USDCAD pulls lower as risk appetite expands

The USDCAD pair remains under pressure. The market is in a risk-on mood and unfazed by weak Canadian employment data. Find out more in our analysis for 11 August 2025.

USDCAD forecast: key trading points

- The USDCAD pair is declining despite weak Canadian statistics

- Risk appetite was driven by a positive external backdrop and improvements in geopolitics

- USDCAD forecast for 11 August 2025: 1.3720

Fundamental analysis

The USDCAD rate starts the week at 1.3750. The CAD holds steady despite weak employment data, which only moderately affected expectations for a Bank of Canada rate cut. By the end of last week, the Canadian dollar had strengthened by 0.3%.

In July, Canada’s economy lost 40.8 thousand jobs, partially offsetting strong growth in the previous month. The employment-to-population ratio fell to its lowest level in eight months. The forecast had suggested an increase of 13.5 thousand jobs.

While the free trade agreement with the US remains the main external risk, the market does not consider it critical for the economy or for Bank of Canada decisions. In June, 92% of Canada’s exports by value went to the US duty-free under the USMCA, and the number of registered participants in the agreement continues to grow.

The likelihood of a key interest rate cut from the current 2.75% at the 17 September meeting is estimated at 38%, up from 33% before the release of the employment report.

The USDCAD forecast is moderately negative.

USDCAD technical analysis

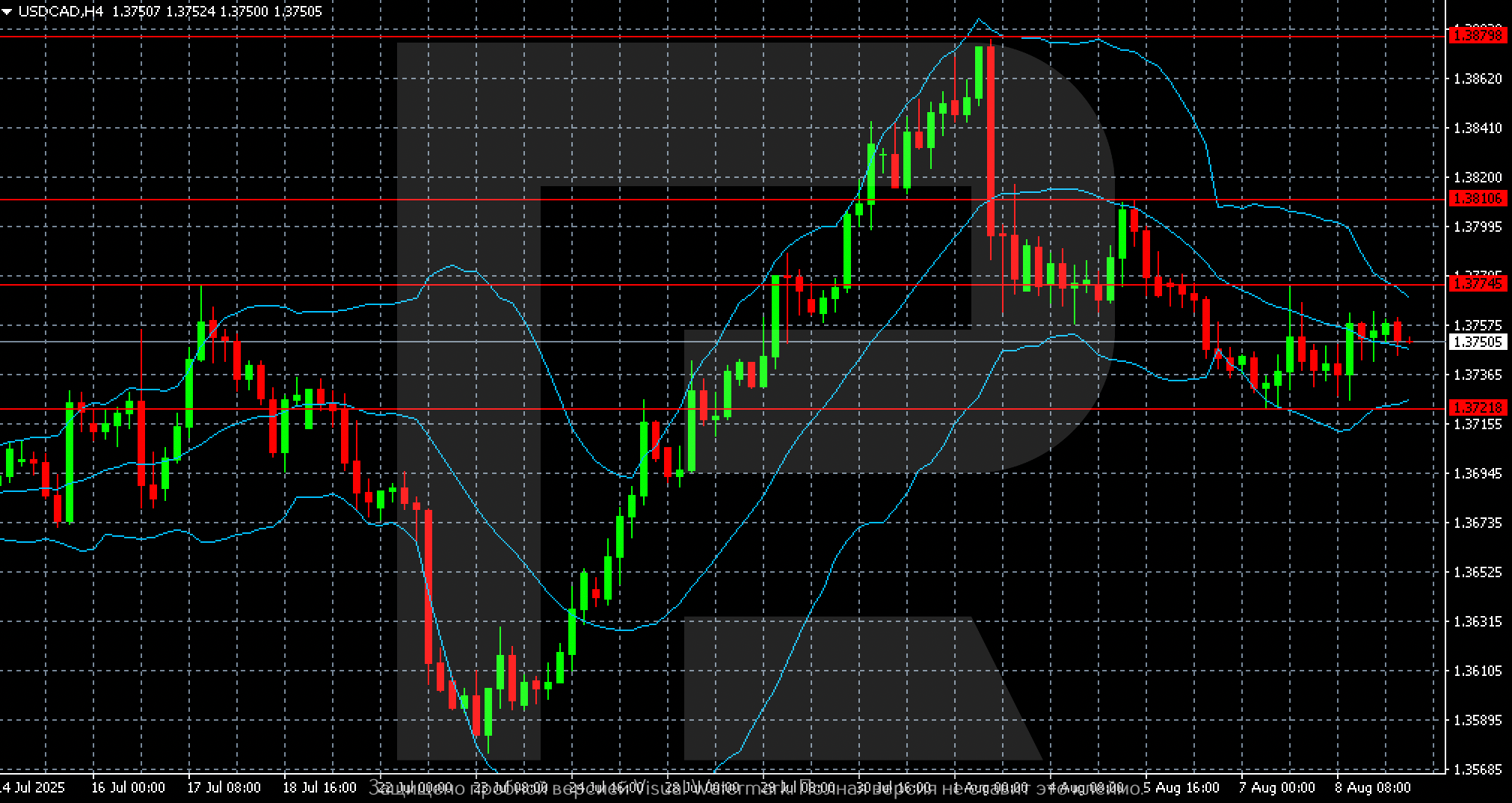

On the H4 chart, the USDCAD pair is trading at 1.3750 and remains within the 1.3720-1.3775 range. After climbing to 1.3880 in late July, quotes corrected and have mostly been moving sideways since early August.

The nearest resistance level is at 1.3775, with higher levels at 1.3810 and 1.3880. The support line lies at 1.3720; a breakout below this level would open the way to 1.3670 and 1.3630. Bollinger Bands have narrowed, indicating lower volatility and increasing the likelihood of a breakout from the range in the coming sessions.

A consolidation above 1.3775 would signal a move towards 1.3810 and 1.3880, while a drop below 1.3720 would strengthen selling pressure.

Summary

With the USDCAD pair remaining in a sideways range, the market may choose one of two directions. The USDCAD forecast for today, 11 August 2025, suggests a possible test of 1.3720.