The USDCAD pair pulled back to 1.3600. The market favours CAD strength amid the oil price rally and domestic news from Canada. Find out more in our analysis for 16 June 2025.

USDCAD forecast: key trading points

- The USDCAD pair drops to its lowest level in eight months

- Oil rally and domestic signals support the CAD

- USDCAD forecast for 16 June 2025: 1.3566

Fundamental analysis

The USDCAD rate declined to 1.3600 on Monday, marking a fresh eight-month low.

Several factors bolster the Canadian dollar. Firstly, support comes from the oil price rally, with Brent prices rising due to Middle East instability. This is particularly important for Canada, where oil is a major export commodity. Secondly, there is growing speculation that the US Federal Reserve may resume rate cuts if the US economy starts losing momentum again.

Additional backing for the Canadian currency came from the announcement of an early increase in defence spending. Prime Minister Mark Carney stated that Canada would meet NATO’s 2% of GDP defence spending target in the current fiscal year, five years ahead of schedule. This news may help reduce friction in the upcoming trade negotiations with the US.

The USDCAD forecast is bearish.

USDCAD technical analysis

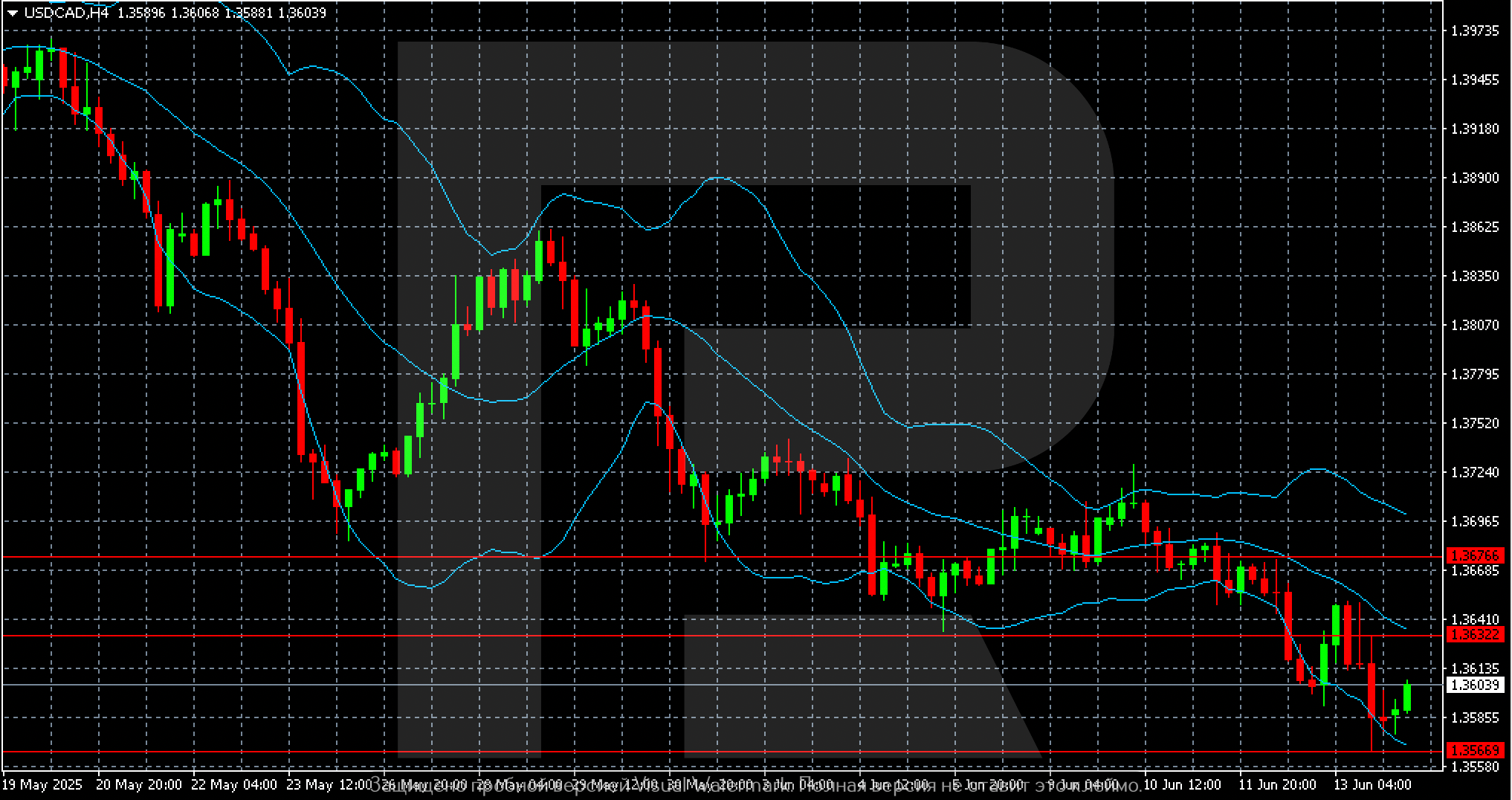

The USDCAD H4 chart shows a setup for a continuation of the downtrend towards 1.3566 after a brief correction.

Summary

The USDCAD pair hit an eight-month low amid the oil price rally and easing tensions over Canada’s position in the upcoming trade talks with the US. The USDCAD forecast for today, 16 June 2025, suggests a possible return of selling pressure with a target at 1.3566.