USDJPY falls below 148.00

The USDJPY pair is declining, moving below 148.00 following the release of US inflation data. Find more details in our analysis for 13 August 2025.

USDJPY forecast: key trading points

- Market focus: the July US Consumer Price Index (CPI) came in line with forecasts

- Current trend: moving downwards

- USDJPY forecast for 13 August 2025: 148.50 or 147.00

Fundamental analysis

The Japanese yen strengthened after the release of US consumer inflation data, which matched forecasts, rising by 0.2% month-on-month and 2.7% year-on-year. This boosted market expectations for a Federal Reserve interest rate cut next month.

In Japan, business sentiment improved for the second consecutive month in August following a trade deal with Washington. The agreement reduced US tariffs on cars and other goods to 15% in exchange for a Japanese investment package worth 550 billion USD.

Bank of Japan board members remain divided over the timing and pace of future rate hikes. While some policymakers favour maintaining the current accommodative policy for now, they also pointed to uncertainty over whether current economic forecasts will materialise.

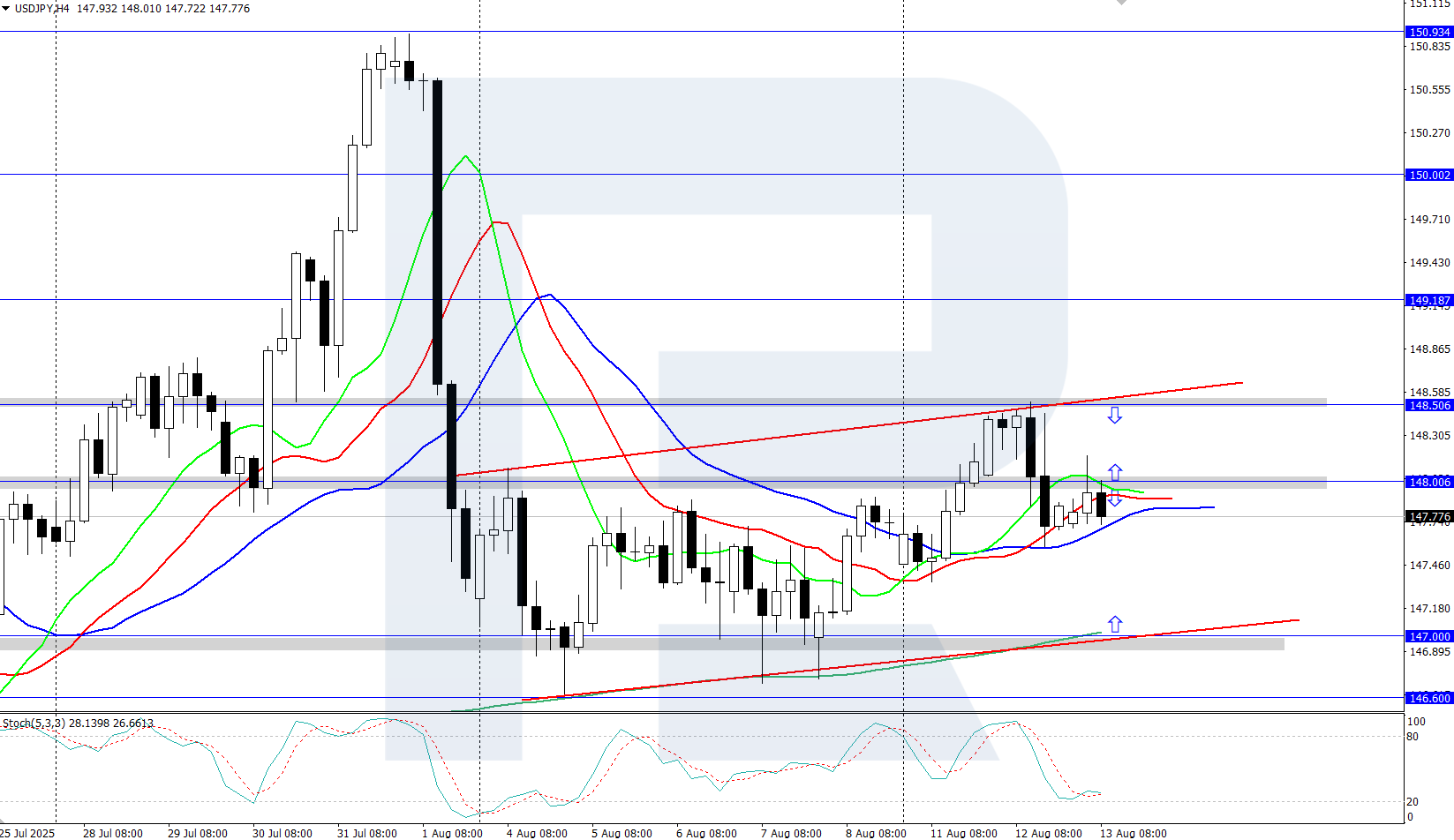

USDJPY technical analysis

The USDJPY pair is edging lower after setting a local high around 148.50. The Alligator indicator is turning downwards, confirming the current bearish trend. The local support level is now at 147.00; a breakout below this level would open the way towards 146.00.

Today’s USDJPY forecast suggests the pair may continue its downward trajectory towards the 147.00 support level if bears retain the initiative. However, an upward move could be expected if bulls reverse the price and gain a foothold above 148.00, in which case growth towards the 148.50 resistance level is possible.

Summary

The USDJPY pair is declining after the release of the July US CPI data. The weak pace of inflation growth gives the market reason to expect a Fed rate cut at the September meeting.

Open Account