The USDCHF pair is tumbling. The market is gearing up for an imminent Federal Reserve interest rate cut. Find out more in our analysis dated 20 August 2024.

USDCHF forecast: key trading points

- The USDCHF pair declines further

- The market is working against the US dollar

- USDCHF forecast for 20 August 2024: 0.8833 and 0.9070

Fundamental analysis

The USDCHF rate moves to 0.8617 on Tuesday, with sales continuing for the third consecutive trading day.

The reason behind it is the weakness of the US currency. Investors are focused on seeking hints at the Federal Reserve's future actions. The Federal Reserve is largely expected to lower interest rates by 25 basis points at its September meeting and leave room for a further more massive reduction. Friday’s speech by Federal Reserve Chair Jerome Powell will be crucial in this context. He will likely confirm that there are reasons for an interest rate cut. As to the rest, the monetary policymaker will be highly careful in order to prevent excessive price volatility.

From the fundamental perspective, this works against the US dollar and in favour of the CHF.

The USDCHF forecast suggests local sales will persist.

USDCHF technical analysis

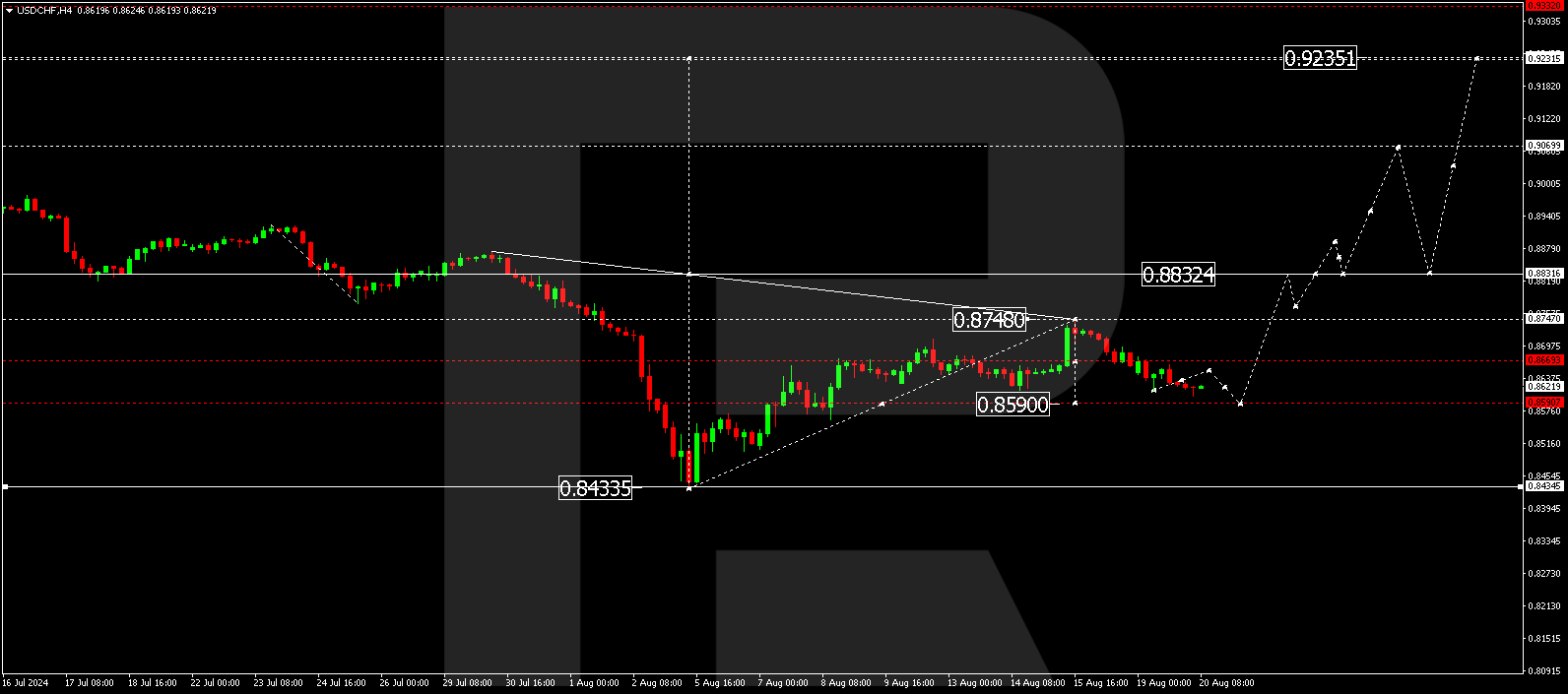

The USDCHF H4 chart shows that the market has completed a growth wave, reaching 0.8748. Subsequently, the price declined to 0.8666, with a consolidation range forming around this level. The market broke below the range today, 20 August 2024. A correction could extend to 0.8590. Once the correction is complete, a new growth wave might begin, aiming for 0.8833 and potentially continuing towards the local target of 0.9070.

Summary

The USDCHF sales are ongoing for the third consecutive day, with the market sentiment remaining unchanged. Technical indicators in today’s USDCHF forecast suggest a correction towards 0.8590, followed by a rise to the 0.8833 and 0.9070 levels.