USDCAD: the Canadian dollar continues to lose ground

The latest US and Canadian data may strengthen the US dollar, pushing the USDCAD pair towards the 1.4096 level. Find out more in our analysis for 4 December 2024.

USDCAD forecast: key trading points

- US ADP nonfarm employment change: previously at 233,000, projected at 166,000

- Canada’s Q3 labour productivity: previously at -0.2%, projected at 0.2%

- US services PMI: previously at 55.0, projected at 57.0

- USDCAD forecast for 4 December 2024: 1.4096

Fundamental analysis

The US ADP nonfarm employment change is based on data from approximately 400,000 business sources. The reading is published two days before the government statistics release. Weaker-than-forecasted data may cause increased market volatility.

The forecast for 4 December 2024 suggests a significant drop in nonfarm employment. If the actual reading aligns with the forecast of 166,000, it could negatively affect the US dollar.

Labour productivity reflects changes in workers’ average efficiency in producing goods and services. It is calculated by dividing GDP by the total number of hours worked.

Fundamental analysis for 4 December 2024 shows that Canada’s labour productivity in Q3 could emerge from negative territory and rise to 0.2%. If the actual reading exceeds expectations, it could encourage the strengthening of the Canadian dollar.

According to the forecast, the US services PMI for August could rise to 57.0. Since it has remained relatively flat over the past six months, investors do not have elevated expectations for the data. If the PMI surpasses expectations, it could bolster the US dollar against its Canadian counterpart.

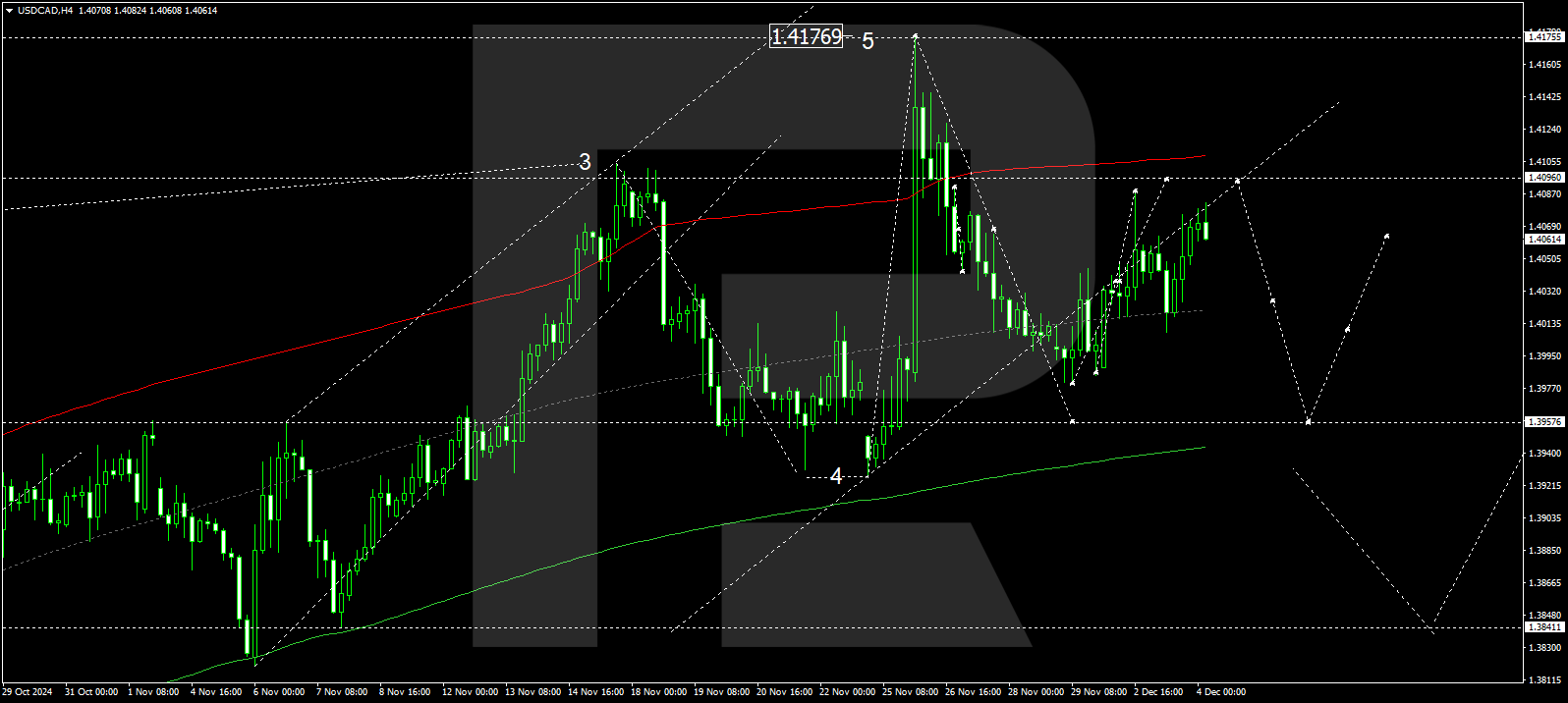

USDCAD technical analysis

The USDCAD H4 chart shows that the market is forming an upward wave towards 1.4096. The price is expected to reach this target level today, 4 December 2024, before creating a new downward wave towards 1.3958. The market is currently within a broad consolidation range around the 1.4070 level. A downward breakout would open the potential for movement towards 1.3841, while an upward breakout could target the 1.4175 level.

The Elliott Wave structure and wave matrix, with a pivot point at 1.4011, technically support this scenario. This level is considered crucial for a downward wave in the USDCAD rate. The market is forming a growth structure towards the upper boundary of a price envelope at 1.4096. After the price reaches this level, a new downward wave is expected, aiming for the envelope’s central line at 1.4025 and potentially extending further to its lower boundary at 1.3958.

Summary

Alongside technical analysis for today’s USDCAD forecast, a batch of US fundamental data suggests that the growth wave could continue towards the 1.4096 level.