The USDJPY pair has fallen below the 143.00 level amid broad US dollar weakness and expectations of continued monetary tightening by the Bank of Japan. Find more details in our analysis for 16 April 2025.

USDJPY forecast: key trading points

- Market focus: Japan’s core machinery orders rose 4.3% in February month-on-month

- Current trend: bearish

- USDJPY forecast for 16 April 2025: 142.00 and 144.00

Fundamental analysis

The USDJPY rate continues to decline, now trading below 143.00, as the US dollar remains under pressure. The dollar’s weakness is driven by growing fears over the potential economic fallout from President Trump’s latest tariff actions.

Market attention is shifting to upcoming trade negotiations between Japan and the US. Tokyo is demanding full cancellation of Trump’s tariffs. Bank of Japan Governor Kazuo Ueda stated in an interview with Sankei that the BoJ may consider further measures if US tariffs negatively impact the Japanese economy.

USDJPY technical analysis

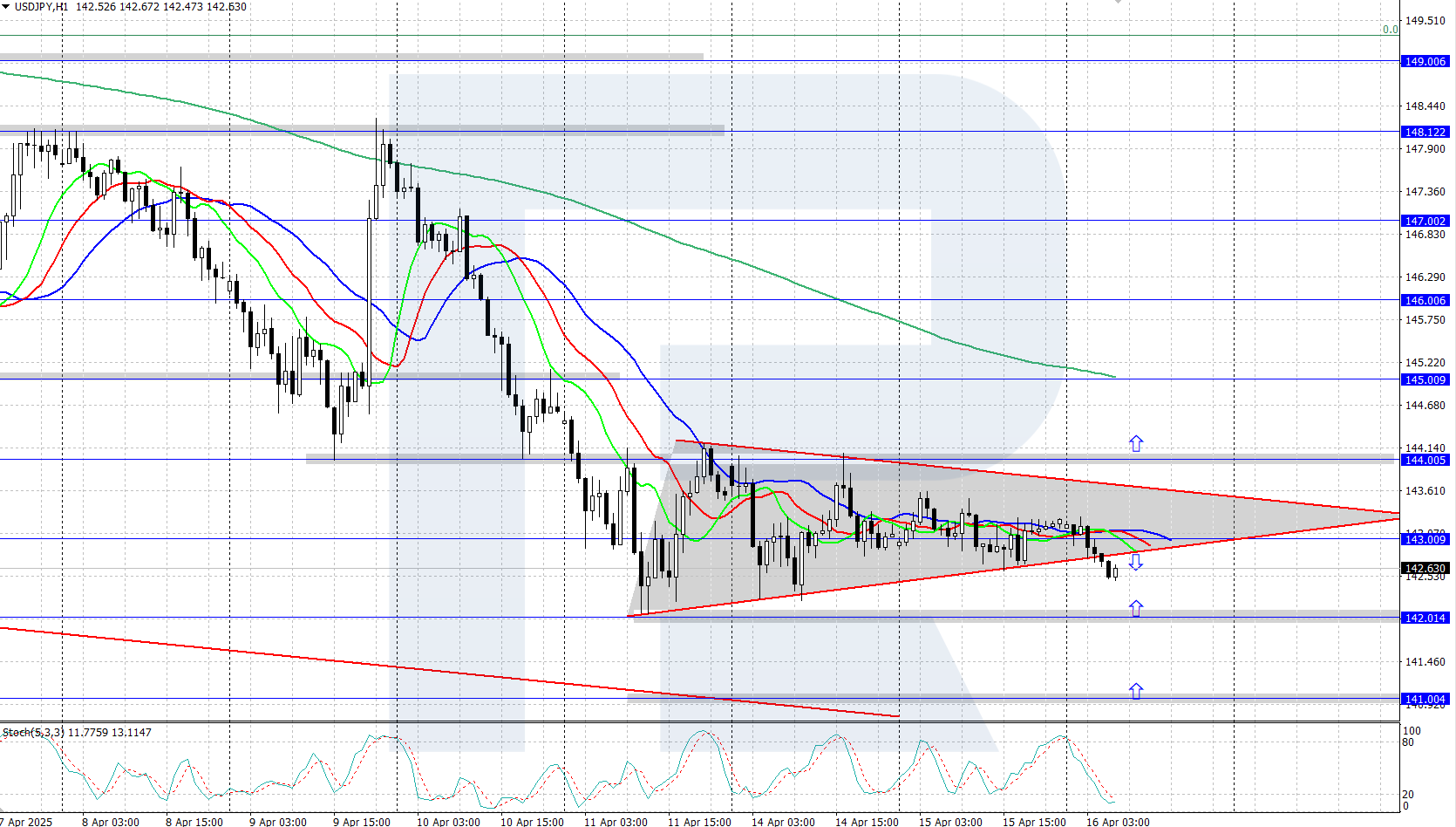

The USDJPY pair remains in a downtrend, with the Alligator indicator confirming the prevailing downward momentum. A Triangle pattern has formed on the H4 chart, suggesting a further decline towards the 141.00 level.

Today’s USDJPY forecast assumes the pair could continue to fall to the 141.00 area if bears maintain control. A bullish correction may only be considered if bulls seize the initiative and push the price above the 144.00 mark.

Summary

The USDJPY pair plunged to the 142.00 area due to persistent US dollar weakness. The market is now focused on upcoming US-Japan trade talks.