US Tech analysis: the index undergoes a correction but remains in an uptrend

The US Tech stock index is undergoing a correction after breaching the 20,330.0 level but is still in an uptrend. The US Tech forecast for next week is positive.

US Tech forecast: key trading points

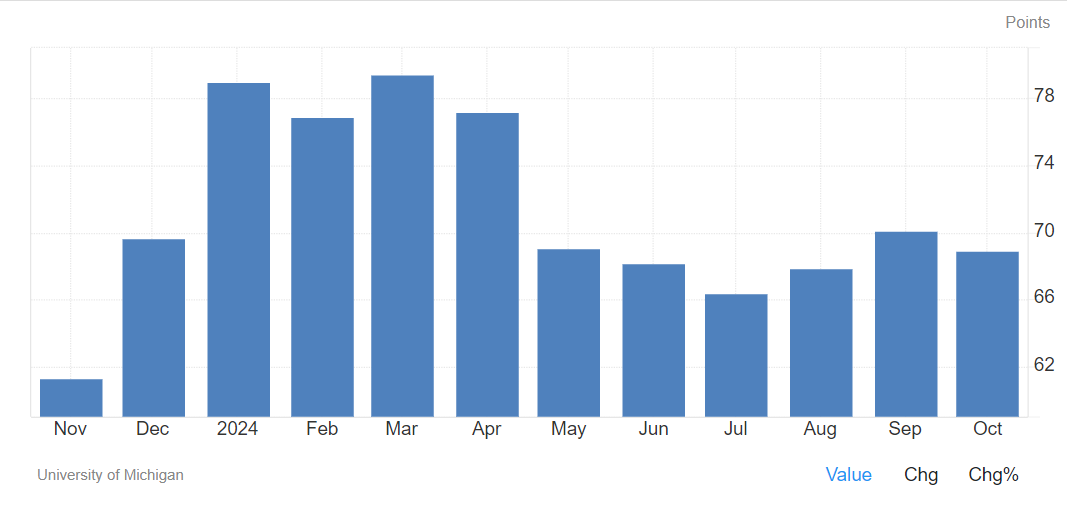

- Recent data: the preliminary Michigan Consumer Sentiment reached 68.9 points in October

- Economic indicators: the index measures consumer confidence in the economy and is a crucial gauge of its health

- Market impact: a decline in consumer sentiment may adversely impact the stock market, especially demand-sensitive sectors such as retail and consumer goods

