The USDJPY pair is trading around 145.00 following the Bank of Japan’s decision to keep its key interest rate unchanged. Market focus now shifts to today’s US Federal Reserve rate announcement. Find out more in our analysis for 18 June 2025.

USDJPY forecast: key trading points

- Market focus: traders await today’s Fed decision and any signals regarding future policy

- Current trend: moving upwards

- USDJPY forecast for 18 June 2025: 144.50 and 145.46

Fundamental analysis

Yesterday, the BoJ held its regular policy meeting and opted to keep the benchmark interest rate at 0.5%. Bank of Japan Governor Kazuo Ueda stated that the central bank continues to closely monitor domestic economic conditions and global trade developments. He also acknowledged the potential for future policy tightening.

Today, investor attention turns to the Federal Reserve’s rate decision. Markets broadly expect the Fed to maintain current rates, but focus will be on the central bank’s forward guidance regarding the timing and scale of future rate cuts.

USDJPY technical analysis

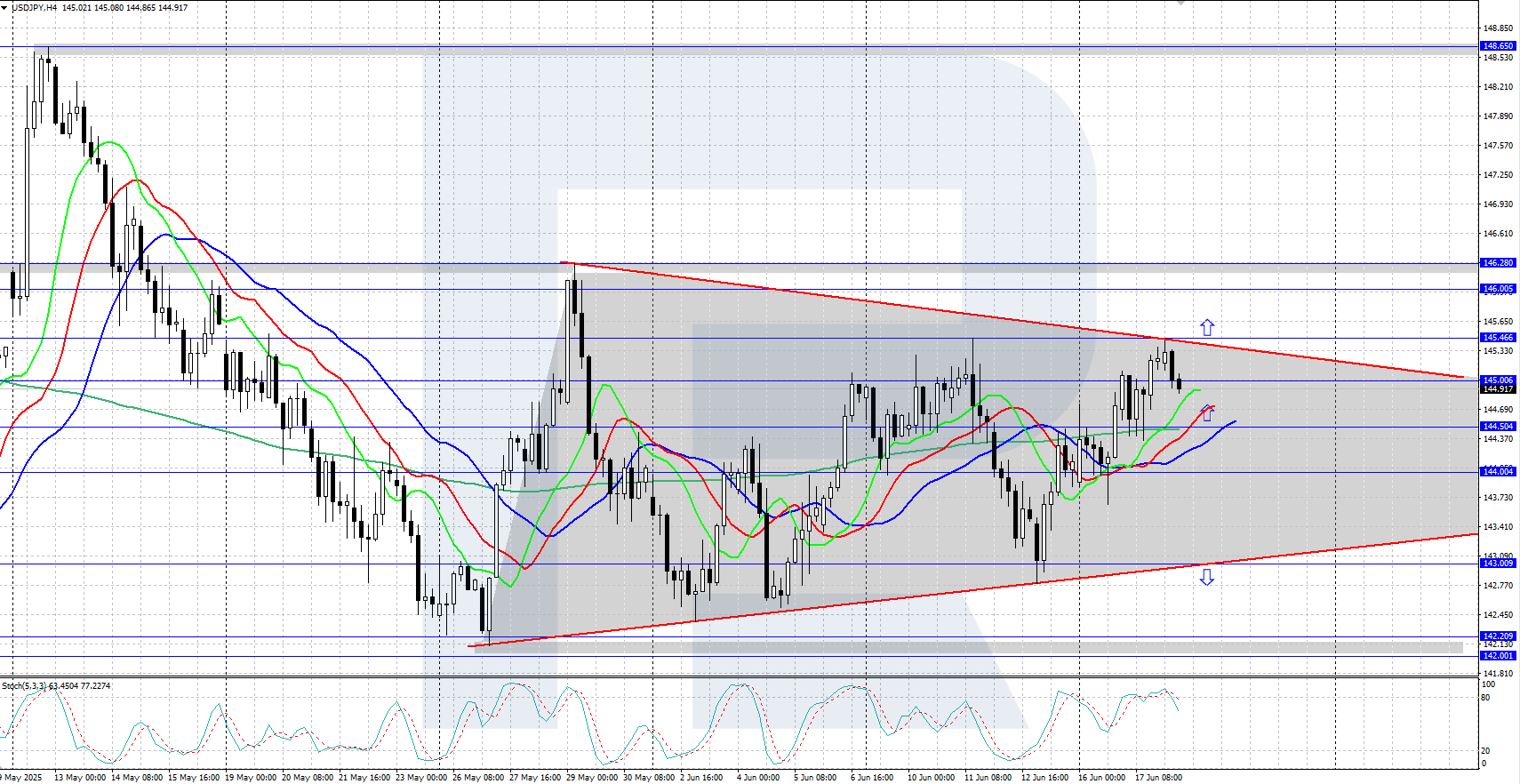

The USDJPY pair is rising on the H4 chart, reaching a local high at 145.46. The Alligator indicator points upwards, confirming the bullish trend. The local support level lies at 144.50, and the price is forming a Triangle pattern.

Today’s USDJPY forecast suggests a potential correction towards the 144.50 support level following the recent rise. If buyers push the price above 145.46 and gain a foothold there, the pair could continue its ascent towards the 146.00 resistance level.

Summary

The USDJPY pair is hovering around 145.00 following the BoJ’s decision to leave rates unchanged. All eyes now turn to today’s Fed interest rate decision.