US Tech forecast: the index rebounds from the recent drop and hits a new all-time high

A rally in the US Tech index has led to a new all-time high, although the probability of a correction remains elevated. The US Tech forecast for this week is positive.

US Tech forecast: key trading points

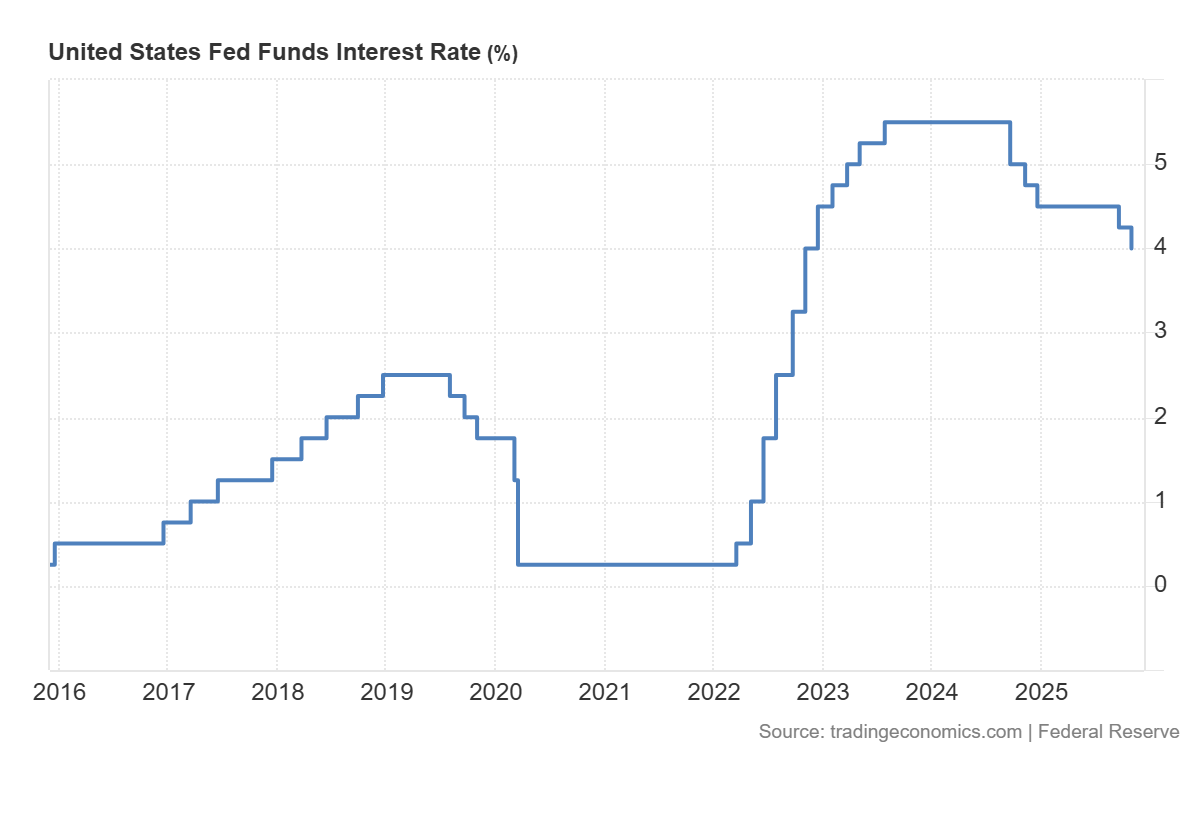

- Recent data: The US Federal Reserve cut the federal funds rate to 4.0%

- Market impact: the data is positive for the technology sector

US Tech fundamental analysis

The Federal Reserve’s decision to lower the target range for the federal funds rate to 3.75–4.00% for the second consecutive time, along with the announcement that balance sheet reduction will end in December 2025, significantly eases financial conditions through two main channels – the cost of capital and system liquidity. Falling short-term interest rates and potentially lower real yields reduce discount rates, supporting multiple expansion in equities, while the end of quantitative tightening helps lower term premiums and stabilise systemic liquidity.

US Fed funds interest rate: https://tradingeconomics.com/united-states/interest-rateFor the broader equity market, this is a moderately positive backdrop, as profit resilience in cyclical sectors improves, credit spreads narrow, and rate-sensitive segments benefit. However, the upside remains limited by the Fed’s accompanying rhetoric: inflation remains slightly above target, and uncertainty in the labour market keeps policymakers data-dependent, meaning the trajectory of bond yields remains the key risk to equity revaluation.

