US Tech forecast: the index prepares to break resistance and set a new all-time high

This week, the US Tech index set another all-time high and aims to repeat this success. The forecast for US Tech next week is positive.

US Tech forecast: key trading points

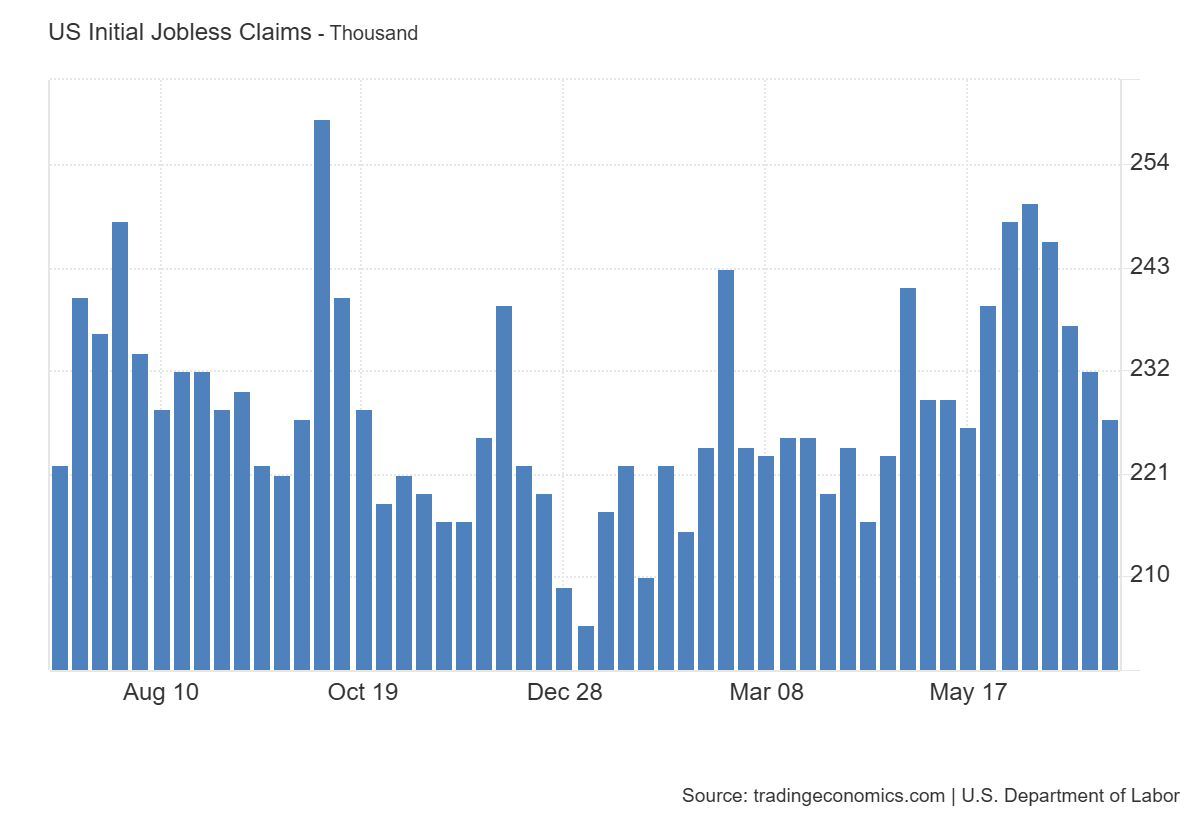

- Recent data: Initial Jobless Claims for the week in the US came in at 227,000

- Market impact: a lower number of new jobless claims indicates a strong economy and reduced risks of rising unemployment

US Tech fundamental analysis

The reading stood at 227,000, beating the forecast of 236,000 and down from the previous 232,000. This indicates that the US labour market remains stable and is even showing signs of improvement. A strong labour market boosts household incomes and purchasing power, supporting demand for consumer goods and services.

United States Initial Jobless Claims: https://tradingeconomics.com/united-states/jobless-claimsA strong labour market maintains stable demand for technology, software, and IT services. Companies such as Microsoft, Apple, and Nvidia gain additional investor confidence amid stable economic conditions. Job growth and declining unemployment support economic activity, positively impacting industrial companies.

US Tech technical analysis

A decrease in Initial Jobless Claims indicates labour market resilience and positive economic momentum. This benefits the US stock market, particularly the technology sector. In the short term, the market may react positively to this data, strengthening the positions of the largest companies within the US Tech index.

