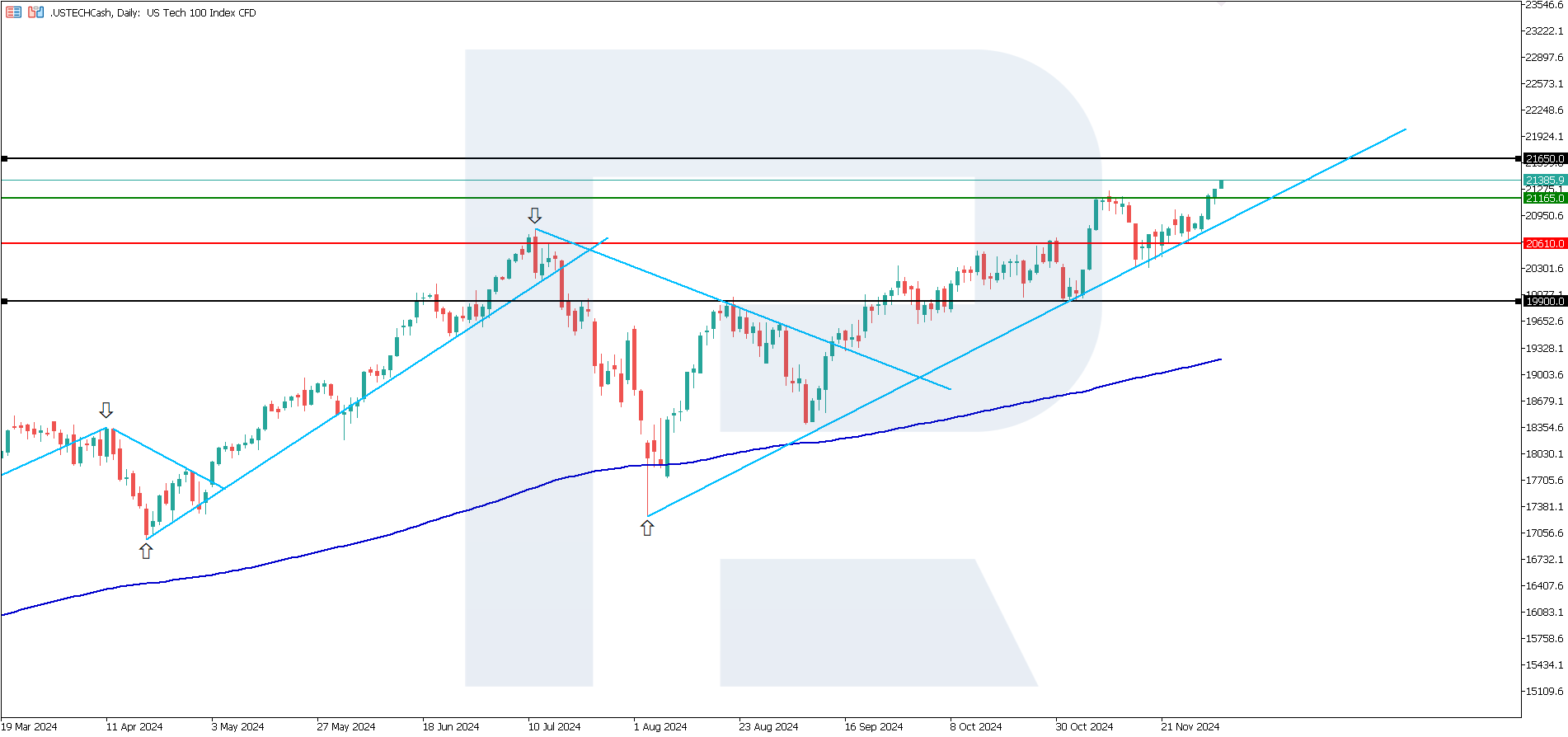

- Resistance: 21,165.0, Support: 20,610.0

- US Tech price forecast: 21,650.0

Fundamental analysis

The US Federal Reserve uses labour market data (including JOLTS) to assess economic resilience and its impact on inflation. According to the Bureau of Labor Statistics (BLS), job openings totalled 7.74 million, exceeding the projected 7.51 million and last month’s reading of 7.37 million.

Source: https://tradingeconomics.com/united-states/job-offers

The current JOLTS reading shows strong labour demand, highlighting economic resilience despite high inflation. An increase in vacancies points to a robust labour market, which supports consumer spending and drives up stocks of companies focused on the domestic market (retail trade, real estate, and services). Firms operating in the human resources area, such as recruitment agencies and job search platforms, may also benefit from the growing labour demand.

Surveys conducted after Donald Trump’s victory show that US companies are optimistic about their prospects, anticipating a more business-friendly policy and reduced regulatory burdens. From factories to construction sites and farms, optimism reflected in various Federal Reserve Banks’ surveys maintains a trend known as the “Trump effect”. This trend began with stock market growth following the 5 November election and the strengthening of the US dollar. The US Tech index forecast is moderately positive.

US Tech technical analysis

The US Tech stock index continues to hit new all-time highs within a mid-term uptrend. Any declines should be viewed as short-term corrections, following which the current trend will resume. According to the US Tech technical analysis, if the quotes secure above the 21,165.0 level, the growth target could be 21,650.0.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 20,610.0 support level could push the index down to 19,900.0

- Optimistic US Tech forecast: if the price gains a foothold above the previously breached 21,165.0 resistance level, it could rise to 21,650.0

Summary

According to the Bureau of Labor Statistics, job openings totalled 7.74 million in October, well above analysts’ forecasts and previous readings. A robust labour market indicates economic stability. Nevertheless, this could lead the US Federal Reserve to reconsider its plans to lower interest rates.