USDCAD forecast: Canada’s trade deficit increased due to a decline in oil exports

The USDCAD rate has risen for the sixth consecutive trading session, breaking above the 1.3625 resistance level. Find out more in our analysis for 9 October 2024.

USDCAD forecast: key trading points

- Canada’s trade deficit reached 1.097 billion CAD in August, considerably exceeding forecasts

- Canada’s labour market is expected to weaken further, which may increase the likelihood of monetary policy easing by the regulator

- The odds of a 50-basis-point Federal Reserve interest rate cut have decreased, with markets estimating the likelihood of a 25-basis-point cut at 86.7%

- USDCAD forecast for 9 October 2024: 1.3700

Fundamental analysis

The USDCAD rate is undergoing a correction after reaching 1.3674. The Canadian dollar fell to an eight-week low amid expectations of a tighter Federal Reserve monetary policy, adding pressure on the USDCAD pair.

The robust US employment data have reduced the odds of a substantial 50-basis-point rate cut at the next meeting in November. Markets now estimate the likelihood of a more moderate 25-basis-point rate cut at 86.7%.

The trade deficit in Canada increased to 1.097 billion CAD in August, coming in well above the forecasted 0.047 billion. This is the most significant gap since May, driven by a decline in exports and a slump in energy supplies, including oil, Canada’s key export commodity. Crude oil exports fell by 4.1%, which, according to today’s USDCAD forecast, may contribute to the current growth.

Additionally, expectations point to a potential weakening of the Canadian labour market, which increases the likelihood of further monetary policy easing by the Bank of Canada. The employment indicator is projected to fall from 22,100 to 8,000 employees, while the unemployment rate may decrease slightly from 6.6% to 6.5%.

USDCAD technical analysis

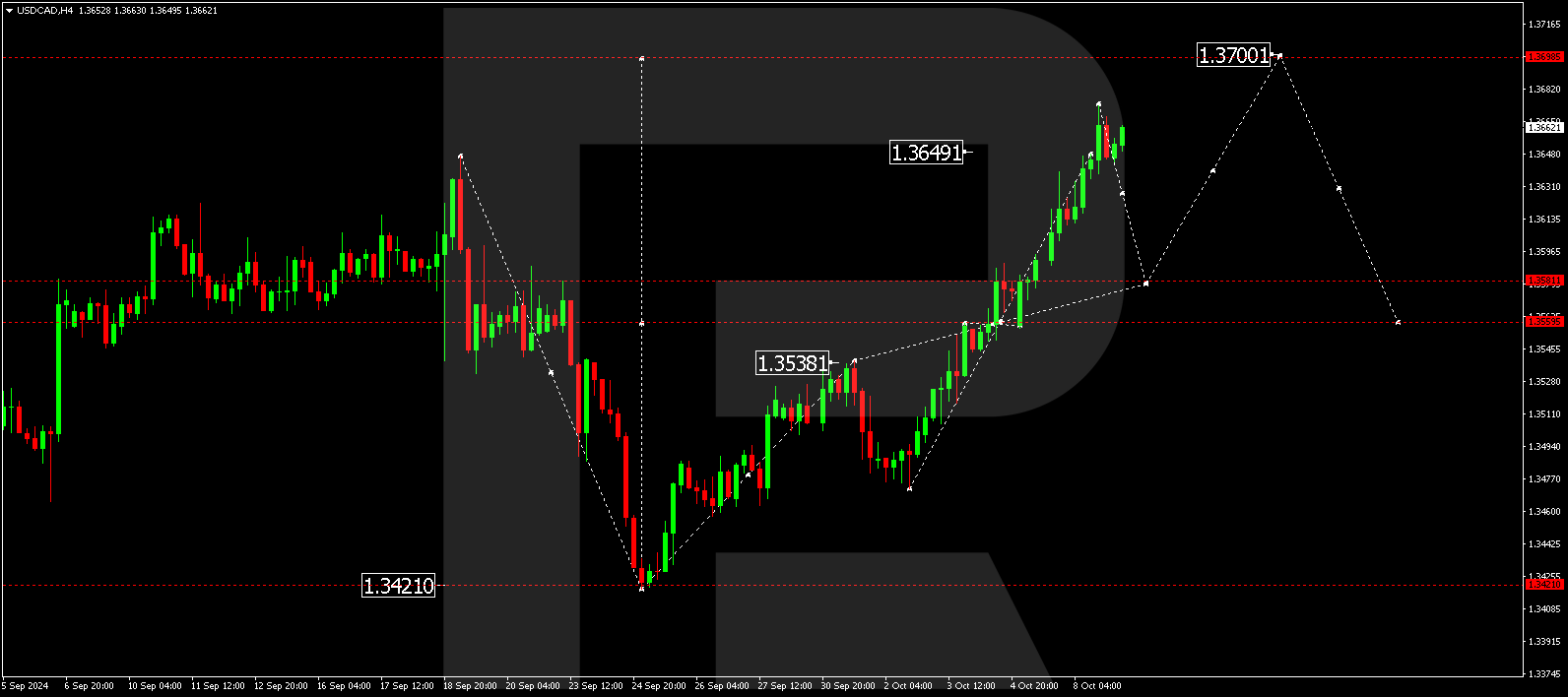

The USDCAD H4 chart shows that the market has completed a growth wave, reaching 1.3655. A consolidation range is expected to form around this level today, 9 October 2024. With a breakout below the range, a correction in the USDCAD rate is possible, targeting 1.3581. Subsequently, another growth wave could begin, aiming for 1.3700. A breakout above the range will open the potential for the trend to continue towards 1.3700, the first target.

Summary

The USDCAD currency pair remains under pressure amid expectations of a tight Federal Reserve monetary policy and an increase in Canada’s trade deficit. The expected weakening of the Canadian labour market increases the likelihood of monetary policy easing by the Bank of Canada, which may continue to support upward momentum in USDCAD. Technical indicators in today’s USDCAD forecast suggest a growth wave structure towards 1.3700.