The USDCAD pair is hovering around 1.4169 on Monday. Investors have increasingly less faith in Trump’s threats. Find more details in our analysis for 17 February 2025.

USDCAD forecast: key trading points

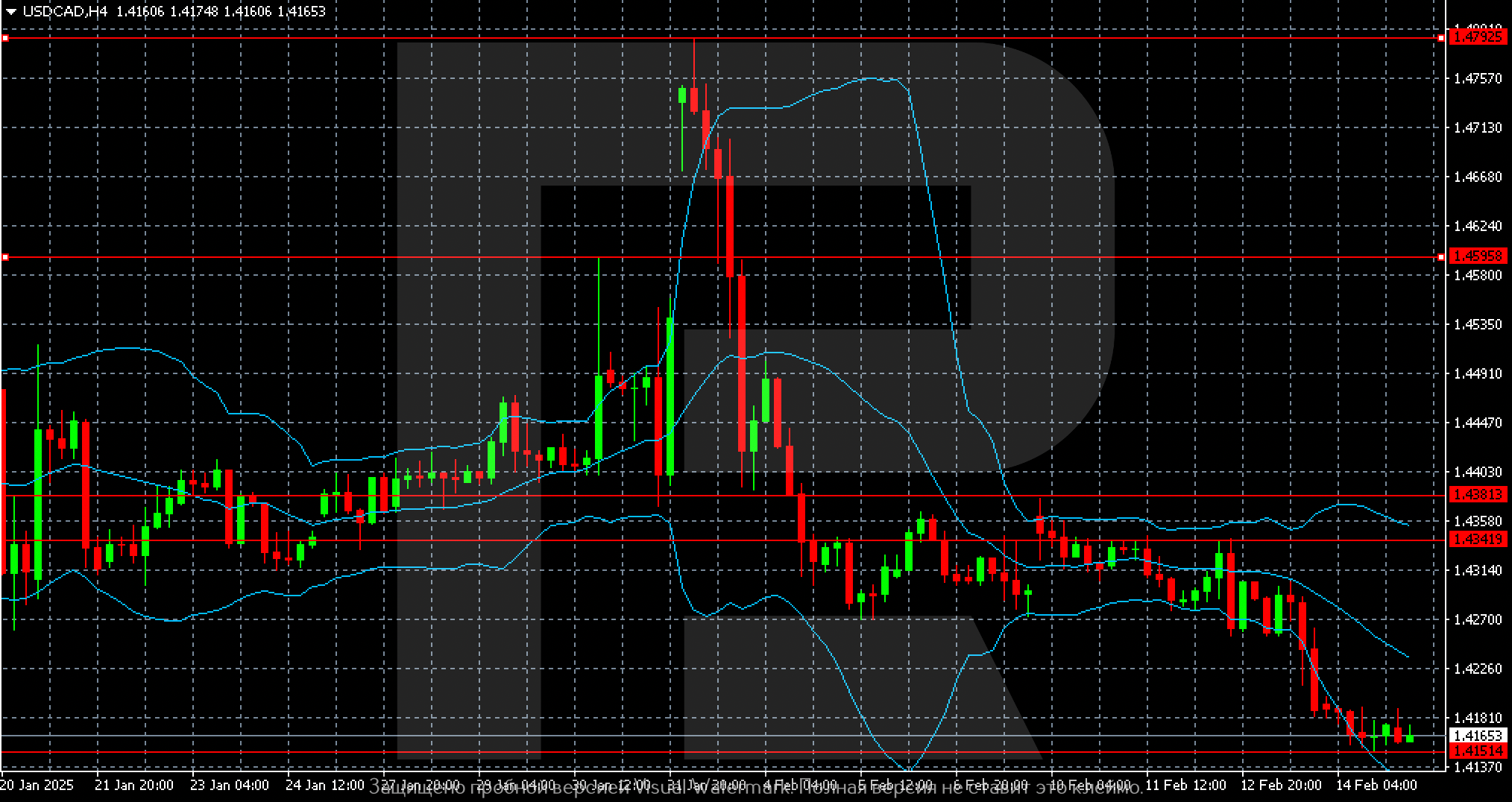

- The USDCAD pair is falling, hitting lows seen on 12 December 2024

- The Canadian dollar is supported by the lack of real actions by the US to introduce trade tariffs

- USDCAD forecast for 17 February 2025: 1.4151 and 1.4140

Fundamental analysis

The USDCAD rate continues its downward trajectory, falling to 1.4169, the lowest level unseen since 12 December 2024.

Investors began to doubt whether the trade tariffs promised by US President Donald Trump are really serious. The market was expecting a blow as Trump announced a large-scale financial aggression. However, the announcement turned out to be vague and postponed until at least early April. This is very similar to the usual scenario for the White House under Trump, with threats of sanctions being louder than real actions.

Canada’s domestic data appears mixed. Wholesale sales fell by 0.2% in December, while manufacturing sales rose by 0.3% m/m amid increased demand for oil products and food.

The USDCAD forecast remains negative.

USDCAD technical analysis

On the USDCAD H4 chart, the nearest target for a decline remains at 1.4151. The intermediate support level below it is 1.4140, with the next at 1.4125.

Summary

The USDCAD pair has fallen to a two-month low and may plunge even lower as the threat of trade implications between the US and Canada has dimished. The USDCAD forecast for today, 17 February 2025, suggests that a selling wave could extend towards 1.4140.