USDJPY falls: the market awaits BoJ interest rate hike

The USDJPY rate is declining after rebounding from the 154.65 resistance level. Find out more about market expectations ahead of the BoJ and Federal Reserve meetings in our analysis dated 29 July 2024.

USDJPY trading key points

- The BoJ is expected to raise the interest rate by 10 basis points

- The market awaits Federal Reserve interest rate cut signals for September

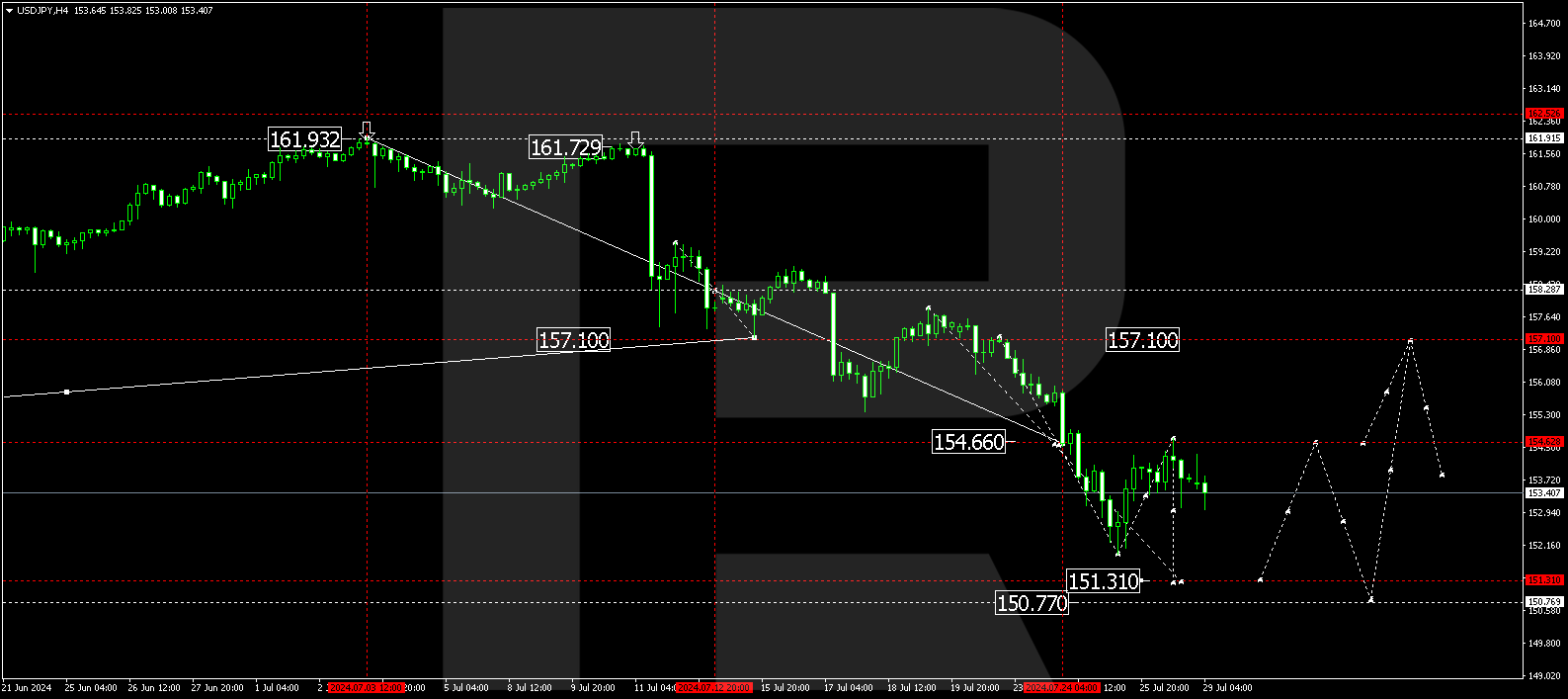

- USDJPY forecast for 29 July 2024: 151.31, 154.50, and 157.10

Fundamental analysis

The Japanese yen is strengthening today, bolstered by market expectations of a Bank of Japan interest rate hike. Investors hope the central bank will take action to curb inflation.

Markets forecast that the BoJ will raise the interest rate by 10 basis points to 0.1% at the upcoming meeting. According to analysts, if the central bank does not increase rates, it will be forced to resort to a more aggressive quantitative tightening policy to prevent sharp fluctuations in the USDJPY rate following the announcement of the decision.

Both the BoJ and the US Federal Reserve meetings are scheduled for Wednesday. The decisions of these central banks will significantly impact the movements of the USDJPY currency pair. While investors expect the Bank of Japan to raise the interest rate, they are also looking for signals from the Federal Reserve about a potential rate cut in September.

Traders note that the USDJPY pair was overvalued, and the current dynamics do not favour the US dollar. Any signs of the Federal Reserve easing monetary policy may significantly push down the dollar-yen rate.

USDJPY technical analysis

On the H4 chart, the USDJPY pair has corrected to 153.06, with a consolidation range forming below this level today, 29 July 2024. A downward breakout will open the potential for a decline wave towards 151.31. If the USDJPY rate increases, the wave is expected to develop towards 157.10. Subsequently, the price could decline to 150.77.

Summary

Expectations of tighter monetary policy from the Bank of Japan and potential easing from the Federal Reserve will help strengthen the Japanese yen. Today’s technical indicators for the USDJPY forecast suggest a decline towards 151.31, followed by a rise to the 154.50 and 157.10 targets.