US Tech technical analysis

For the US Tech index, the effect is fundamentally positive. As a long-duration asset, it benefits more from declining real yields and reduced risk premiums, which increases the P/E ratio among high-growth, future-cash-flow-heavy companies. The end of the balance sheet reduction further enhances liquidity and investor risk appetite for growth stocks. Nevertheless, the Fed’s emphasis on persistent uncertainty tempers excessive optimism.

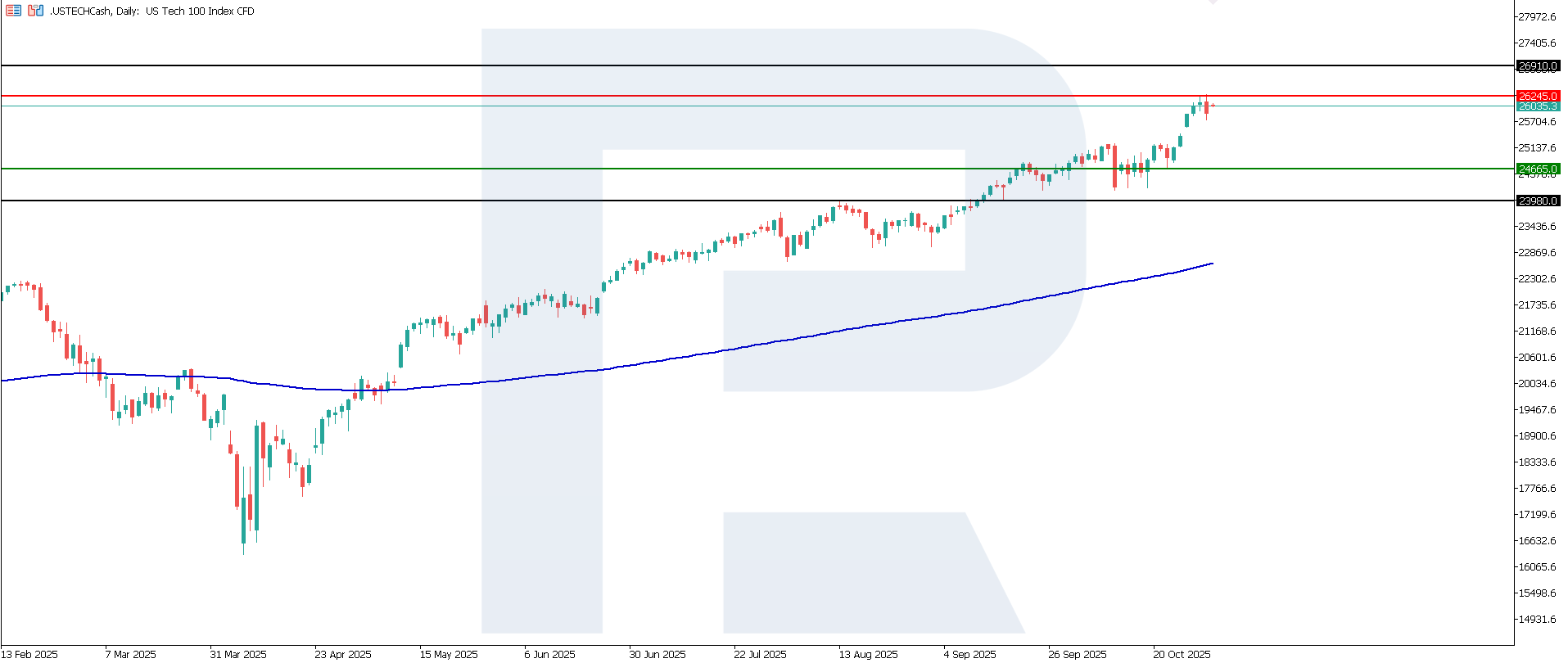

US Tech technical analysis for 31 October 2025The US Tech index has recouped losses and reached a new all-time high, while correcting without a trend reversal. The resistance level has formed at 26,245.0, while the new support zone lies near 24,655.0. The next potential upside target could be 26,910.0.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech scenario: a breakout below the 24,655.0 support level could push the index to 23,980.0

- Optimistic US Tech scenario: a breakout above the 26,245.0 resistance level could drive the index to 26,910.0

Summary

The Fed’s rate cut and announcement to end balance sheet reduction soften financial conditions, providing a moderately positive impulse to the US stock market by lowering discount rates and improving liquidity. The US Tech, as a long-term asset, stands to gain the most, as multiples could widen. The main risk to sustaining the rally remains a rise in long-term yields amid persistent inflation and labour market uncertainty. From a technical perspective, the next upside target for the US Tech could be 26,910.0.