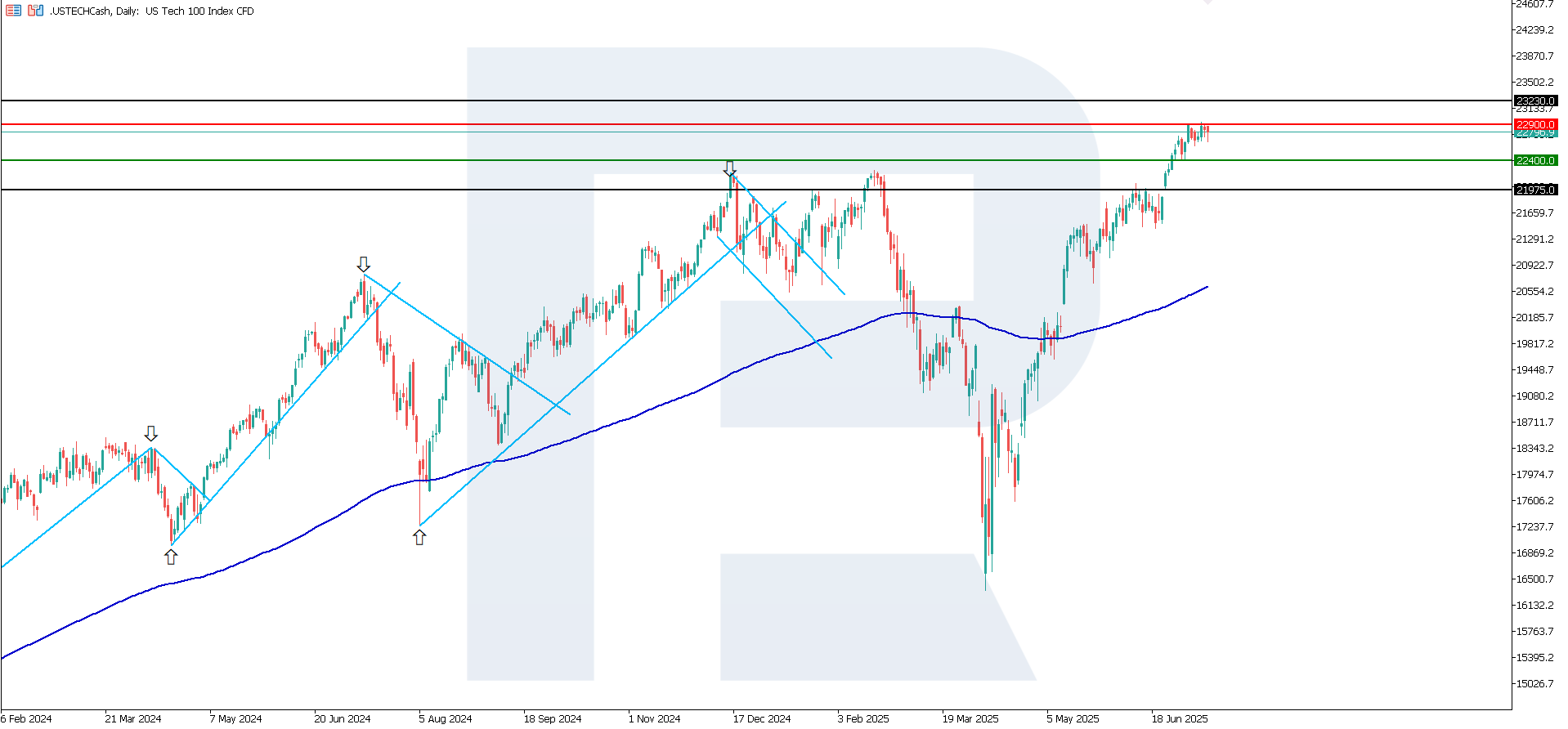

US Tech technical analysis for 11 July 2025The US Tech index broke its previous resistance level at 22,740.0, with support shifting to 22,400.0. A new resistance level has formed at 22,900.0. The index has approached this resistance closely, and if broken, there is potential to reach a new all-time high.

Scenarios for the US Tech index price forecast:

- Pessimistic scenario for US Tech: if the support level at 22,400.0 is breached, prices may fall to 21,975.0

- Optimistic scenario for US Tech: if the resistance level at 22,900.0 is broken, prices may rise to 23,230.0

Summary

US Tech remains in an uptrend with the potential to set a new all-time high. The fundamental backdrop is favourable for technology sector stocks. The next growth target may be 23,230.0. A strong labour market continues to support robust demand for technology, software, and IT services. Only the release of negative news regarding future US Federal Reserve monetary policy could reverse this uptrend.