US Tech forecast: the index continues to rise, but the likelihood of a correction increases

The US Tech stock index remains in a strong uptrend and is set to reach new all-time highs. The US Tech forecast for next week is positive.

US Tech forecast: key trading points

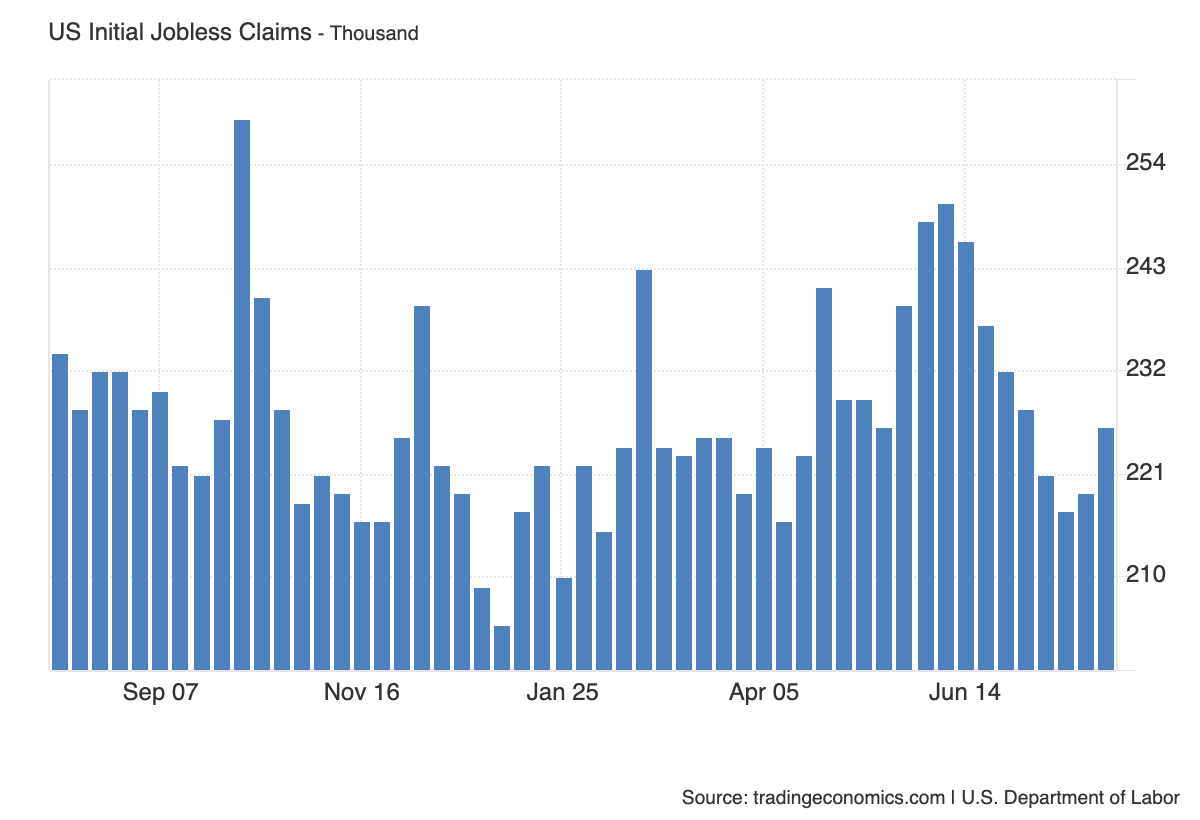

- Recent data: US initial jobless claims for last week came in at 226 thousand

- Market impact: current data signals a weakening labour market, which negatively impacts the stock market

US Tech fundamental analysis

As of 7 August 2025, US initial jobless claims totalled 226 thousand, above the forecast of 221 thousand and the previous reading of 219 thousand. The stock market may react negatively, as rising claims are often seen as a sign of an economic slowdown and potential risks to corporate earnings. The financial and industrial sectors are likely to be hit the hardest.

US initial jobless claims: https://tradingeconomics.com/united-states/jobless-claimsHowever, the technology sector (US Tech) could see a moderately positive boost. A rise in unemployment may heighten expectations of Federal Reserve policy easing, which benefits growth stocks, particularly tech companies with high debt levels and interest rate sensitivity. Nevertheless, if unemployment continues to rise, it could lead to weaker consumer demand and investment activity, negatively affecting IT companies.