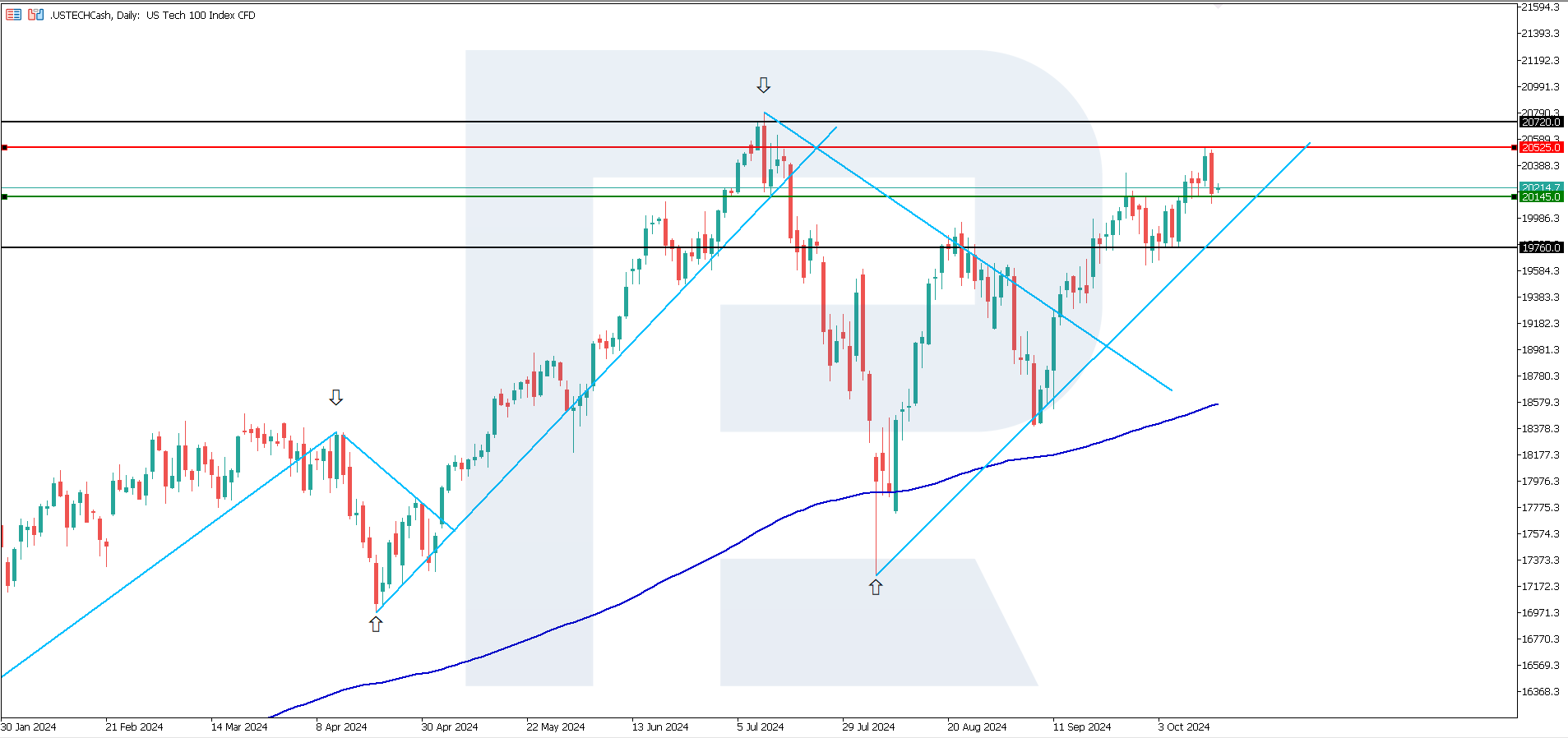

- Resistance: 20,525.0, Support: 20,145.0

- US Tech price forecast: 20,720.0

Fundamental analysis

The University of Michigan Consumer Sentiment Index (a preliminary reading of 68.9 in October) came in below expectations of 70.9 and the previous reading of 70.1. It reflects consumer confidence in the economy and is a crucial health gauge.

Source: https://tradingeconomics.com/united-states/consumer-confidence

A higher confidence level usually correlates with increased consumer spending, which drives economic growth. A decline in consumer sentiment indicates that Americans are becoming more pessimistic about the economy, probably due to inflation, high interest rates, and increasing instability.

Rising inflationary expectations, especially in the short term, indicate that consumers are concerned about future price growth. This could prompt the Federal Reserve to resume its interest rate hiking policy, leading to tighter financial conditions. However, this scenario is unlikely and may be related to seasonal factors. The US Tech index forecast is optimistic.

US Tech technical analysis

The US Tech stock index remains in an uptrend, with yesterday’s correction halting at the 20,145.0 support level. According to technical analysis, the US Tech index still has the potential for further growth and a new all-time high. A breakout above the 20,525.0 resistance level may signal a continuation of the uptrend, with the nearest target at 20,720.0.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 20,145.0 support level could cause the index to fall to 19,760.0

- Optimistic US Tech forecast: a breakout above the 20,525.0 resistance level could drive the index to 20,720.0

Summary

According to preliminary estimates, the Michigan Consumer Sentiment Index will reach 68.9 points in October. A decline in consumer sentiment and rising inflationary expectations signal potential economic challenges, which may negatively impact the technology sector and the overall stock market, especially if inflation boosts interest rates and reduces consumer demand.