A positive USDA report may support the US dollar and drive further growth in the USDJPY rate. Find out more in our analysis dated 12 August 2024

USDJPY trading key points

- US Department of Agriculture (USDA) report on world agricultural supply and demand estimates

- A report on US federal budget execution: previously at -66.0 billion, forecasted at -254.3 billion

- USDJPY forecast for 12 August 2024: 150.00 and 155.25

Fundamental analysis

The monthly US Department of Agriculture (USDA) report provides up-to-date forecasts for global and national balances between the supply and use of key cereal crops, soybeans, derivative products, and cotton. Additionally, it includes data on US domestic supply and consumption of sugar and livestock products. Positive key indicators may support the US dollar against the Japanese yen.

The monthly federal budget execution report estimates the difference between government revenues and expenditures for a specific month by calculating the difference between inflows and spending. A negative reading indicates a budget deficit, while a positive reading suggests a surplus. Analysis for 12 August 2024 shows that a budget deficit is projected to increase to -254.3 billion US dollars. This could negatively impact the US dollar, causing the USDJPY rate to fall.

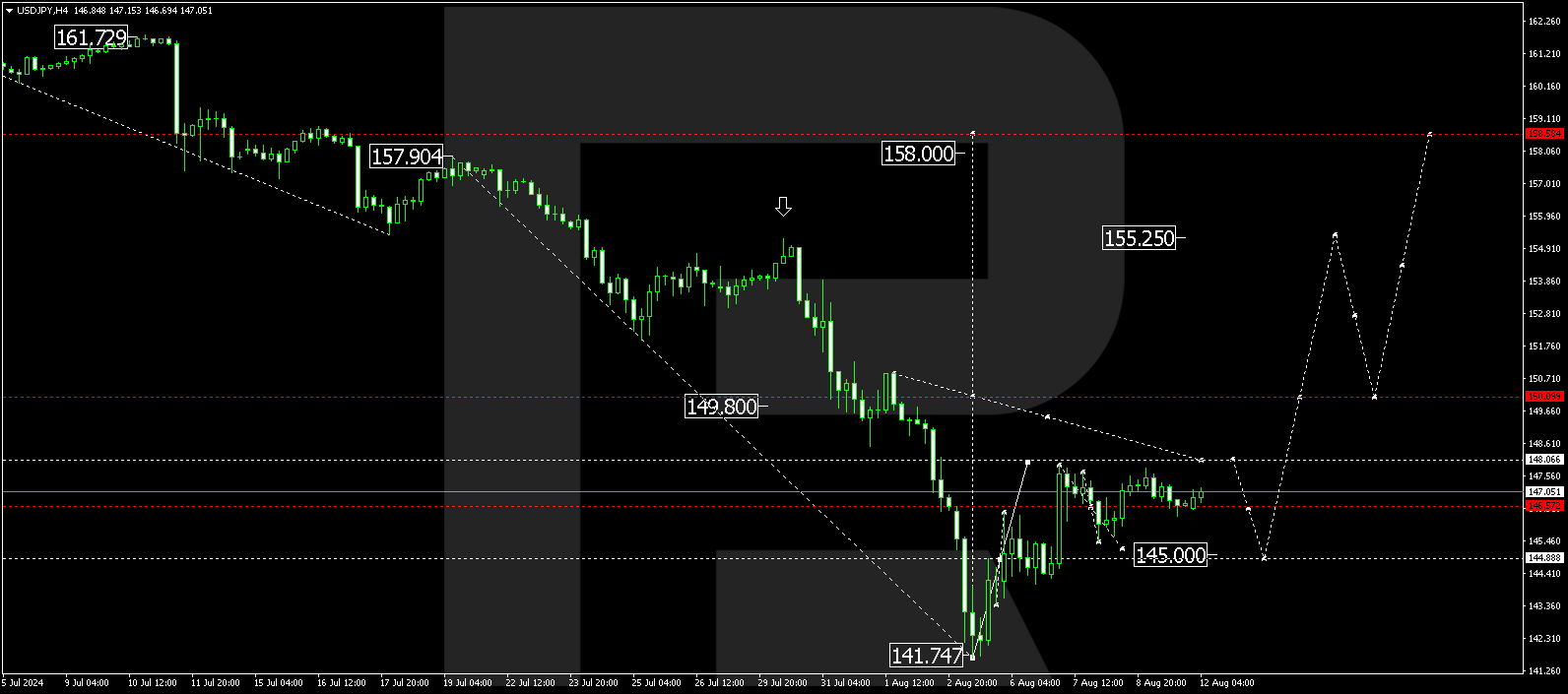

USDJPY technical analysis

The H4 USDJPY chart shows that the market continues developing a consolidation range around 146.54 without a clear trend. The consolidation range is expected to extend to 145.00 and 148.13 today, 12 August 2024. Subsequently, the USDJPY rate could break above the range, aiming for 150.00. If this level is surpassed, the upward trend is expected to continue towards 155.25, the local estimated target.

Summary

Analysis for 12 August 2024 suggests that an increase in the US budget deficit may weaken the US dollar. However, the USDJPY technical analysis in today’s USDJPY forecast indicates that the price could break above the consolidation range, aiming for 150.00 and potentially continuing the trend to 155.25.