US Tech forecast: the index slightly corrected after reaching a new all-time high

The US Tech index rally continues, with the benchmark hitting a new all-time high ahead of US labour market data. The US Tech forecast for the coming week is positive.

US Tech forecast: key trading points

- Recent data: the yield on 30-year US Treasury bonds reached 4.734% at the latest auction

- Market impact: for the technology sector, this development has a negative effect

US Tech fundamental analysis

The yield on 30-year US Treasury bonds rose to 4.734%, up from 4.651% at the previous auction. The increase indicates that investors are demanding higher compensation for holding long-term securities, reflecting expectations of prolonged high interest rates or elevated inflation risks. A rise in long-term yields is typically viewed as a sign of tighter financial conditions.

US 30-year bond yield: https://tradingeconomics.com/united-states/30-year-bond-yieldThis means the cost of capital is rising, while the relative attractiveness of equities versus bonds is declining, especially amid uncertainty about future monetary policy. Higher yields may also signal reduced demand for government debt, adding to financial market volatility. Overall, this creates a moderately negative backdrop for the US stock market, as higher yields increase the appeal of risk-free assets and reduce the present valuation of companies’ future profits.

US Tech technical analysis

The technology sector, represented by the US Tech index, is particularly sensitive to movements in long-term rates. Companies in this sector tend to have high valuation multiples and rely on future earnings, making them vulnerable when discount rates increase. Rising rates also raise financing costs for innovative and capital-intensive projects. Consequently, the rise in 30-year bond yields, especially near multi-year highs, may reduce investor appetite for tech stocks and trigger a mild correction in the US Tech index.

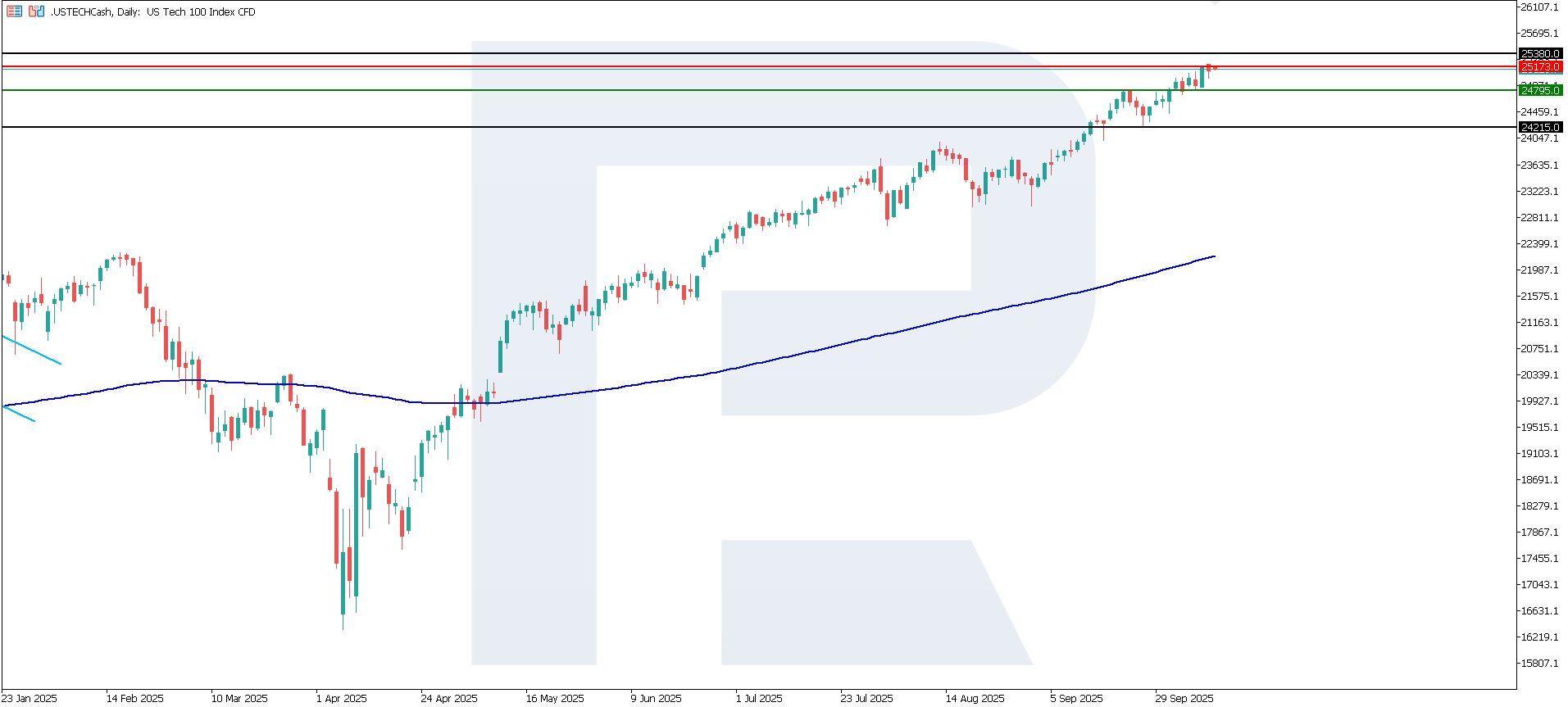

US Tech technical analysis for 10 October 2025The US Tech index has hit a new all-time high, forming a resistance level at 25,173.0 and a new support area at 24,795.0. The uptrend will likely be medium-term, with the nearest upside target at 25,380.0.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech scenario: a breakout below the 24,795.0 support level could push the index to 24,215.0

- Optimistic US Tech scenario: a breakout above the 25,173.0 resistance level could drive the index to 25,380.0

Summary

The US Tech index continues to set new all-time highs. The rise in 30-year Treasury yields reflects expectations of sustained high interest rates, which exerts pressure on equities, particularly in the technology sector. The index may experience short-term declines or consolidation due to higher capital costs and reduced risk appetite. Upcoming US labour market data, expected later today, could influence further dynamics. The next upside target could be at 25,380.0.