USDCHF: the pair continues to correct ahead of the US presidential election

Switzerland’s stable unemployment rate and the upcoming US election may strengthen the Swiss franc. Discover more in our analysis for 5 November 2024.

USDCHF forecast: key trading points

- Switzerland’s seasonally adjusted unemployment rate: previously at 2.6%, currently at 2.6%

- The US ISM services PMI: previously at 54.9, currently at 53.8

- USDCHF forecast for 5 November 2024: 0.8720

Fundamental analysis

Switzerland’s unemployment rate remained unchanged from the previous month at 2.6%. The indicator reflects the percentage of the total working-age population actively seeking employment. Analysis for 5 November 2024 indicates that these readings have slightly impacted the USDCHF rate, contributing to a modest strengthening of the Swiss franc.

The ISM services PMI is an indicator of business activity in the US services sector published by the Institute for Supply Management (ISM). It tracks the overall state of the services sector, including finance, healthcare, education, transport, and retail trade. The services sector is a significant part of the US economy, making this index an essential gauge of economic activity.

The forecast for 5 November 2024 suggests that the actual index reading may decline to 53.8 points from the previous figure. Given this, alongside other data and the upcoming US presidential election, it may exert some pressure on the US dollar and contribute to a decline in the USDCHF rate in the near term.

USDCHF technical analysis

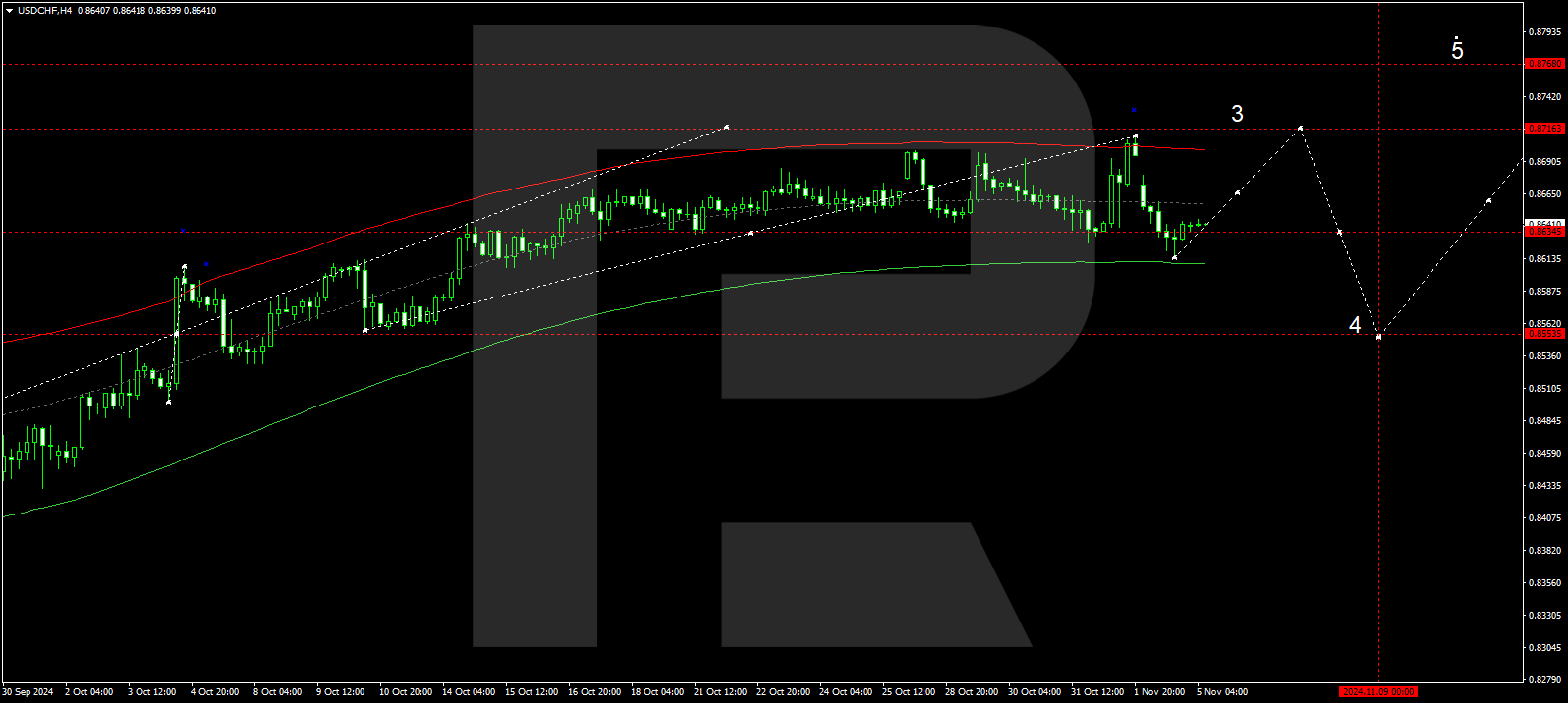

The USDCHF H4 chart shows that the market has formed a downward wave towards 0.8615. A growth structure is expected to develop today, 5 November 2024, aiming for 0.8666. A breakout above this level will open the potential for a growth wave towards 0.8720, the local target. After the price reaches this target, a new downward structure towards 0.8555 could develop. Subsequently, the fifth growth wave is expected to start, aiming for 0.8770 as the first target.

The Elliott Wave structure and wave matrix, with a pivot point at 0.8555, technically confirm this scenario. This level is considered crucial for a growth wave in the USDCHF rate. The market has rebounded upwards from the envelope’s lower boundary at 0.8615. A growth structure is expected to develop towards the upper boundary at 0.8720. Subsequently, the USDCHF pair might continue its decline to the envelope’s lower boundary at 0.8555.

Summary

Alongside technical analysis for today’s USDCHF forecast, the US presidential election and fundamental data suggest a potential growth wave towards 0.8720.