The USDJPY pair is approaching the upper boundary of a consolidation range. Today is a public holiday in Japan, and trading volumes are lower than usual. More details and insights are available in our analysis for 14 October 2024.

USDJPY forecast: key trading points

- Japan’s Producer Price Index reached 2.8% year-on-year

- This indicates that year-on-year growth in producer prices is accelerating, which may prompt the Bank of Japan to raise the key rate further

- USDJPY forecast for 14 October 2024: 150.30 and 151.20

Fundamental analysis

The USDJPY rate is hovering below the upper boundary of the consolidation range at 149.30 on Monday. There are signs that this level may be breached today, with a target of 151.20.

Japan’s Producer Price Index shows 2.8% growth compared to September last year, exceeding the previous reading of 2.6%. This indicates that year-on-year growth in producer prices is accelerating. The Bank of Japan may consider tightening monetary policy to curb inflation if it rises. This could help strengthen the yen, as higher interest rates make the Japanese currency more attractive to investors.

However, inflation is also rising in the US, which may prompt the Federal Reserve to pause its rate-hiking cycle, potentially exerting pressure on the yen. The USDJPY forecast is neutral.

USDJPY technical analysis

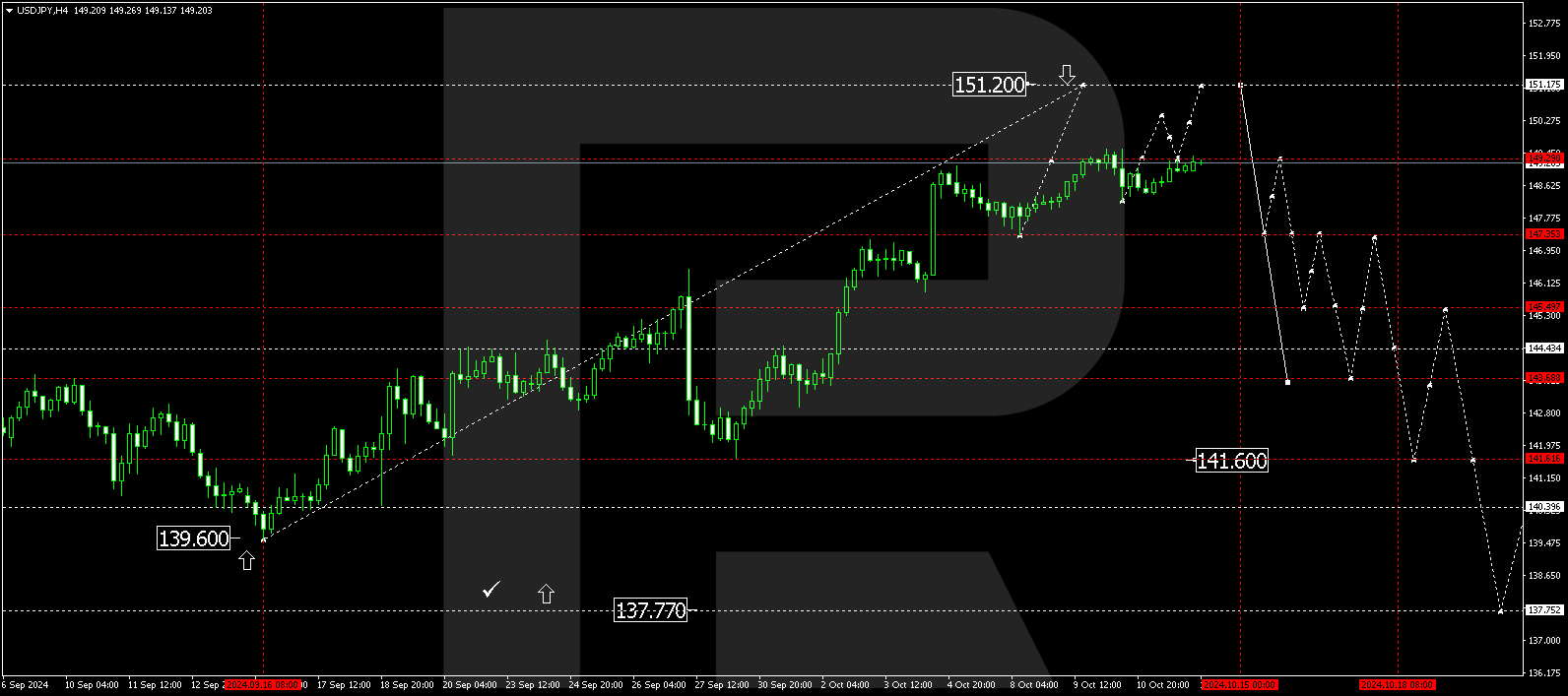

The USDJPY H4 chart shows that the market is applying pressure on the upper boundary of the consolidation range at 149.30. If the price breaks above this level today, 14 October 2024, it will open the potential for a movement towards 151.20. Once this level is reached, a downward wave in the USDJPY rate could start, aiming for the lower boundary of the range at 147.35. A correction could then begin. A breakout below this level would open the potential for a decline to 145.50, with the correction potentially continuing towards 143.70.

Summary

Technical indicators in today’s USDJPY forecast suggest potential further growth towards the 150.30 and 151.20 levels.