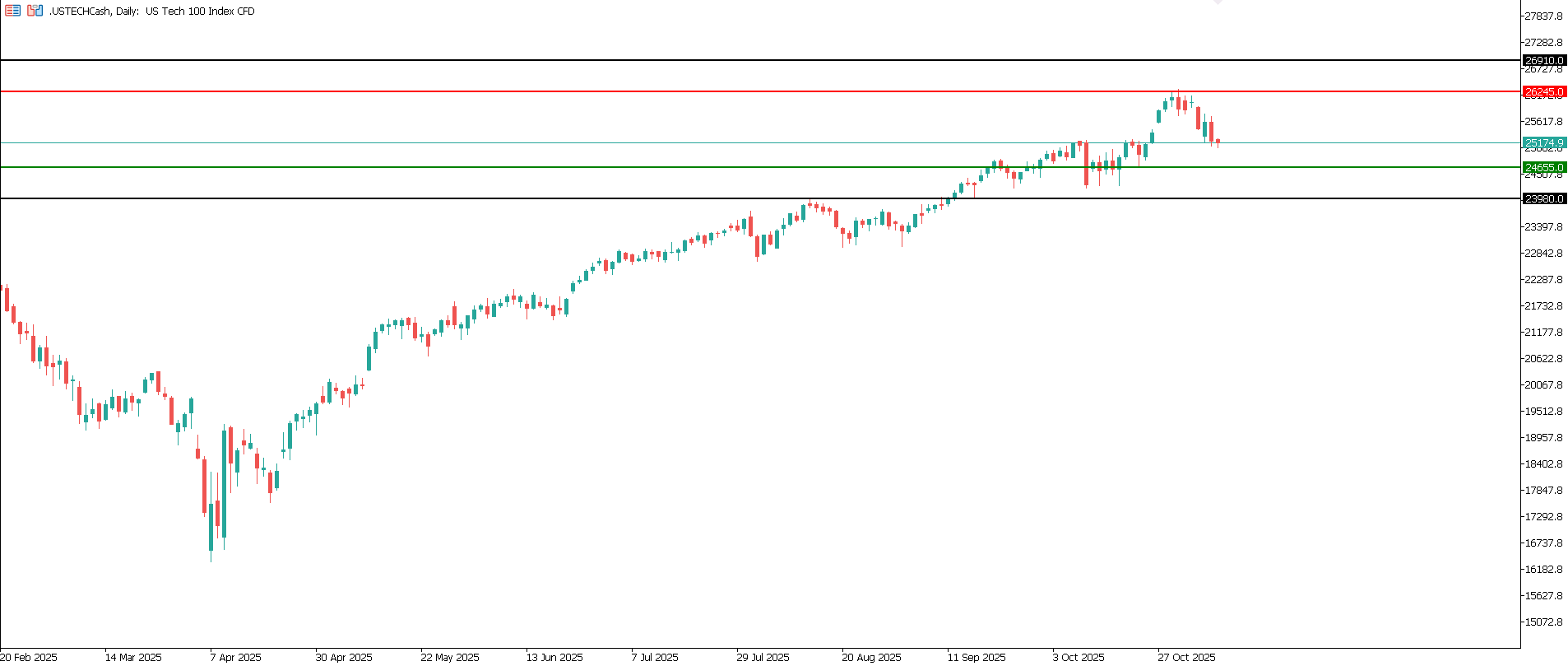

US Tech forecast: the index continues its correction, down more than 4%

The expected correction in the US Tech index continues, although the overall trend remains upward. The US Tech forecast for the coming week is positive.

