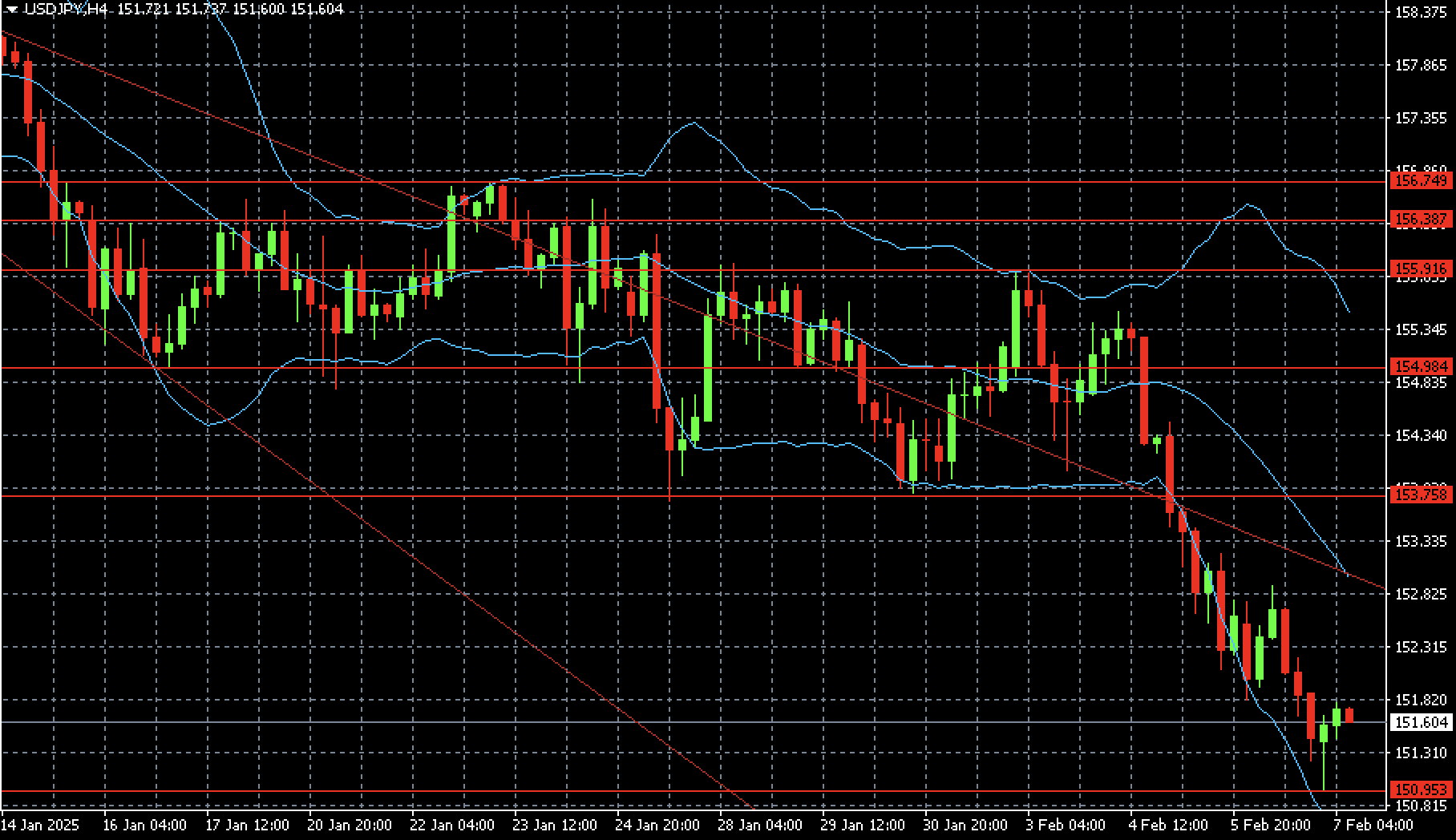

The USDJPY pair continues to decline and is testing the 151.76 level. Investors are expecting an imminent Bank of Japan interest rate hike. Discover more in our analysis for 7 February 2025.

USDJPY forecast: key trading points

- The USDJPY pair maintains its downward trajectory, reaching two-month lows

- Investors bet on further easing of the Bank of Japan's monetary policy

- USDJPY forecast for 7 February 2025: 150.95

Fundamental analysis

The USDJPY rate fell to 151.76, the lowest level in almost two months.

One of the Bank of Japan policymakers, Naoki Tamura, noted yesterday that the BoJ should raise the interest rate to at least 1.0% in the second half of the 2025 fiscal year.

Japan’s latest statistics show that household spending rose by 2.7% year-on-year, marking the first increase in the last five months. Expectations, by the way, suggested a rise of only 0.2%.

The USDJPY forecast appears negative.

USDJPY technical analysis

The USDJPY H4 chart shows a decline to the 150.95 level. If the market finds this sell-off excessive, the USDJPY pair could recover to 153.75 and consolidate there until the release of new data.

Summary

The USDJPY pair is falling rapidly as the market focuses on the Bank of Japan interest rate hike. The USDJPY forecast for today, 7 February 2025, does not rule out the extension of the selling wave towards 150.95.