The USDJPY pair has been holding in a range for the third day. Investors are cautious. Find out more in our analysis for 9 October 2024.

USDJPY forecast: key trading points

- The USDJPY pair has started to consolidate

- Investors are conserving strength in anticipation of the latest Federal Reserve meeting minutes

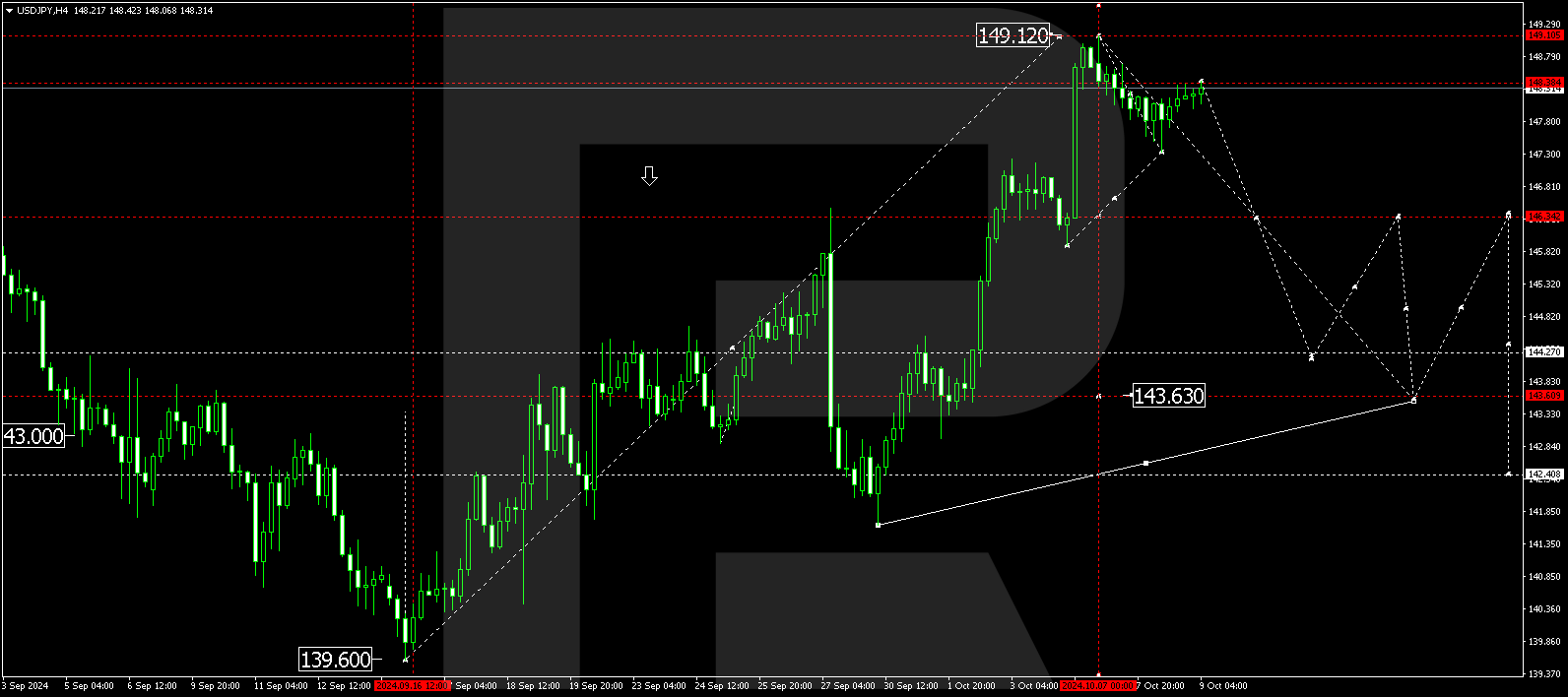

- USDJPY forecast for 9 October 2024: 146.36, 144.20, and 143.60

Fundamental analysis

The USDJPY rate is stable, hovering around 148.34 on Wednesday.

Although interesting signals emerge, Japan’s domestic statistics do not affect the JPY trajectory. The Tankan sentiment index rose to 7 points in October, above the forecasted 6, which is a positive signal for Japan’s economy.

Investors are awaiting the release of the previous US Federal Reserve meeting minutes today to gain insights into the regulator’s true intentions regarding the future of interest rates. Current expectations now suggest two rate cuts before the end of the year, of 25 basis points each. The minutes will reveal whether this perspective will persist or be revised to a more aggressive stance.

The USDJPY forecast appears neutral.

USDJPY technical analysis

The USDJPY H4 chart shows that the market has completed a downward wave, reaching 147.33. A correction towards 148.38 (testing from below) is expected today, 9 October 2024, with the market outlining the boundaries of a consolidation range. It will be important to consider the completion of the correction and the beginning of a new downward wave in the USDJPY rate, aiming for 146.36. A breakout below this level could signal a continuation of the trend towards 144.20, the local target.

Summary

The USDJPY pair has been in a sideways range for the third day. Technical indicators in today’s USDJPY forecast suggest a potential downward wave towards the 146.36, 144.20, and 143.60 levels.