USDCAD: markets expect a faster interest rate cut by the Bank of Canada

The USDCAD rate is declining on Wednesday after rebounding from the crucial resistance level. Find out more in our analysis for 18 September 2024.

USDCAD forecast: key trading points

- Inflation in Canada eased to 2.0% in August, the lowest in 3.5 years

- Inflation data supports the Bank of Canada governor’s statements that the pace of interest rate cuts may be accelerated

- Housing starts in Canada fell by 22.3% to 217,000 in August, marking the lowest reading since November 2023

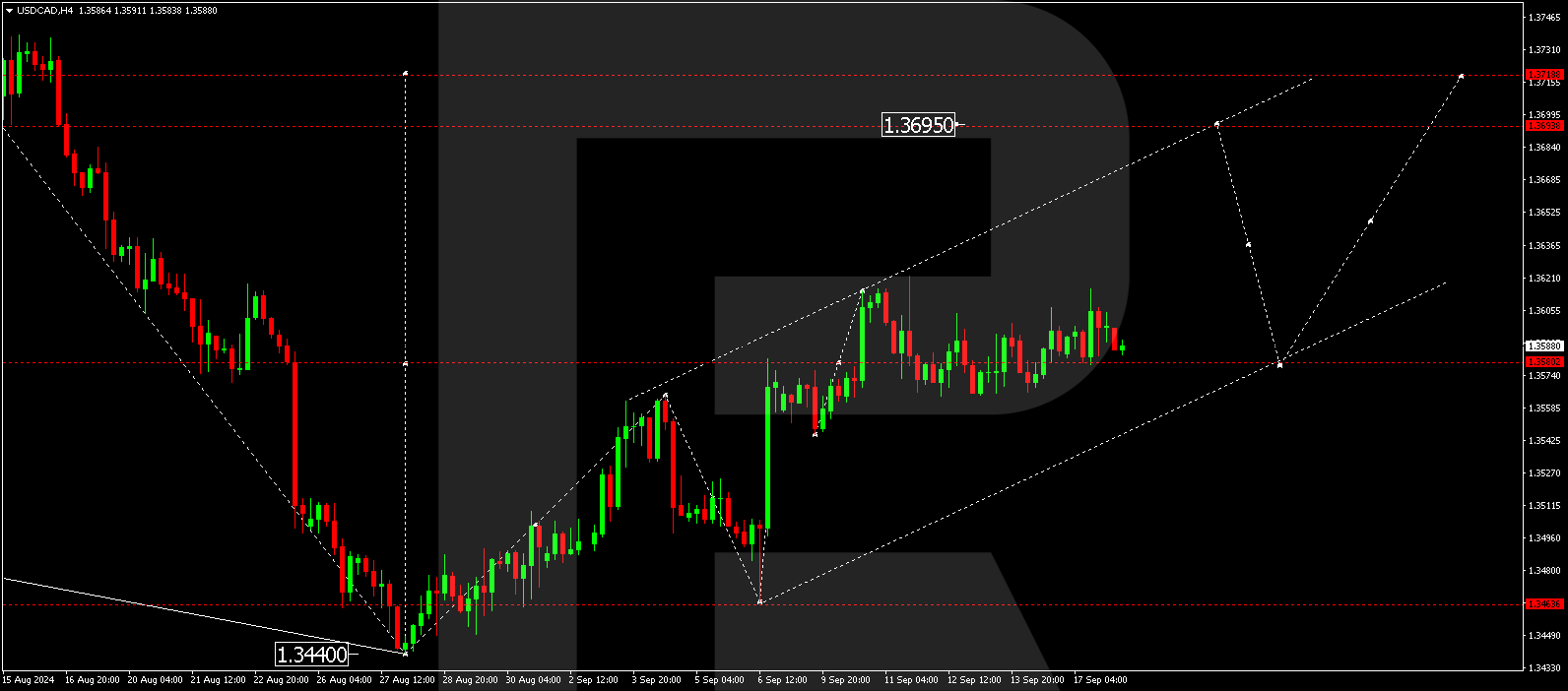

- USDCAD forecast for 18 September 2024: 1.3695

Fundamental analysis

The USDCAD rate is influenced by inflation data as investors are confident in further monetary policy easing by the Bank of Canada.

Inflation in Canada continued to slow, reaching 2.0% in August. This is the lowest reading in the past 3.5 years and is in line with the regulator’s forecasts, which expected inflation to ease to 2.5% in the second half of 2024. However, analysts believe inflation may rise again as the August slowdown is partially due to falling global fuel prices.

This data reinforces statements by Bank of Canada Governor Tiff Macklem about a potential acceleration of the pace of interest rate cuts amid concerns about the employment market and an expected fall in oil prices. The markets now anticipate a 50-basis-point interest rate cut, which may lead to sharp price fluctuations as part of the USDCAD forecast for today.

However, high mortgage rates and rents continue to exert pressure on inflation, indicating ongoing challenges in the Canadian economy despite the overall inflation easing. This is further confirmed by the data on a sharp decrease in construction: housing starts fell by 22.3% to 217,000 in August 2024, the lowest since November 2023 and well below market expectations of 258,000.

USDCAD technical analysis

The USDCAD H4 chart shows that the market continues to develop a consolidation range around 1.3580 without a clear trend. It will be relevant to consider the likelihood of a growth wave towards the local target of 1.3695. The price is expected to rise to 1.3640 today, 18 September 2024. Subsequently, it could fall to 1.3600 (testing from above) before rising to 1.3695. A corrective wave structure has developed. After reaching this level, the price might dip to 1.3580. Subsequently, a new growth wave could begin, aiming for 1.3720 as the main target.

Summary

Continued high mortgage rates and rents as well as a decline in housing starts indicate that Canada has yet to fully overcome inflationary challenges and may limit the potential for the Canadian dollar to strengthen. Technical indicators in today’s USDCAD forecast suggest that the growth wave could continue towards the 1.3695 level.