USDCAD: expectations of the Bank of Canada’s decision keep the market on edge

The USDCAD rate shows a minor correction, dropping to 1.4164. More details in our analysis for 11 December 2024.

USDCAD forecast: key trading points

- The US dollar strengthens amid strong employment data

- Canada’s unemployment rate rose to 6.8% in November, exceeding forecasts

- Canada’s economy grew by 1.0% in Q3

- Traders await the Bank of Canada’s interest rate decision, forecasting a 50-basis-point rate cut

- USDCAD forecast for 11 December 2024: 1.4100

Fundamental analysis

The USDCAD rate declines after rebounding from a crucial resistance level at 1.4180. The Canadian dollar remains under pressure due to expectations of a substantial Bank of Canada rate cut.

The US dollar has strengthened for three consecutive trading sessions due to robust employment data, which exceeded market expectations even amid an uptick in the unemployment rate to 4.2%. US inflation expectations also rose to 3.0% in November from 2.9% in October, indicating persistent price pressures. Despite mixed economic signals, the markets estimate the likelihood of a 25-basis-point Federal Reserve rate cut this month at 86.1%.

Canada’s unemployment rate rose to 6.8% in November, higher than forecasts of 6.6% and reaching the highest level since September 2021. This reinforced concerns about the weakness of the labour market. Canada’s economy grew by 1.0% year-on-year in Q3 2024, aligning with market expectations. However, the figure was below the Bank of Canada’s forecast of 1.5%, showing the slowest growth in the past four quarters. These factors fuel expectations of a 50-basis-point rate cut by the regulator, which, according to today’s USDCAD forecast, supports current growth in the currency pair.

USDCAD technical analysis

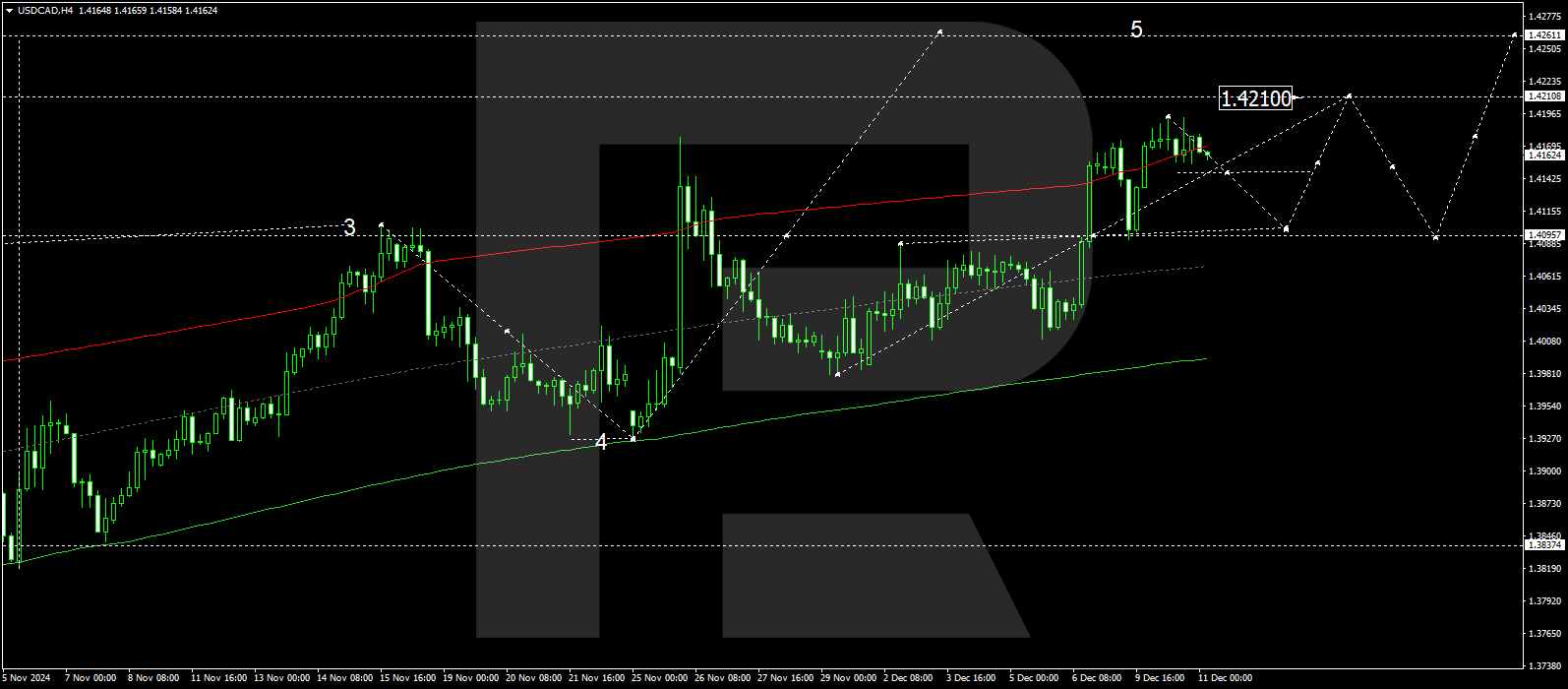

The USDCAD H4 chart shows the market has completed a growth wave, reaching the local target of 1.4193. A consolidation range is expected to form below it today, 11 December 2024. A correction will begin with a breakout below the range, targeting 1.4100. The market is forming a broad consolidation range around it. Subsequently, a growth wave could begin, aiming for 1.4210 as the main target.

The Elliott Wave structure and wave matrix, with a pivot point at 1.4100, technically support this scenario. This level is considered crucial for a growth wave in the USDCAD rate. The market has achieved the local target of the growth wave and reached the upper boundary of a price envelope at 1.4193. A new downward wave is expected after the price reaches this level, aiming for the envelope’s central line at 1.4100. A new growth wave could follow next, targeting the envelope’s upper boundary at 1.4210.

Summary

Growth in the USDCAD pair is driven by the strengthening of the US dollar due to strong employment statistics. Expectations of an imminent Bank of Canada rate cut exert significant pressure on the Canadian dollar, bolstering current growth in the currency pair. Technical indicators for today’s USDCAD forecast suggest that a correction could continue to the 1.4100 level.