The USDCHF pair declined after last week’s rise. The market is moving out of its overbought status. Find out more in our analysis for 8 October 2024.

USDCHF forecast: key trading points

- The USDCHF pair is declining

- The market is moving out of its overbought status after last week’s rally

- USDCHF forecast for 8 October 2024: 0.8623

Fundamental analysis

The USDCHF rate has fallen to 0.8540.

The US dollar gained strength last week. The robust September employment report confirmed that the Federal Reserve may not need to ease monetary policy aggressively.

Swiss inflation data was released earlier. The Consumer Price Index decreased to 0.8%, below market expectations of 1.1%. Weaker price statistics reinforced market expectations of a December 50-basis-point SNB interest rate cut. The regulator has previously reduced interest rates by 25 basis points on three occasions.

The USDCHF forecast suggests room for a correction.

USDCHF technical analysis

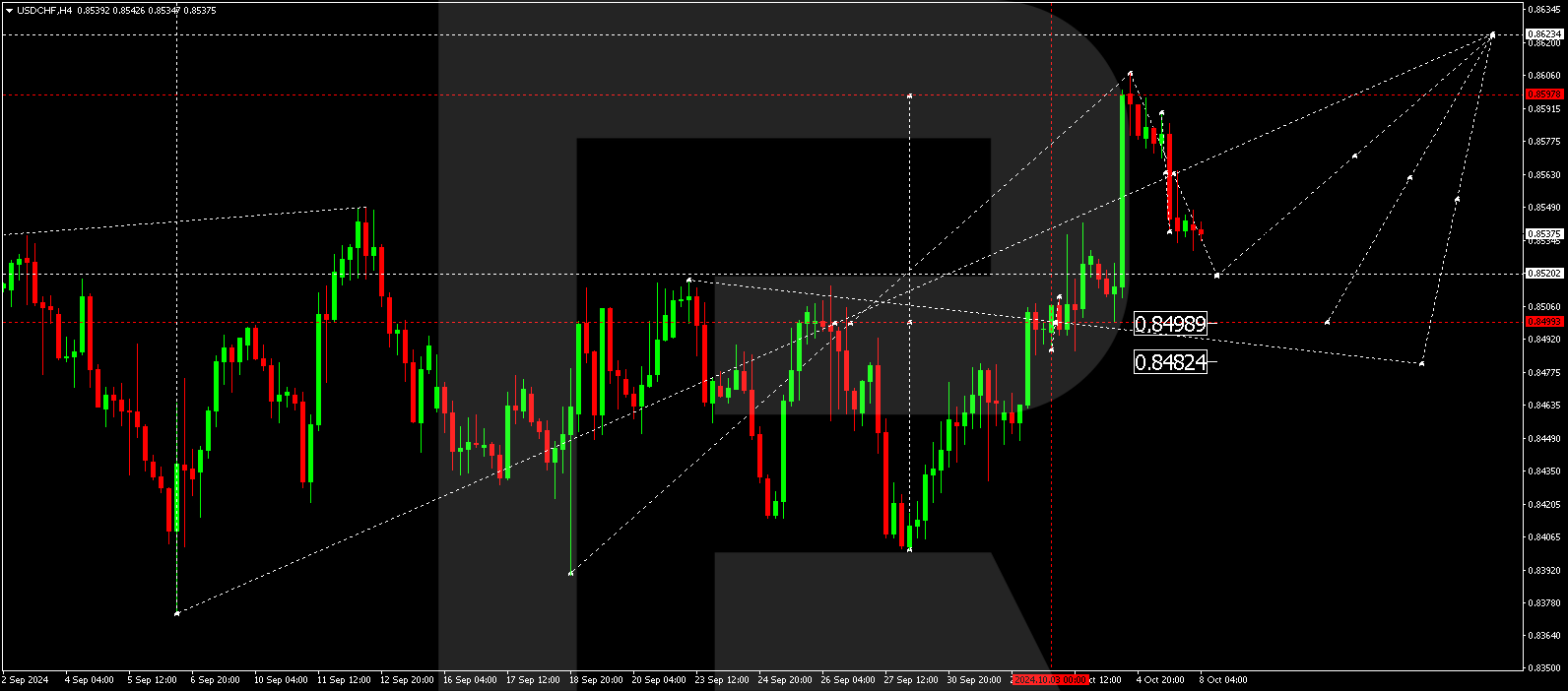

The USDCHF H4 chart shows that the market has reached the growth wave’s local target of 0.8606. A correction is expected to develop today, 8 October 2024, targeting 0.8520. After reaching this level, a new upward wave in the USDCHF rate could start, aiming for 0.8623 as the first target. Subsequently, the price might correct towards 0.8484.

Summary

The USDCHF pair reaches equilibrium as investors reassess the US dollar’s position. Technical indicators in today’s USDCHF forecast suggest a potential downward wave towards 0.8520 as part of the correction, followed by a rise to 0.8623.