The USDJPY rate has dropped below the 144.00 mark as inflation in Japan accelerates and investors anticipate a rate hike from the central bank in July. Find more details in our analysis for 30 May 2025.

USDJPY forecast: key trading points

- Market focus: Japan’s Consumer Price Index rose by 3.6% year-on-year in May

- Current trend: moving downwards

- USDJPY forecast for 30 May 2025: 143.00 and 144.75

Fundamental analysis

The Japanese yen is strengthening as inflation increases. Tokyo’s Consumer Price Index rose by 3.6% year-on-year in May, up from 3.4% in April and surpassing the 3.5% market forecast. This marks the highest inflation reading in two years and boosts expectations that the Bank of Japan may raise interest rates at its July meeting.

Today, market participants are awaiting US inflation data, with the core PCE price index due during the American session. Forecasts anticipate a 0.1% monthly rise and a 2.5% year-on-year increase. Higher-than-expected inflation could support the US dollar, while a weaker reading would likely strengthen the yen further.

USDJPY technical analysis

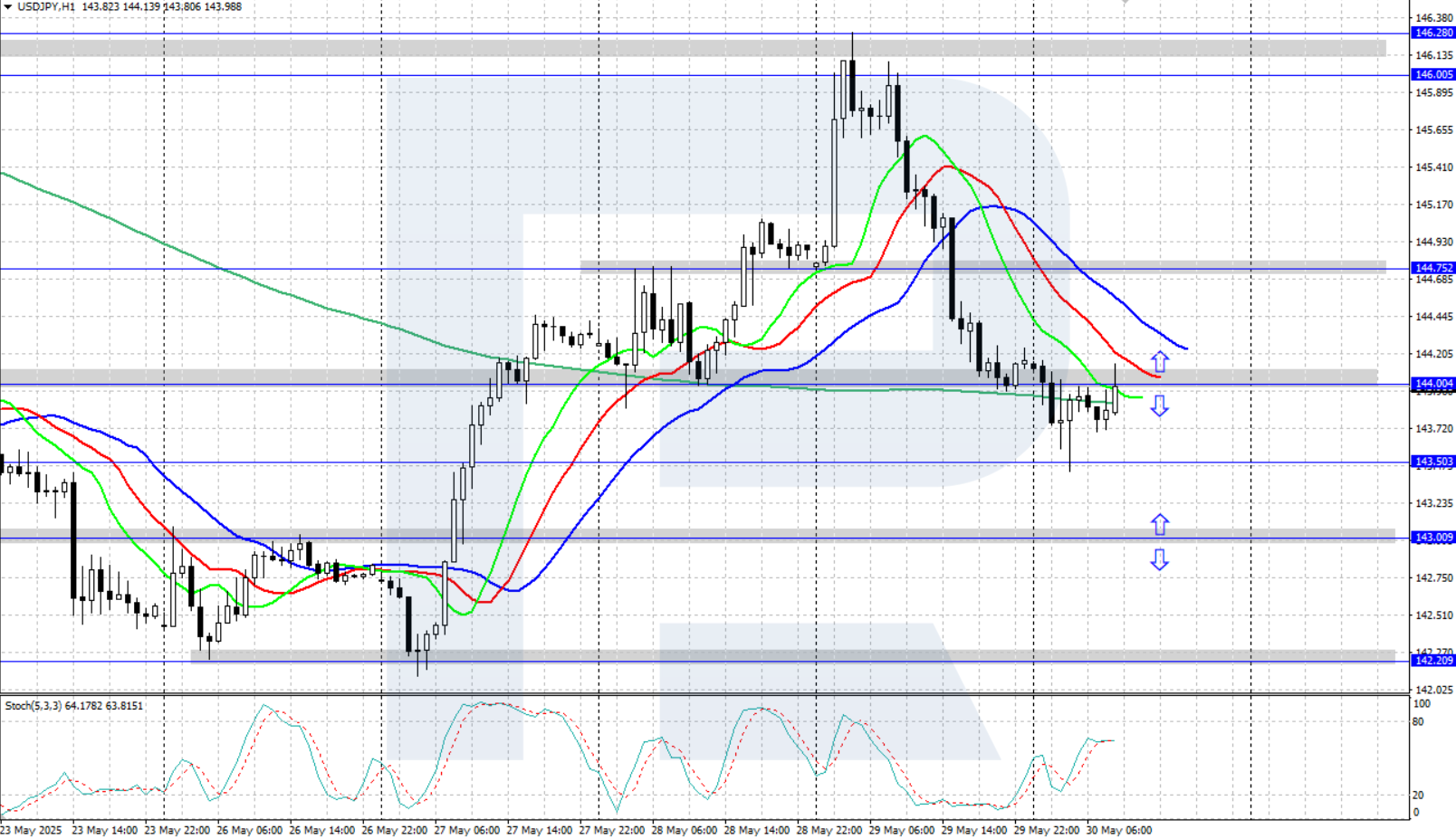

On the H4 chart, the USDJPY pair is edging down after reversing from the local daily high of 146.28. The Alligator indicator is trending downwards, confirming the bearish momentum. The local support level currently stands at 143.50.

Today’s USDJPY forecast suggests a further decline towards the 143.00 support level if bears retain control. A bullish correction is possible if buyers push the price above 144.00, with a potential recovery to the 144.75 resistance level.

Summary

The USDJPY pair has fallen below 144.00 amid rising inflation in Japan. Today, the market focus shifts to US inflation data.