The USDJPY rate is declining, dropping to 148.00 amid unresolved issues with US government funding. Discover more in our analysis for 30 September 2025.

USDJPY forecast: key trading points

- Market focus: US government funding expires at midnight Tuesday unless Congress reaches an agreement

- Current trend: correcting downwards

- USDJPY forecast for 30 September 2025: 147.00 or 148.80

Fundamental analysis

The US Department of Labor and Commerce warned on Monday that a partial government shutdown would halt the release of key economic data, Reuters reported.

These include the September jobs report, crucial for Federal Reserve decisions, as well as August data on construction spending and international trade. Funding expires at midnight Tuesday unless Congress reaches a last-minute agreement.

The Bank of Japan signalled that further rate hikes are possible if its outlook for economic activity and prices proves accurate, as shown in the summary of opinions following the September meeting. Policymakers emphasised the need to assess economic prospects without any bias.

USDJPY technical analysis

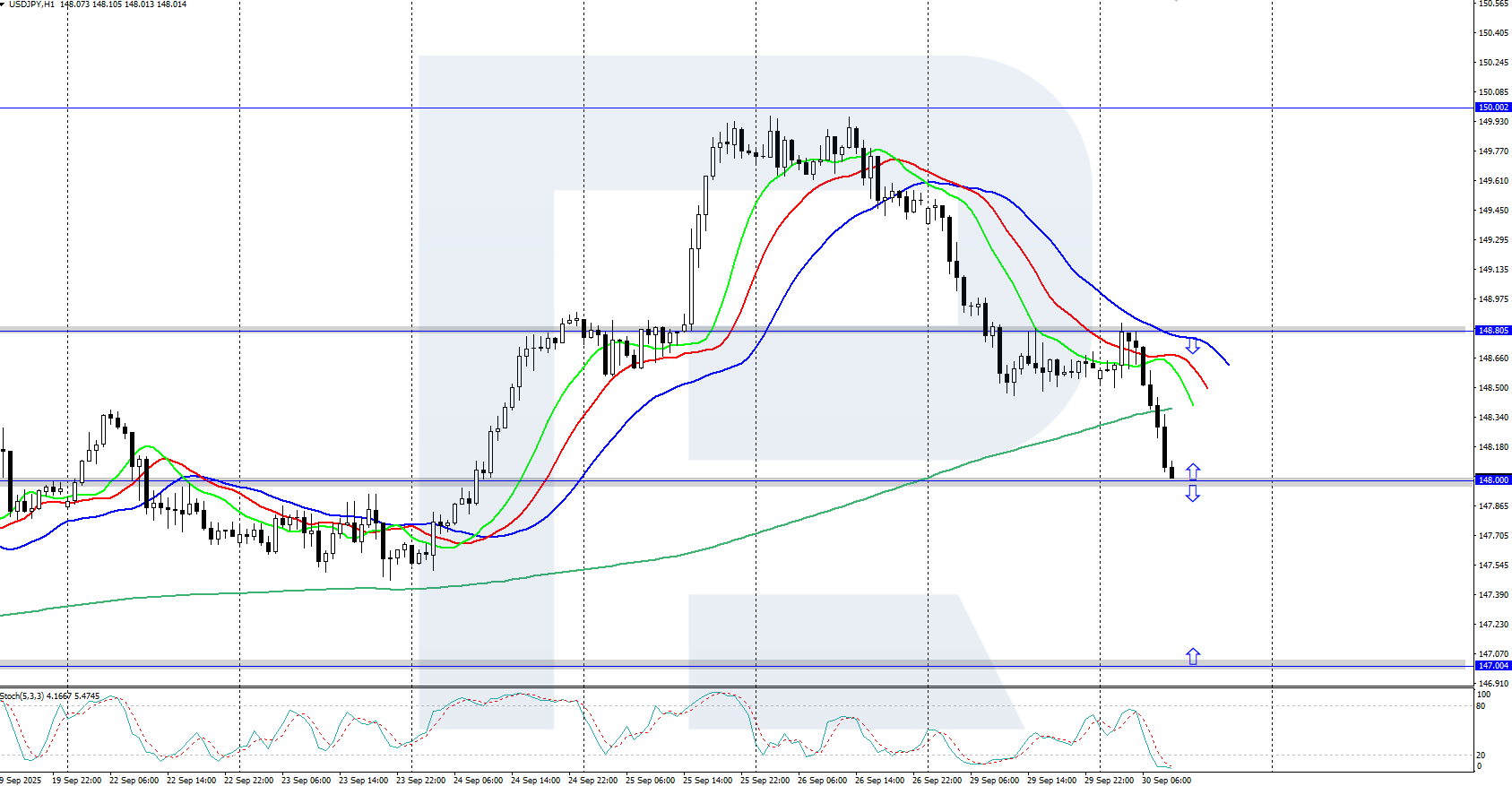

The USDJPY pair is declining within the current downward correction. The Alligator indicator has turned downwards, confirming the ongoing bearish momentum. The local support level is now at 148.00, with a breakout below this level likely to open the path to 147.00.

Today’s USDJPY forecast suggests further decline towards the 147.00 support level if the bears maintain control. An upward move could be considered if the bulls reverse the quotes and gain a foothold above 148.00.

Summary

The USDJPY price has fallen to around 148.00 amid US government funding issues. Market participants are awaiting the outcome of the standoff between Democrats and Republicans in the Senate – whether a compromise will be reached or a shutdown will occur.

Open Account