The USDJPY pair has dropped below 150.00. The market anticipates a December interest rate hike by the Bank of Japan. Discover more in our analysis for 6 December 2024.

USDJPY forecast: key trading points

- The USDJPY pair continues to decline

- The market remains confident about a December Bank of Japan rate hike

- USDJPY forecast for 6 December 2024: 149.29 and 151.15

Fundamental analysis

The USDJPY rate fell to 149.92 on Friday.

Yesterday’s statistics showed Japan’s inflation-adjusted real wages were unchanged year-on-year in October. This is a positive development, as the indicator had fallen by 0.4% in September and 0.8% in August.

Investors expect the Bank of Japan to increase the interest rate this month, although opinions on subsequent actions are divided.

Last week, Bank of Japan Governor Kazuo Ueda stated that a rate hike was unavoidable as economic results align with expectations.

The USDJPY forecast suggests a continued decline in the pair.

USDJPY technical analysis

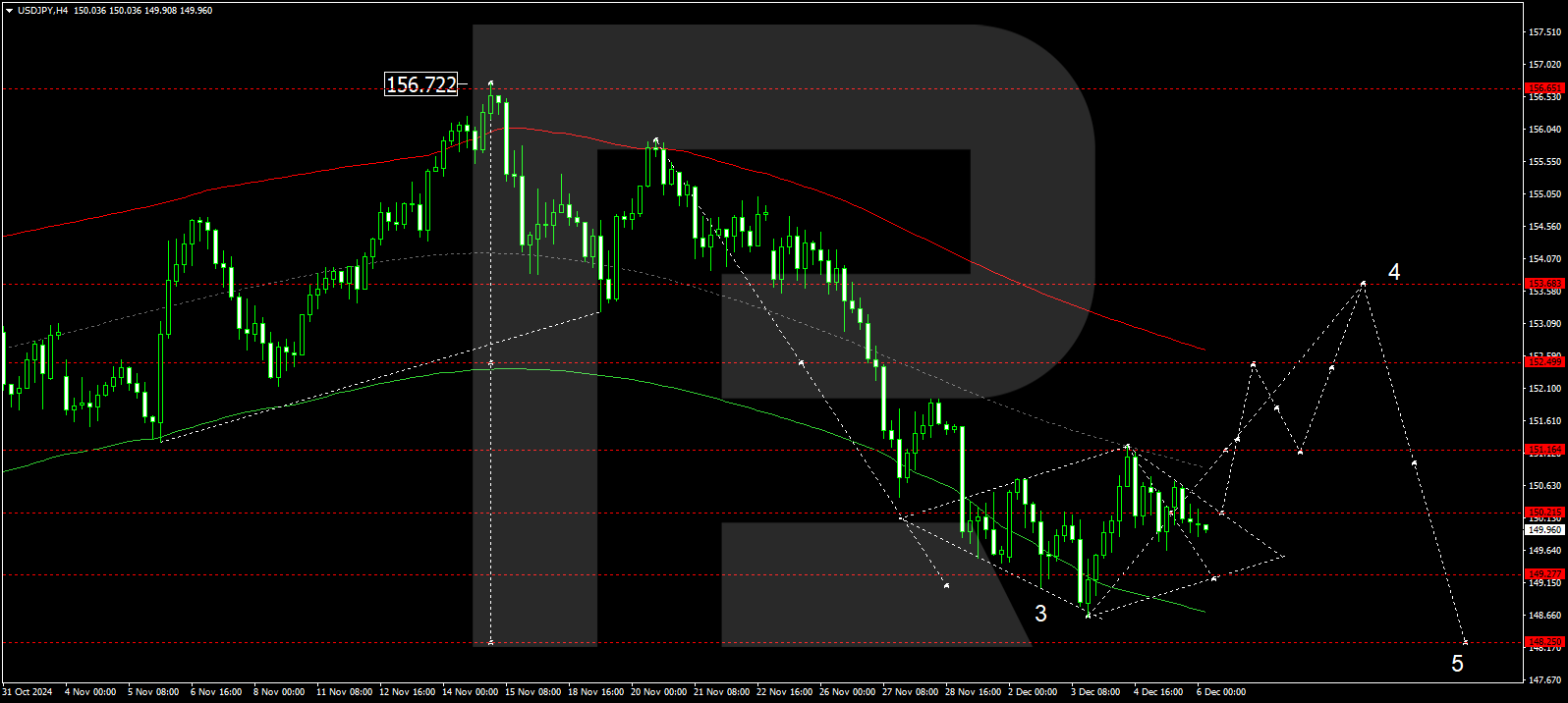

The USDJPY H4 chart indicates that the market is forming a consolidation range around 150.20, with expectations for it to extend downward to 149.29 today, 6 December 2024. Subsequently, a growth structure might develop, aiming for 151.15. A breakout above this level could signal further movement towards the local target of 152.50.

The Elliott Wave structure and growth wave matrix, with a pivot at 151.20, technically support this scenario for the USDJPY rate. The market has reached the central line of a price envelope at 151.20. The price could decline to 149.29 today before rising to the envelope’s upper boundary at 152.50, potentially extending further to 153.70.

Summary

The USDJPY pair dipped below 150.00, with the yen appearing strong. Technical indicators for today’s USDJPY forecast suggest a potential decline to 149.29, followed by a rise to 151.15.