US Tech technical analysis

The increase in jobless claims could support the US technology sector in the short term due to falling bond yields and expectations of a softer Fed policy. However, prolonged deterioration in the labour market could weigh on corporate revenues, especially in consumer and advertising segments. The market’s reaction will depend on whether this data is seen as a one-off deviation or the start of a new phase of economic weakness.

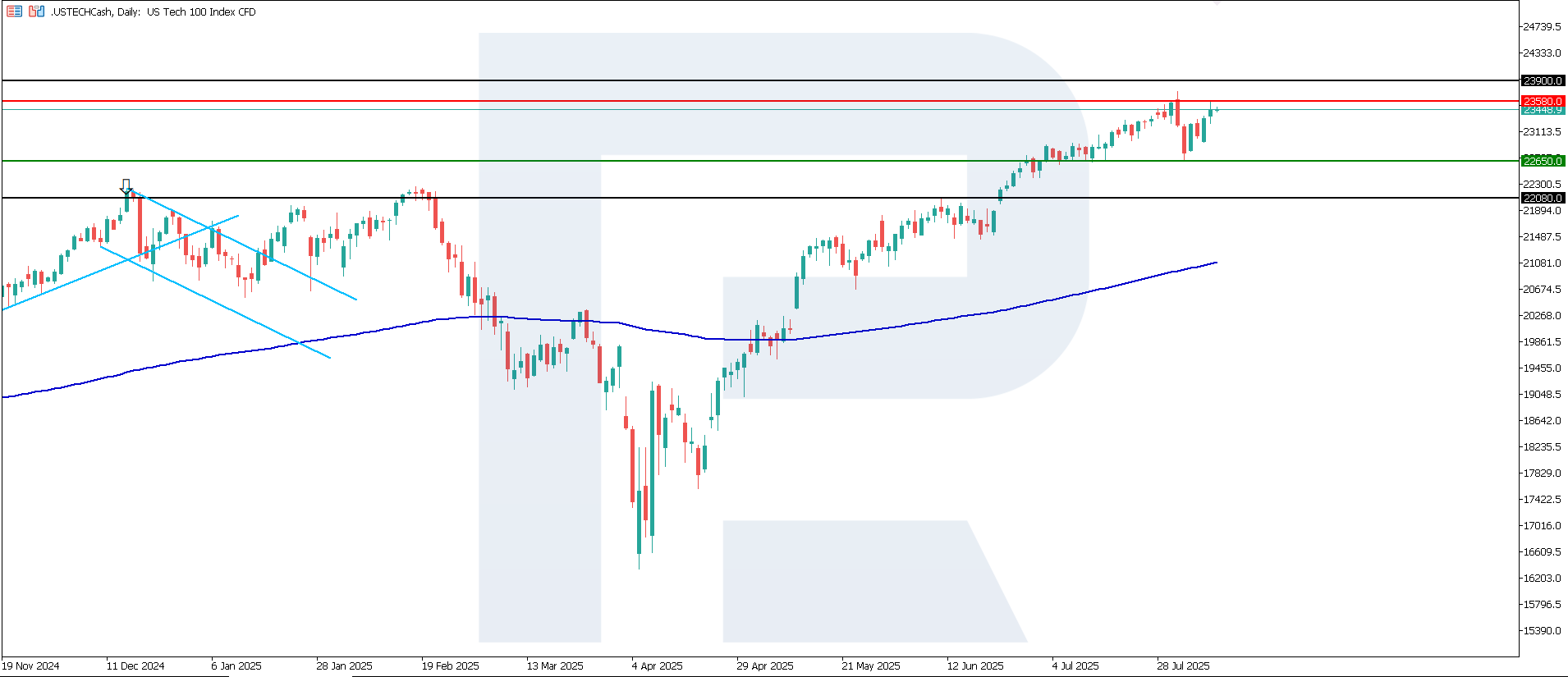

US Tech technical analysis for 8 August 2025The US Tech fell below the previous support level of 23,260.0, forming new resistance at 23,580.0 and nearest support around 22,650.0. The index is moving within a corrective downward channel, which will likely remain short-term, with the nearest downside target at 22,905.0.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech scenario: a breakout below the 22,650.0 support level could push the index down to 22,080.0

- Optimistic US Tech scenario: a breakout above the 23,580.0 resistance level could drive the index to 23,900.0

Summary

The rise in US initial jobless claims to 226 thousand (above forecast and previous reading) has a mixed but potentially positive impact on the US Tech index, particularly in the short term. However, if the labour market continues to weaken and the Federal Reserve does not cut rates, technology stocks could come under pressure. The US Tech index has entered a downtrend, with the next downside target possibly at 22,080.0.