USDCHF is on the rise: the US dollar leaves no alternatives

The USDCHF pair is rising, with investors favouring the US dollar. More details in our analysis for 12 November 2024.

USDCHF forecast: key trading points

- The USDCHF pair has gained significantly

- The SNB may lower the interest rate by 50 basis points at once at its December meeting

- USDCHF forecast for 12 November 2024: 0.8850

Fundamental analysis

The USDCHF rate is rising to 0.8811.

In this pair, as in USDJPY, the strong market bias towards the US dollar leaves the second currency with little support. Investors believe that the protectionist policies promoted by the administration of the elected US President, Donald Trump, will drive up inflation. This will force the Federal Reserve to keep interest rates higher than expected, favouring the USD.

Switzerland’s inflation eased to a three-year low, reaching 0.6% in October.

This data has heightened expectations of an interest rate cut from the Swiss National Bank at its December meeting, with borrowing costs potentially reduced by 50 basis points at once.

The USDCHF forecast is in favour of the US dollar.

USDCHF technical analysis

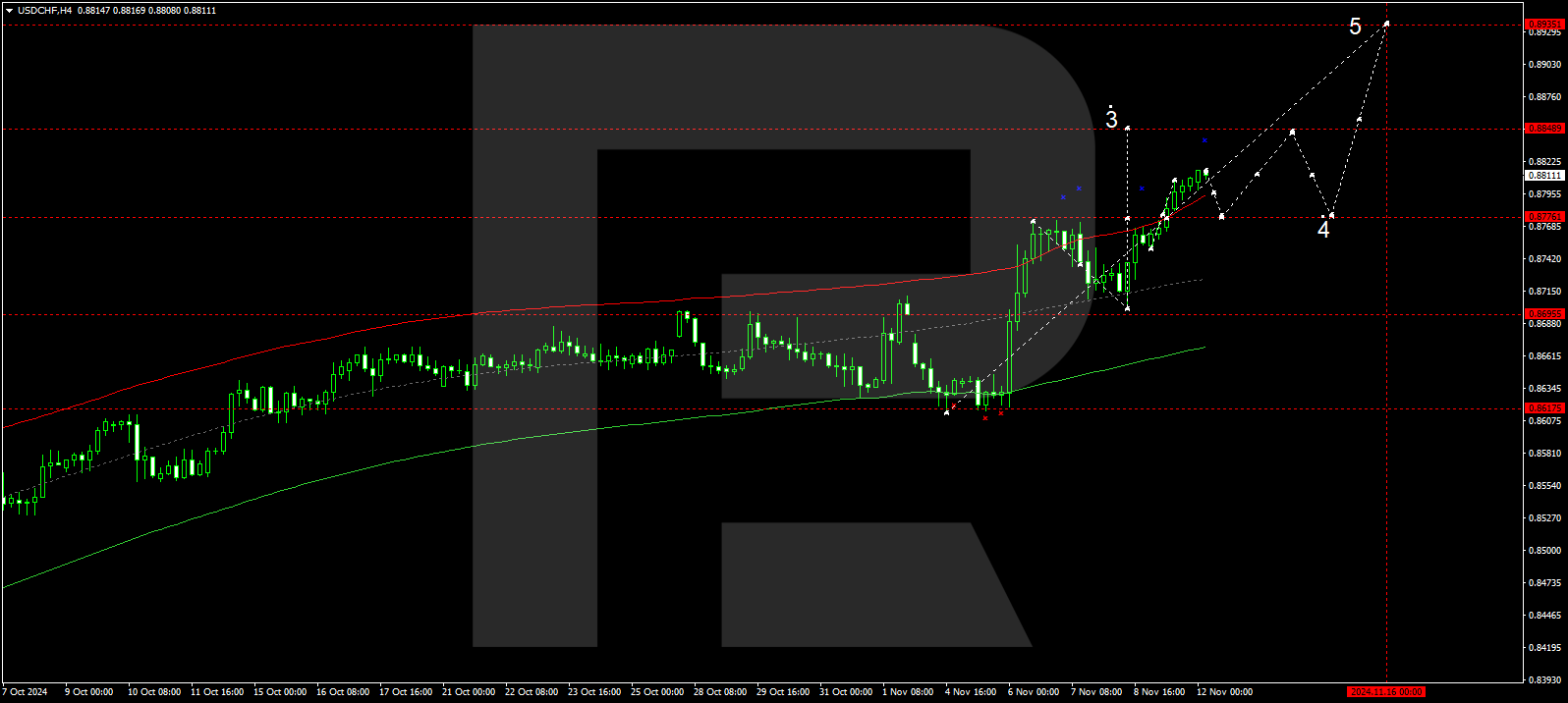

The USDCHF H4 chart shows that the market has broken above the 0.8777 level and is maintaining upward momentum towards 0.8850. A technical pullback to the 0.8777 level is possible today, 12 November 2024. Subsequently, a growth structure is expected to develop, aiming for 0.8850 as the local target. A correction could develop after the price reaches this level, potentially testing 0.8777 from above. A growth wave might follow next, targeting 0.8935.

The Elliott Wave structure and wave matrix, with a pivot point at 0.8777, technically confirm this scenario. This level is considered crucial for a growth wave in the USDCHF rate. The market has breached this level, opening the potential for a growth wave towards the upper boundary of a price envelope at 0.8850. Once the price hits this level, a correction towards the envelope’s mid-line is likely before a further growth wave towards the upper boundary at 0.8935.

Summary

The USDCHF pair is rising while investors favour the US dollar. Technical indicators for today’s USDCHF forecast suggest the potential for a growth wave towards the 0.8850 level.