The USDCHF pair is rising for the second day. Activity in USDCHF is low as the market is keeping an eye on the situation.

USDCHF trading key points

- The USDCHF pair is rising on sympathies with the US dollar

- Switzerland's PPI decreased again in June

- USDCHF price targets: 0.8901

Fundamental analysis

The USDCHF pair rose to 0.8957 on Tuesday.

The instrument appears quite stable now. This is a long-awaited equilibrium point following a marked previous decline.

The US dollar is strengthening against the franc amid growing overall market sympathy with the USD. This comes after last weekend’s incident with former US President Donald Trump. The assassination attempt on the politician increased his chances of winning the presidential race and the November election. Supported by this, the US dollar and US government bond yields are increasing, with other currencies forced to adapt to this situation.

Due to this, Switzerland’s domestic statistics are of secondary importance to investors. Switzerland’s producer price index for June was released yesterday, coming in at zero month-over-month following a previous decrease of 0.3%. However, the indicator fell by 1.9% year-over-year.

USDCHF technical analysis

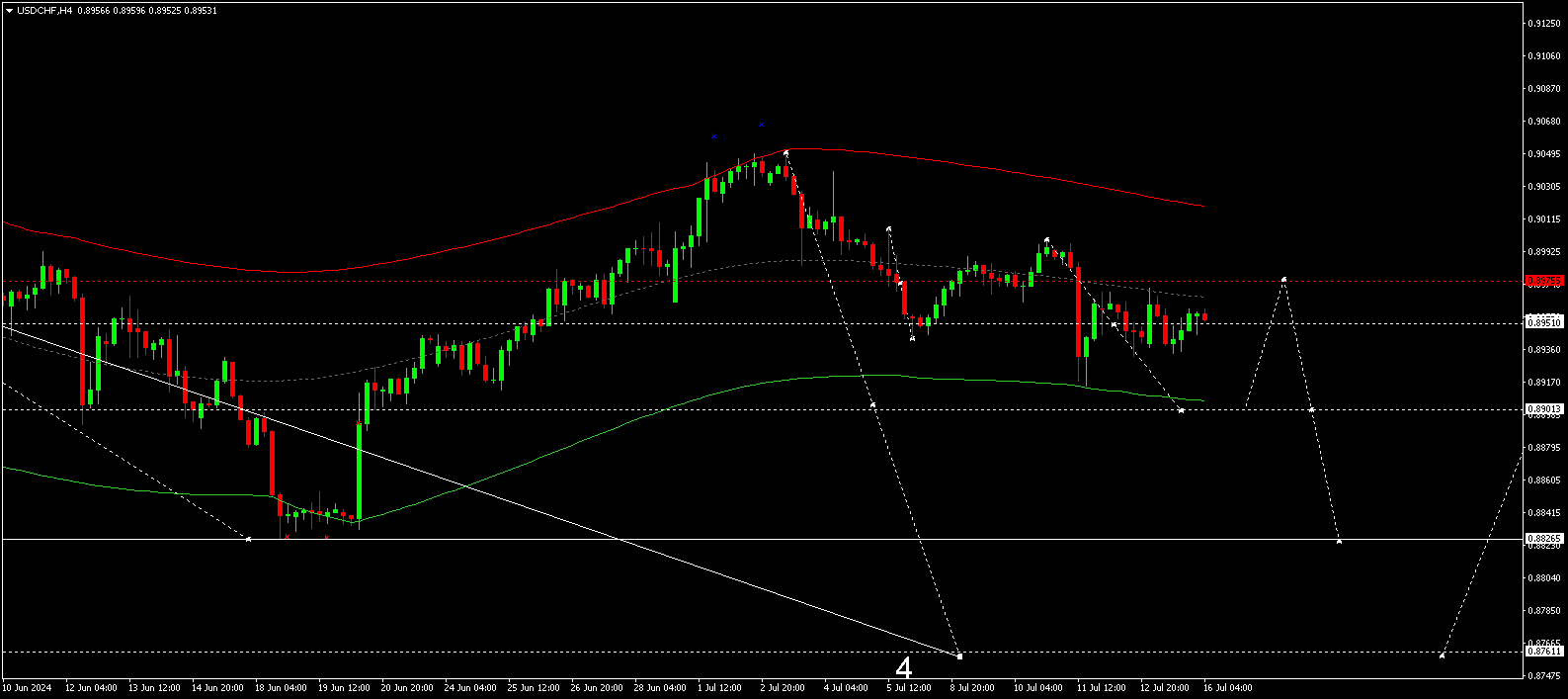

Technical analysis of the USDCHF pair on the H4 chart as of 16 July 2024 suggests that a decline wave could continue to 0.8901, representing the first target. Once the price reaches this target, a correction towards 0.8975 might develop. Subsequently, another decline wave could follow, aiming for 0.8826 and potentially continuing to 0.8761.

Summary

USDCHF investors are forced to take into account the strength of the US dollar. Technical analysis for today’s USDCHF forecast suggests that a wave might continue to the 0.8901 target.