The USDJPY pair continues its ascent, with no significant correction expected in the near term.

USDJPY trading key points

- 10-year Japanese government bond (JGB) auction – 1.091%

- Japan’s monetary base (y/y) – 0.6%

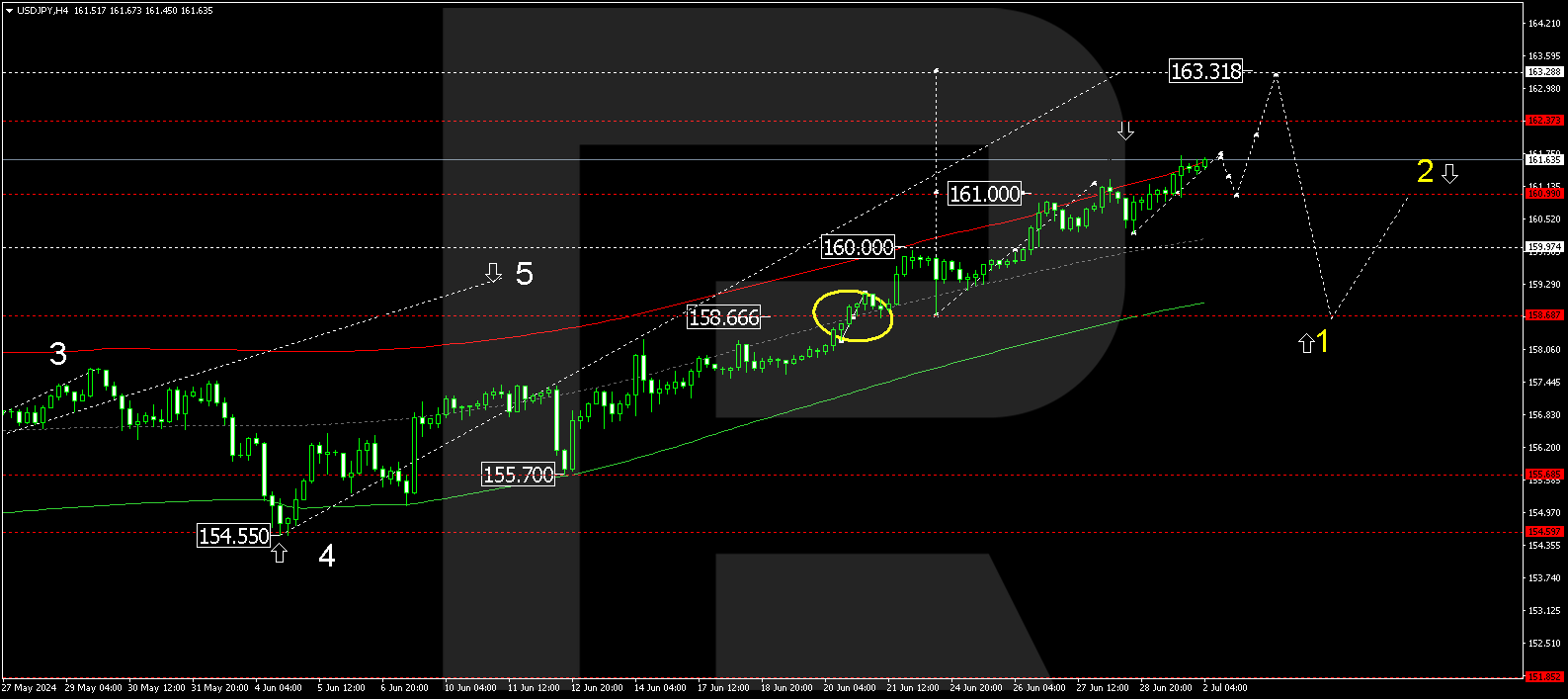

- USDJPY targets: 163.30, 158.90, 157.40

USDJPY fundamental analysis

The 10-year Japanese government bond (JGB) auction did not help the yen. The USDJPY rate continues its ascent. Insignificant news does not rescue the yen from depreciation at this stage.

Japanese authorities’ actions are widely viewed as playing for a rival, with attempts to strengthen the yen ending with another increase in the USDJPY rate. Bulls are aggressive and seem to have a clear strategy – to make the most of the yen’s depreciation.

USDJPY technical analysis

The H4 chart shows an upward breakout of the 161.00 level, with the growth wave continuing to develop. Today, 2 July 2024, the wave might extend to 161.80. After the price reaches this level, a corrective phase is possible, aiming for 161.00 (testing from above). Subsequently, a growth structure towards 163.30 could follow.

Summary

If the price rises to 163.30, Japanese authorities may take urgent action to stabilise the JPY rate. The USDJPY technical analysis points to a price reversal from the 163.30 level, followed by a decline to the 158.90 and 157.40 targets.