USDCHF analysis: potential for correction and market forecast

In today’s USDCHF analysis for 24 September 2024, the pair exhibits potential for a correction. With critical economic events, such as the upcoming speech by a Federal Open Market Committee (FOMC) member and the anticipated increase in the US Consumer Confidence Index, traders should remain vigilant. These factors could significantly influence the USDCHF forecast and signal potential market movements.

USDCHF forecast: key trading points

- FOMC Speech: Michelle Bowman, a member of the US Federal Open Market Committee (FOMC), is expected to speak

- US Consumer Confidence Index: the previous reading was 103.3, and the forecast stands at 103.9, signalling potential economic optimism

- USDCHF forecast for 24 September 2024: 0.8555 and 0.8696

Fundamental analysis

Today, 24 September 2024, Michelle Bowman, a member of the US Federal Open Market Committee (FOMC), will deliver a speech. Bowman is also a member of the Fed’s Board of Governors and is involved in shaping monetary policy. Her speech may contain data on future US economic policy. The expectation of its tightening may further affect the strengthening of the US dollar, which will influence the USDCHF rate towards growth.

The Consumer Confidence Index shows how much people trust the economic activity of businesses and the prospects of the economy. A high reading of their spending may indicate optimistic sentiment. In turn, the above-forecast data is a positive factor for the US Dollar. In the last reporting period, the actual value came out better than expected, at 103.3.

The USDCHF forecast for 24 September 2024 assumes that consumer confidence will continue to improve compared to last month. Analysts consider the figure to be 103.9. Although the increase is marginal, it can be a positive factor for the US dollar. Over the past three months, the Consumer Confidence Index has consistently shown positive dynamics, and today’s forecast suggests this trend may continue. This positions the USDCHF pair for a potential upward movement, especially if actual data meets or exceeds expectations.

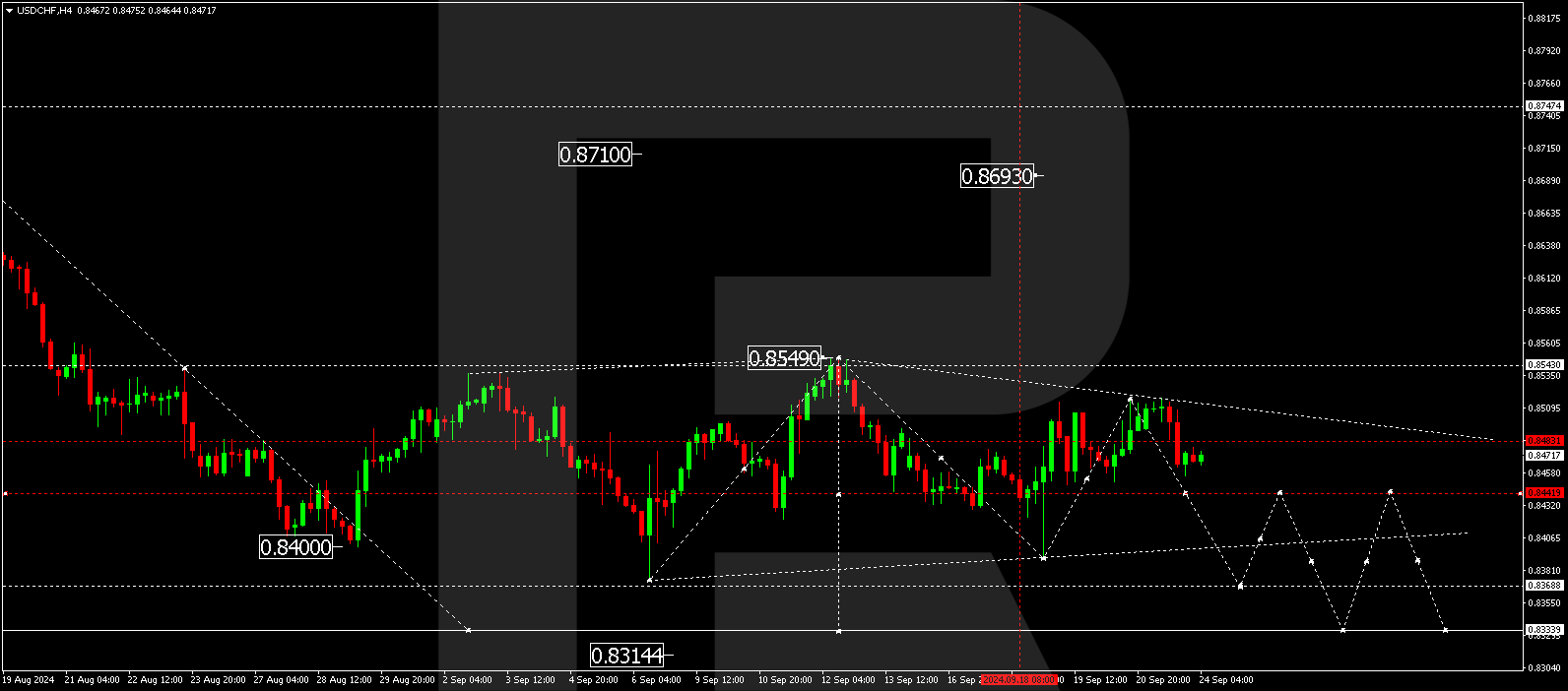

USDCHF technical analysis

On the H4 chart of the USDCHF pair, the market continues to develop a consolidation range around the level of 0.8484. Today, on 24 September 2024, the USDCHF forecast suggests the probability of the range extension down to 0.8440. An upward exit from this range could open the potential for a growth wave to the level of 0.8555, with the prospect of the trend extending to the level of 0.8696. In the event of a downward exit from the range, the continuation of the wave to the level of 0.8368, with the prospect of the trend continuing to the level of 0.8333, is not excluded. The primary target remains.

Summary

The combination of Michelle Bowman’s speech and potential growth in US consumer confidence offers a strong signal for USDCHF traders today. The USDCHF forecast indicates a likely upward correction, with technical signals aligning with key fundamental drivers. Traders should monitor the 0.8555 and 0.8696 levels for potential entry points, as these are critical targets for upward movement in today’s trading.