US Tech forecast: key trading points

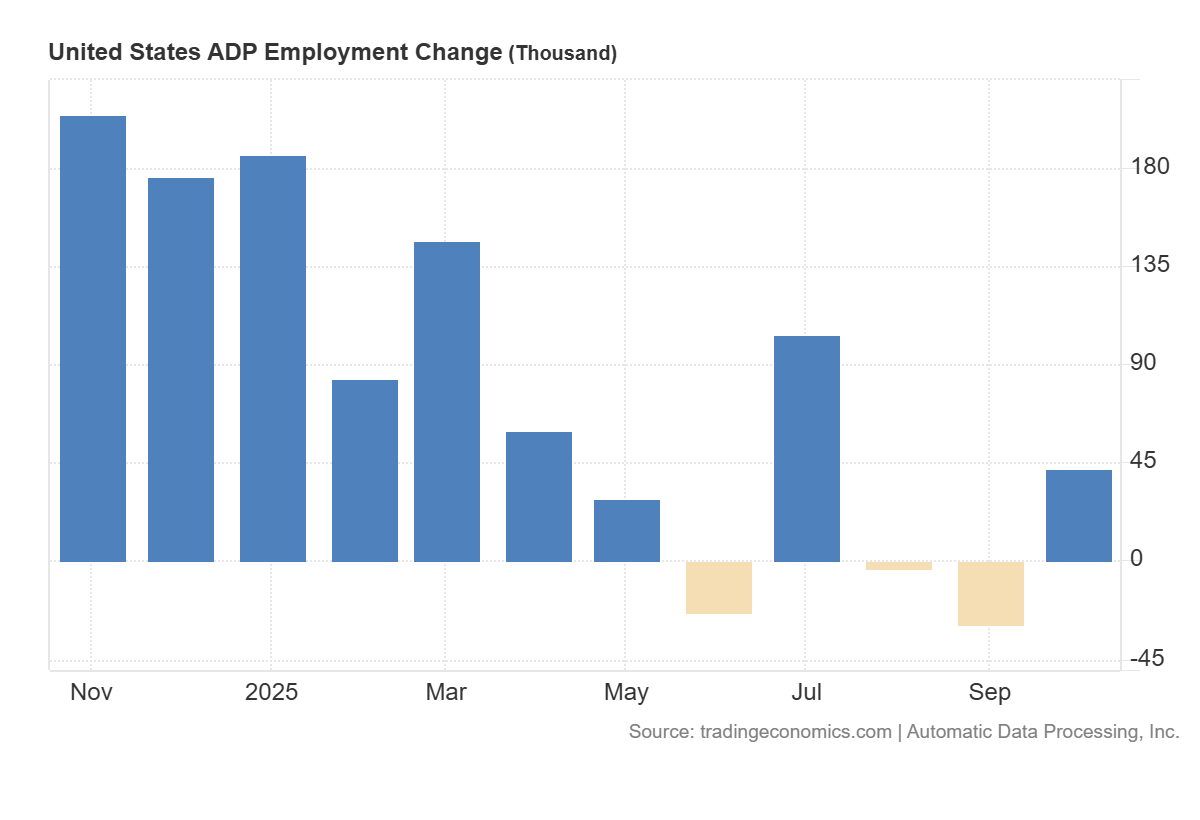

- Recent data: the ADP non-farm employment report came in at +42,000

- Market impact: the current data is negative for the technology sector

US Tech fundamental analysis

The ADP non-farm employment report showed an increase of 42,000 jobs versus the forecast of 32,000 and the previous month’s figure of -29,000. This signals moderate strengthening in the labour market after a brief slowdown and represents a minor positive surprise relative to expectations. For the broader US stock market, this result works in two directions. Stronger-than-expected job growth reduces the risk of a sharp economic slowdown and supports the soft-landing scenario.

US ADP employment change: https://tradingeconomics.com/united-states/adp-employment-changeOn the other hand, stronger employment data compared to consensus expectations increases concerns that the disinflation process may proceed more slowly than the Fed would prefer. For the Federal Reserve, this strengthens the case for a more cautious pace of rate cuts.

US Tech technical analysis

For the US Tech index, the impact is moderately negative in the short term. High-tech companies with long-term cash flow projections are particularly sensitive to changes in expected interest rates and bond yields, as higher discount rates exert disproportionate pressure on their fair value. If, after the ADP release, the market starts to price in less aggressive Fed easing and higher long-term yields, this could lead to a compression of valuation multiples in the technology sector.

US Tech technical analysis for 7 November 2025The US Tech index continues its downward trajectory, correcting without changing its overall trend. The resistance level has formed at 26,245.0, while a new support zone lies at 24,655.0. The next potential upside target could be at 26,910.0.

The US Tech price forecast outlines the following scenarios:

- Pessimistic US Tech scenario: a breakout below the 24,655.0 support level could send the index down to 23,980.0

- Optimistic US Tech scenario: a breakout above the 26,245.0 resistance level could drive the index to 26,910.0

Summary

For the broader US equity market, the latest ADP report provides a balanced yet somewhat positive signal by lowering recession risks. However, for the US Tech index, the focus shifts towards the risk of a tighter rate trajectory and potential downward revaluation of highly valued companies, even with unchanged fundamental growth projections. The next reaction will depend on confirmation from official employment data (Nonfarm Payrolls) and inflation indicators. The nearest upside target could be at 26,010.0.