USDJPY: focus on Fed and BoJ decisions

The USDJPY rate has been declining for the third consecutive trading session. Discover more in our analysis for 16 September 2024.

USDJPY forecast: key trading points

- The USDJPY rate reached its annual low amid expectations of tougher Federal Reserve action

- The Fed meeting on 17-18 September will be the key event of the week, with a 59% likelihood of a 50-basis-point interest rate cut

- The Bank of Japan is expected to maintain its short-term rate at 0.25% despite discussions of a potential hike

- USDJPY forecast for 16 September 2024: 139.70

Fundamental analysis

The USDJPY rate hit its annual low on Monday, falling below 140.00 amid rising expectations of the Federal Reserve taking more aggressive action to lower interest rates this week.

The Fed meeting scheduled for 17-18 September will be the key event of the week. On Monday, market expectations shifted towards a more significant rate reduction by the Federal Reserve, according to CME FedWatch. The likelihood of a 50-basis-point interest rate cut increased to 59% from 47%, while the odds of a 25-basis-point rate cut fell to 41% from the previous 57%.

Investors will also keep a close eye on the Bank of Japan’s decision due on Friday. The rate is projected to remain at 0.25% in the short term. Meanwhile, Bank of Japan Board members have signalled that they are considering an interest rate hike.

Additionally, Sanae Takaichi, one of the potential successors to Prime Minister Fumio Kishida, said on Friday that the Bank of Japan should refrain from further interest rate hikes to support the country’s economic recovery. However, as today’s USDJPY forecast shows, even in this scenario, expectations of an aggressive Federal Reserve interest rate cut continue to exert pressure on the US dollar.

USDJPY technical analysis

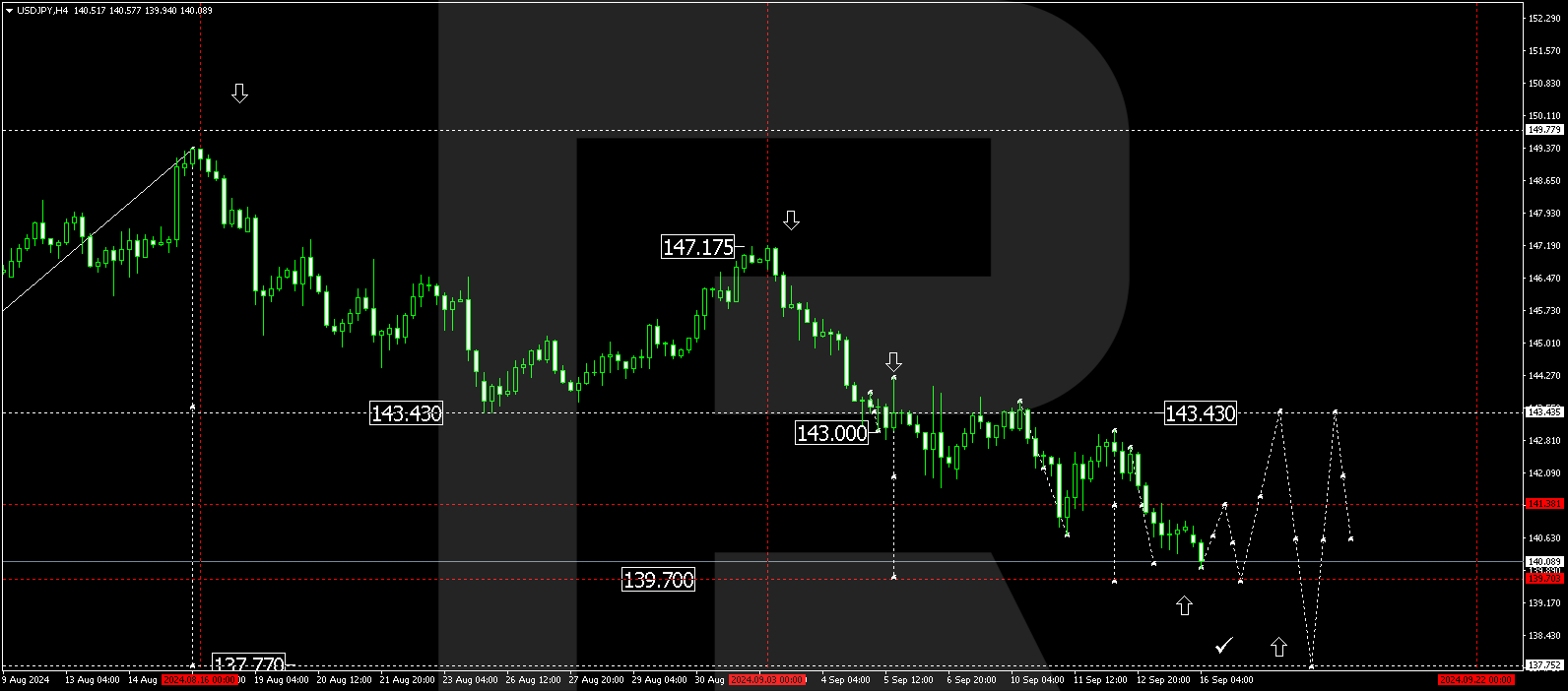

On the USDJPY H4 chart, the market has broken below the 141.38 level, with a downward wave continuing towards 139.70 today, 16 September 2024. The market has declined to 139.94. After reaching this level, a technical rise to 141.38 (testing from below) is possible. Subsequently, the price could fall to the local target of 139.70. Once the USDJPY rate hits this level, a new growth wave could start, aiming for 143.43.

Summary

The decline in the USDJPY rate is caused by growing expectations of a more significant Federal Reserve interest rate cut, increasing pressure on the US dollar. At the same time, investors are awaiting the BoJ decision and expecting the current rate to remain unchanged, which will help strengthen the yen. Technical indicators in today’s USDJPY forecast suggest a potential decline to the 139.70 level.