USDCAD is correcting: investors await signals from the Federal Reserve and the Canadian economy

The USDCAD rate is declining on Wednesday following a protracted rise amid expectations of the Federal Reserve’s decision and falling oil prices. Find out more in our analysis dated 31 July 2024.

USDCAD trading key points

- Investors await the US Federal Reserve’s interest rate decision

- CFTC data indicates a significant increase in Canadian dollar short positions

- Falling oil prices are negatively impacting the Canadian dollar, given Canada’s status as a major oil exporter

- USDCAD forecast for 31 July 2024: 1.3792

Fundamental analysis

The USDCAD rate reached 1.3863 on Monday, marking the pair’s eight-month low. Investors attribute this decline to anticipating the Federal Reserve’s decision and falling oil prices amid concerns about sluggish oil demand from China. The USDCAD rate continues to tumble on 31 July 2024, testing the 1.3840 support level.

The latest CFTC (U.S. Commodity Futures Trading Commission) data reveals a notable increase in bearish positions on the Canadian currency. Speculators are betting on a further decline in the Canadian dollar to a record level. As of 23 July, net short positions increased to 161.6 thousand contracts from 132.5 thousand a week ago.

Investors expect the Federal Reserve to keep interest rates unchanged on Wednesday but anticipate a signal for an imminent cut. Traders will also focus on Canada’s monthly GDP data, which is due for release today.

Analysts note that prolonged one-way movements in the currency market rarely exceed ten trading sessions. Therefore, investors are likely to begin closing short positions in the Canadian dollar soon, which could potentially push the USDCAD rate down.

USDCAD technical analysis

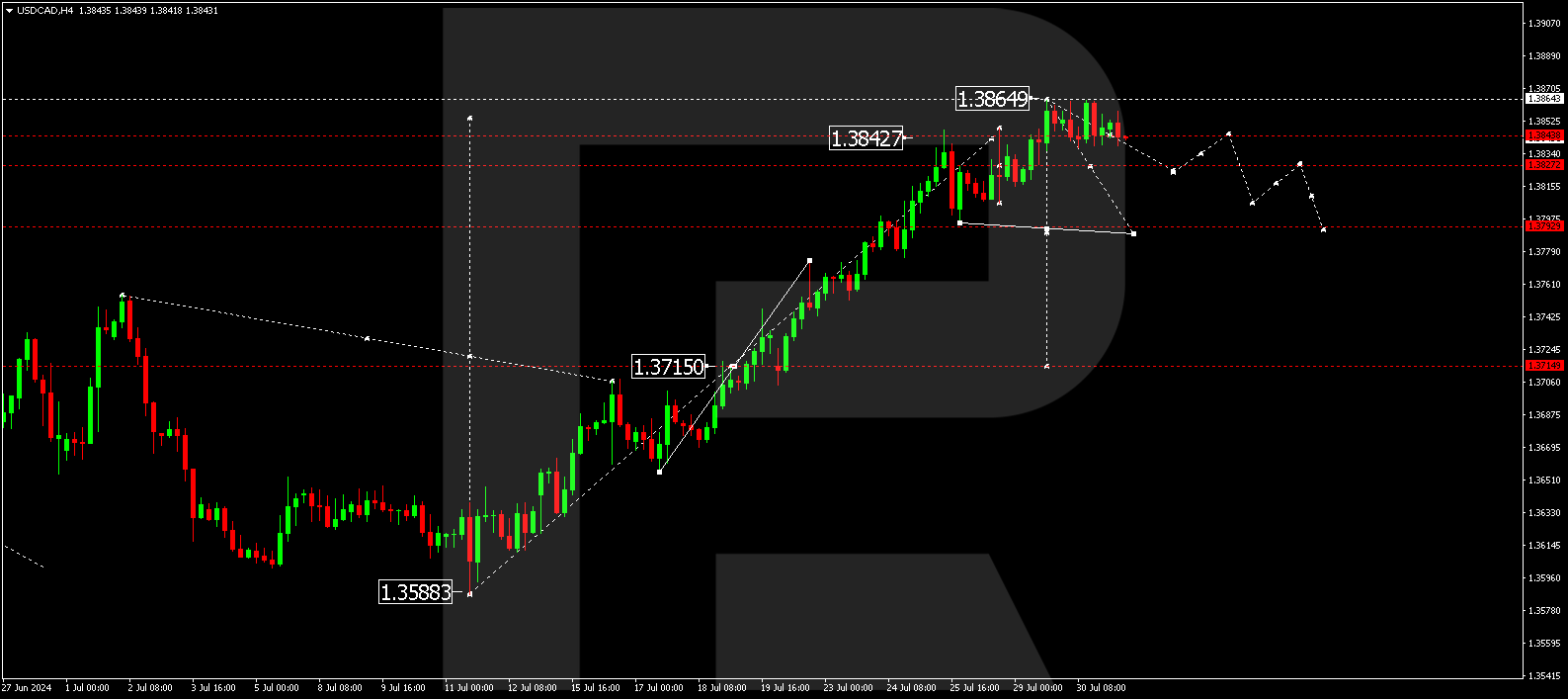

USDCAD technical analysis for 31 July 2024 shows that the pair has completed a growth wave, reaching 1.3864. A consolidation range is currently forming below this level. Today, the rate is expected to decline to 1.3828 before rising to 1.3844 (testing from below). Subsequently, a decline wave might develop, aiming for 1.3793 as the first target of the downtrend.

Summary

Investors anticipate the Federal Reserve will maintain interest rates and closely monitor Canada’s GDP data. Closing short positions in the Canadian dollar may lead to further declines in the USDCAD rate. Technical indicators for today’s USDCAD forecast suggest a decline wave towards 1.3792.