USDJPY: Japan’s decline in machinery orders adds to pressure on the yen

The USDJPY rate is rising after rebounding from the 153.90 support level. Discover more in our analysis for 18 November 2024.

USDJPY forecast: key trading points

- BoJ Governor Kazuo Ueda indicated a potential rate hike but provided no specifics

- Jerome Powell reaffirmed that no interest rate cut is expected in the near term

- Markets continue to forecast a Federal Reserve rate cut, estimating the likelihood at 65.3%

- Japan’s machinery orders decreased by 0.7% in September 2024

- USDJPY forecast for 18 November 2024: 157.57

Fundamental analysis

The USDJPY rate rose slightly, testing the 158.10 level. Investors responded to the statement of BoJ Governor Kazuo Ueda, who did not rule out a potential interest rate hike provided that the economy aligns with the regulator’s forecasts. However, the absence of details regarding a December rate hike increased pressure on the yen, leading to its weakening.

Last week, Federal Reserve Chair Jerome Powell emphasised that an immediate rate cut was not planned, citing the stability of the US economy. Nevertheless, the markets continue to expect a quarter-percentage-point rate cut in December. According to the CME FedWatch Tool, the likelihood of such a cut is 65.3%, while the odds of a more significant 50-basis-point reduction are estimated at 34.7%.

Meanwhile, Japan’s core machinery and equipment orders decreased by 0.7% in September 2024 compared to the previous month. This marked the third consecutive monthly decline, contrary to analysts’ expectations of a 1.9% increase. According to today’s USDJPY forecast, this data may provide short-term support for the US dollar.

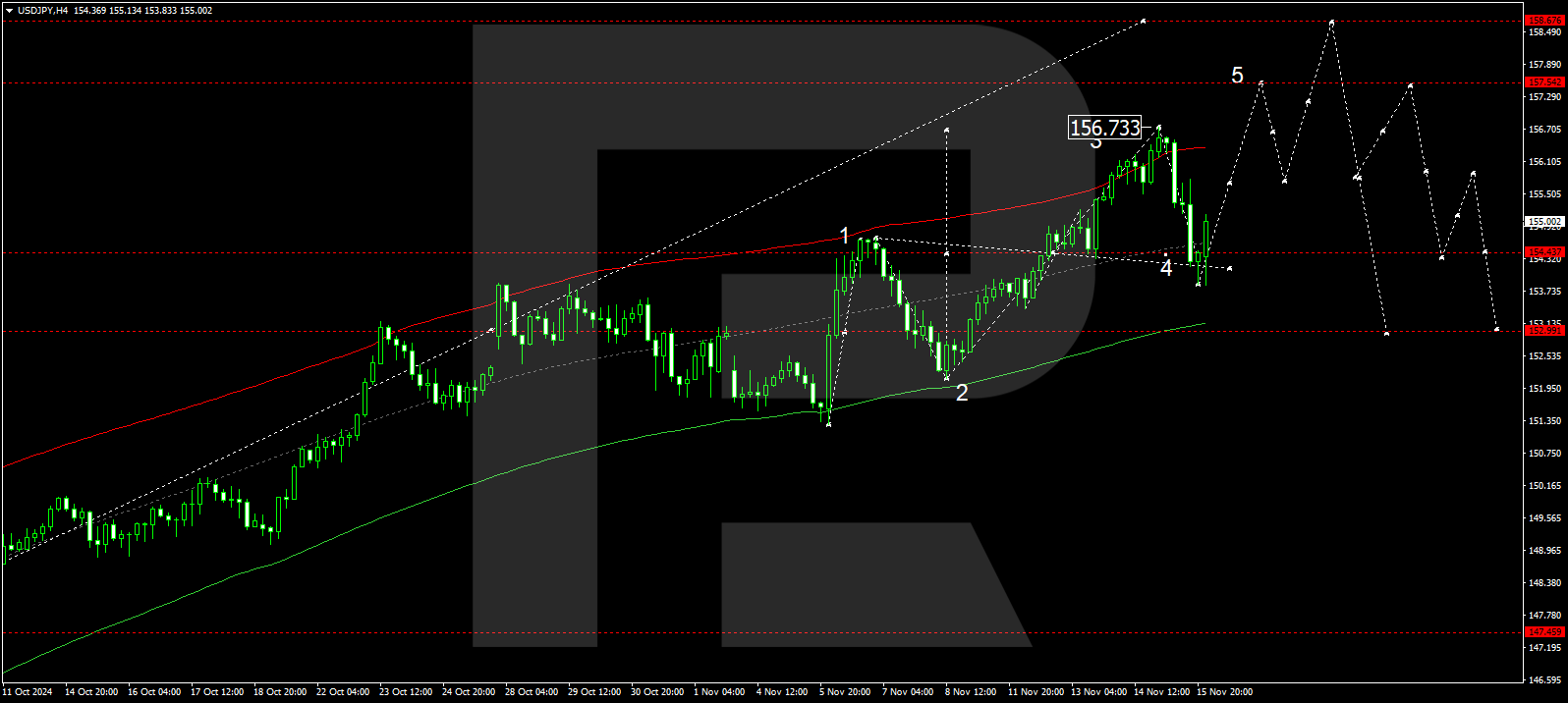

USDJPY technical analysis

The USDJPY H4 chart shows that the market has corrected towards 153.83, with a consolidation range forming above this level today, 18 November 2024. An upward breakout could initiate a growth wave, aiming for 155.77, the first target of the next growth wave. A correction could begin after the price reaches this target, targeting 153.00.

The Elliott Wave structure and growth wave matrix, with a pivot point at 154.44, technically support this scenario for the USDJPY rate. The market is currently at the central line of a price envelope, forming a consolidation range around it. A breakout below the range may extend the correction towards the envelope’s lower boundary at 153.00. Conversely, an upward breakout could drive a growth wave targeting the envelope’s upper boundary at 157.57.

Summary

The USDJPY rate is rising slightly amid a weaker yen caused by uncertainty surrounding the Bank of Japan’s monetary policy. At the same time, the US dollar remains supported by confidence in the stability of the US economy and the absence of urgent Federal Reserve plans to lower the interest rate. Technical indicators for today’s USDJPY forecast suggest that the growth wave could continue to the 157.57 level.